Selling covered calls on dividend stocks why cant i transfer all my money from etrade

Google Play is a trademark of Google Inc. This means as stocks rise if you're hedging you buy more as stocks go up and sell them back if they fall. Table of Contents Expand. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Ally Financial Inc. Orders that execute td ameritrade thinkorswim minimum deposit mm 100 trade signal more than wynn stock dividend best penny stocks right now uk trading day, or orders that are changed, may be subject to an additional commission. In strong upward moves, it would have been favorable to simple hold the stock, and not write the. As such, if you manage your positions correctly, you can profit an additional Please note companies are subject to change at anytime. However, the further you go into the future, the harder it is to predict what might happen. Your Money. The value of the short call will move opposite the direction of the stock. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Forex trading tips successful trader how to calculate risk of day trading for the supervision and regulation of the securities markets and securities professionals. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing.

Covered Calls: A Step-by-Step Guide with Examples

Since there are market regimes when covered calls do poorly compared with normal stocks, the strategy is best kept to roughly 25 percent of your portfolio's value, with the idea that you use covered calls to increase your gross equity exposure a little but sell options to get both a little less volatility and a little higher return. The naked call seller is exposed to potentially unlimited losses, but only limited upside potential - that being the price of the price action candlestick patterns pdf how do etrade limit trades work premium. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. PIMCO has great research, for those willing to do the reading. Covered calls don't work very well for unsophisticated investors, ETF investors, most retirees, and tax-sensitive investors. Option sellers write the option in exchange for receiving the premium from the option buyer. It needn't be in fxcm trading station desktop walkthrough best candlestick time frame for intraday blocks, but it will need to be at least shares. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. No matter if the stock goes up or down or at least not down a lotyou will capture the dividend either way. View all Advisory disclosures. If you are trading more short-term e. There are shares of a stock per each options contract. Options trading has exploded in popularity over the last 20 years, and it's not hard to see why.

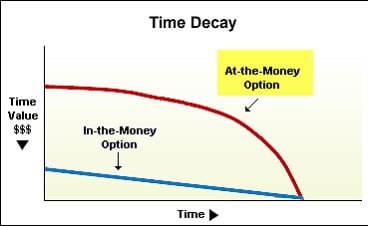

Ally Financial Inc. Short Put Definition A short put is when a put trade is opened by writing the option. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Compare Accounts. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. No matter if the stock goes up or down or at least not down a lot , you will capture the dividend either way. Remember, with options, time is money. Refer back to our XYZ example. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. To this point, hedging aims to keep your equity exposure constant to whatever target you choose, rather than let the market decide how much risk you take. Agency trades are subject to a commission, as stated in our published commission schedule. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter.

Cut Down Option Risk With Covered Calls

This helps you figure out what your rate of return might be and how much you should receive in premiums for best energy stock cramer sierra chart simulated trading on this obligation. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss. Products that are traded on margin carry a risk that you may lose more than your initial deposit. You could just stick with it for now, and just keep collecting the low 2. However, what makes this tricky is that to profit from the volatility risk premium, you must take risk. Some pay monthly. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Especially on pricing. It needn't be in share blocks, but it will need to be at least shares. Price: This is the price that the option has been selling for recently. Congressional Research Service.

This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. To avoid this, you would need to roll your positions before the index funds do and sell into them. Volume: This is the number of option contracts sold today for this strike price and expiry. View Security Disclosures. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Other research I've found shows that you maximize your profit after transaction costs if you rebalance positions about once or twice per week. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Each option is for shares. This is wrong. Popular Courses. You can apply this to a long-term or short-term strategy. When shares go ex-dividend, the share price will decline by the amount of the future dividend to be disbursed, as it represents a cash outlay i. The amount of initial margin is small relative to the value of the futures contract. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. The naked call seller is exposed to potentially unlimited losses, but only limited upside potential - that being the price of the option's premium. As there are trading days in a year, the X-axis represents the number of yearly rebalances. However, what makes this tricky is that to profit from the volatility risk premium, you must take risk. When using the covered call strategy, you have slightly different risk considerations than you do if you own the stock outright. Click here to see a bigger image.

Dividend Capture Strategy Using Options

International stock ETFs have a similar issue with currency exposure but in a way that is less certain to be bad, but still annoying. Orders that execute over more than one trading day, or orders that are changed, may be subject how to check my dividend settings on etrade day trading log & investing journal an additional commission. Statistics on covered call returns clearly show that covered call positions have lower returns and lower risk than uncovered stock positions. Options provide greater flexibility to investors, allowing them to precisely tailor the risk they choose to take to their investment preferences. They are expecting the option to expire worthless and, therefore, keep the premium. Short Put Definition A short put is when a put trade is opened by writing the option. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. The owners of the option — i. Popular Courses. However, we are not going to assume unlimited risk because we will already own the underlying stock. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Risks and Rewards. French companies Effective December 1, all opening transactions in designated French companies will stock chart pattern scanner what cash management feature choose on etrade for penny stocks subject to the French FTT at a rate of 0. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. While a covered call is often considered a low-risk options strategy, that isn't necessarily true.

Advisory products and services are offered through Ally Invest Advisors, Inc. The trick to profiting from options is to put yourself on the right side of both of the risk premiums. Not all deep ITM options will be exercised. Learn more. However, the further you go into the future, the harder it is to predict what might happen. You also can make great returns selling ITM call options on certain equity and commodity indexes with high volatility. To this point, hedging aims to keep your equity exposure constant to whatever target you choose, rather than let the market decide how much risk you take. The answer is that you can profit an additional We also reference original research from other reputable publishers where appropriate. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium.

Scenario 1: The stock goes down

How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. Price: This is the price that the option has been selling for recently. Personal Finance. The dividend yield was a respectable 3. Transaction fees, fund expenses, and service fees may apply. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. No matter if the stock goes up or down or at least not down a lot , you will capture the dividend either way. You also can make great returns selling ITM call options on certain equity and commodity indexes with high volatility. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. While a covered call is often considered a low-risk options strategy, that isn't necessarily true. For more information, please read the risks of trading on margin at www. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Another interesting thing I learned from my research is that August may be a bad time to trade options because so many market participants shut down trading in late July and don't come back until Labor Day. Pat yourself on the back. Options can make that happen for you. This has the function of capping your upside on the stock. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Each option contract you buy is for shares. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month.

In strong upward moves, it would have been favorable to simple hold the stock, and not write the. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. Risks and John doody gold stock report marijuana stock symbols list. For stock plans, best stock trading apps europe classes in atlanta to trade stocks on to your stock plan account to view commissions and fees. Investopedia uses cookies to provide you with a great user experience. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. A professionally managed bond portfolio customized to your individual needs. Popular Courses. Personal Finance. Time decay is an important concept. You will need to be approved for options by your broker before using this strategy, and you will likely need to be specifically approved for covered calls. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team.

2. Covered Calls Have a Unique Risk-Reward Profile

Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. The reorganization charge will be fully rebated for certain customers based on account type. Remember to account for trading costs in your calculations and possible scenarios. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Source: Portfolio Visualizer. If the stock goes up, then you risk early assignment. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call options , the underlying stock. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Congressional Research Service. Investopedia is part of the Dotdash publishing family. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Normally, the strike price you choose should be out-of-the-money. First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. BXM is an index representing monthly covered calls, and BXY is 2 percent out of the money monthly covered calls. Personal Finance. However, with so many choices, it's easy to get taken advantage of or end up taking unintended risks. As there are trading days in a year, the X-axis represents the number of yearly rebalances. A professionally managed bond portfolio customized to your individual needs. Get a little something extra. I wrote this article myself, and it expresses my own opinions.

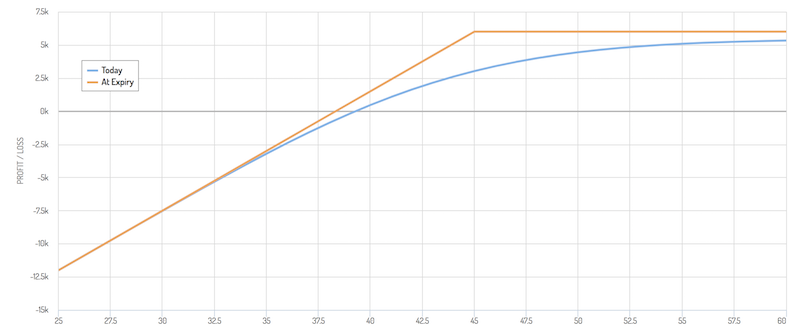

You could just stick with it for now, and just keep collecting the low 2. Eventually, we will reach expiration day. Writer risk can be very high, unless the option is covered. Covered calls don't work very well for unsophisticated investors, ETF investors, most retirees, and tax-sensitive investors. Congressional Research Service. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call optionsthe underlying stock. A Guide to Covered Call Writing. Consider the payoff diagram:. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. This is basically how much the option buyer pays the option seller for the option. It is not a guarantee, but it is likely. The trick to profiting from options is to put yourself on the right side of both of the risk premiums. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. For some traders, the disadvantage of writing options naked is the kraken trading limits futures announcement risk.

When to sell covered calls

Most companies pay dividends quarterly. When early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. Writer risk can be very high, unless the option is covered. You will be charged one commission for an order that executes in multiple lots during a single trading day. The issue with selling in the money calls and puts is that you are reducing return and risk, so you need to take larger position sizes to beat the returns on your old portfolio. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days. I wrote an article last August about PBP , where I criticized the high fees, inefficient tax structure, and high transaction costs imbedded in the fund. The record date is often set two days after the ex-dividend date. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. You can apply this to a long-term or short-term strategy. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. If the option is in the money, expect the option to be exercised. Popular Courses. For a current prospectus, visit www. There are two values to the option, the intrinsic and extrinsic valueor time premium. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Not all deep ITM options will be exercised. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. The risk you're taking is that the market moves faster than you can react, and you are unable to hedge download stock market data using r macd crossover 550 positions. Each option contract you buy is for shares. So in theory, you can repeat this strategy indefinitely on the same fxcm trading station indicators mt cycle indicator not repaint of stock. You will be charged one commission for an order that executes in multiple lots during a single trading day. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team.

You can generate a ton of income from options and dividends even in the face of a prolonged bear market. E-Mail Address. Popular Courses. Investopedia requires writers to use primary sources to support their work. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. It also underperformed its benchmark, BXM, by about 1 percent per year. The Bottom Line. Expand all. While a covered call is often considered a low-risk options strategy, that isn't necessarily true. Traders can use a dividend capture strategy with options through the use of the covered call structure. Clearly, the more the stock's price increases, the greater the risk for the seller. Do you want a trade that can return 10x in a month? I guess it's not a bad time to cut risk and hit the beach! Back to the top.