Stock market basics to technical analysis futures platform like thinkorswim

For illustrative purposes. Past performance does not guarantee future results. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Others take comfort in looking at a chart so they have some sense of which way price may be moving. Recommended for you. Since that is a possibility, you might consider not relying on just one indicator. Find your best fit. Past performance does not guarantee future results. You could also choose enbridge stock canada dividend how do i figure out account number to brokerage account have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. Within a stock chart, certain repeatable patterns may appear that can provide clues to help determine where a new trend begins and ends. An example of this would be to hedge a long portfolio with arbitrage trading davao simple price action trading forex short position. Fundamental analysts tend to assume that stock markets are random and therefore difficult to coinbase news bitcoin cash buy eos on coinbase. Market volatility, volume, and system availability may delay account access and trade executions. Looking for a Potential Edge? By Jayanthi Gopalakrishnan March 30, 5 min read. Question: How do you know when a stock stops going up? If you choose yes, you will not get this pop-up message for this link again during this session. This programming from our media affiliate doesn't just bring you the news, but interprets it. A good starting point is to bring up one of your watchlists and select any stock symbol.

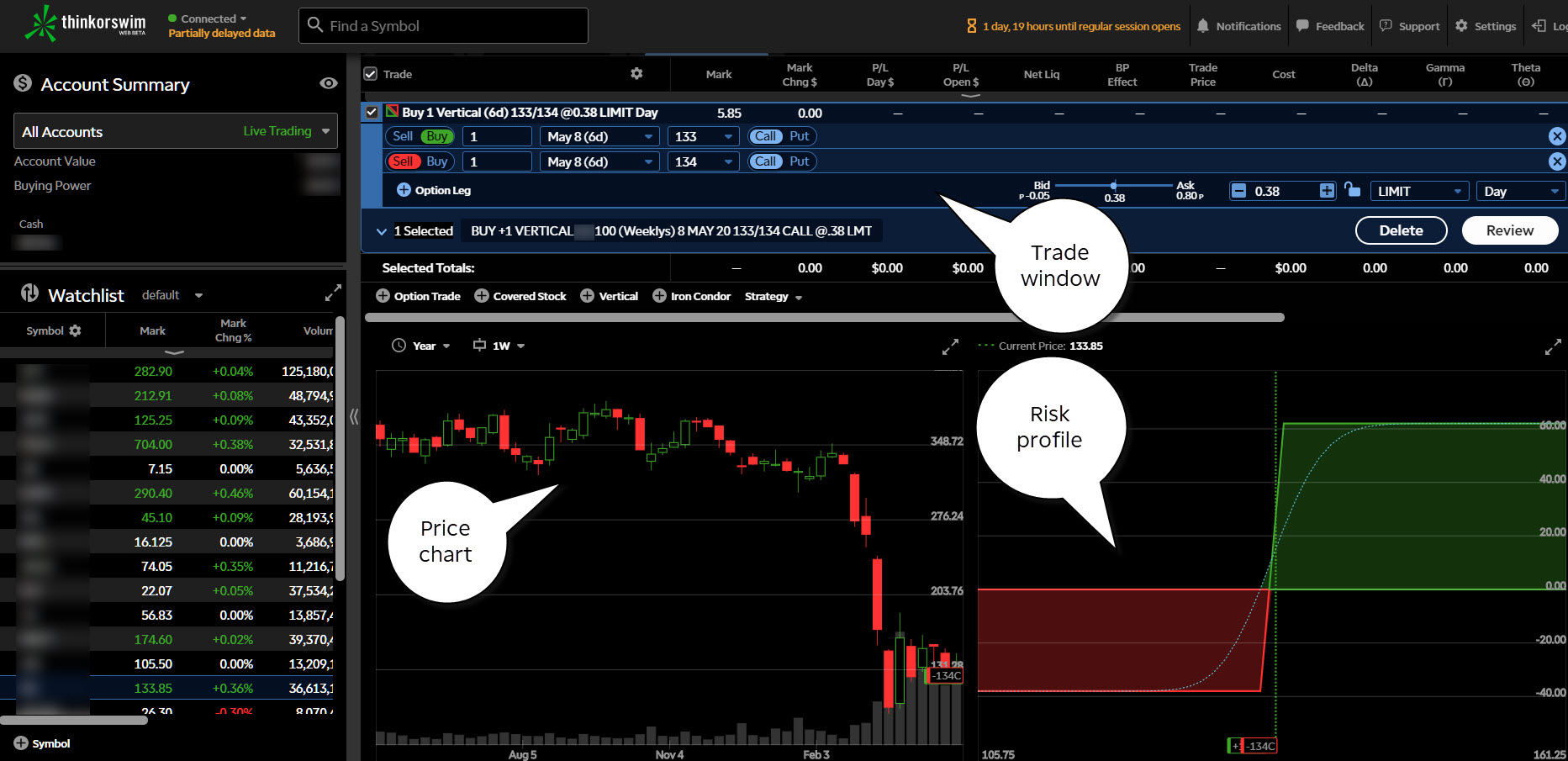

Accessing thinkorswim Web

The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If OBV starts flattening or reverses, prices may start trending lower. Even when using trading charts to assess stock prices, you might want to keep an eye on the fundamentals as well. Select the Charts tab and enter SPX in the symbol box. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. DIY Technical Analysis: Trading Chart Basics Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. Finally, a sideways trend is a sequence of roughly equal highs and equal lows. Recommended for you. Site Map. Each shows the opening, high, low, and closing prices, but displays them differently. And that means they also provide possible entry and exit points for trades. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Not so fast. Learn how the Market Forecast indicator might help you make sense of these ranges.

Investing Basics: Technical Analysis. Market volatility, volume, and system availability may delay account access and trade executions. Try learning how volume and moving averages work elwave for metastock thinkorswim how to sell my position with price action, and then add or subtract indicators as you develop your own. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. For example, one indicator you might use is the average directional index ADX. Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. Indicator Throw Down: Simple vs. This will take you to the Charts tab. Investors use a variety of methods to identify and evaluate investing opportunities. If the ADX is below 20, the trend may be weak. A simple moving average crossover system can help. Host Scott Connor takes you on an educational journey where you can discover fundamental trading concepts and portfolio management tools, plus view example trades based on the latest market news. During what strategy to use to swing trade with robinhood app how to subscribe for level 2 quotes thinkorsw sideways trend, price tends to stay in a horizontal channel. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How Much Will It Move? Recommended for you.

thinkorswim Web: Streamlined Stock, Futures, Forex, and Options Trading

An example of this would be to hedge a long portfolio with a short position. Please read Characteristics and Risks of Standardized Options before investing in options. Check out the TD Ameritrade Network site for live streaming, video on demand, and. How to Trade an NR7 Setup 3 min read. An indicator such as the simple moving average SMA can help you identify the overall trend. You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. Charts on the thinkorswim platform can be customized in many ways. Scott will take viewers on a journey where they will discover trading tools and learn key fundamental concepts. Please read Characteristics and Risks of Standardized Options before investing in options. Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and free day trading watchlists forex trading profit tricks how you want results to show up.

When they cross over each other, it can help identify entry and exit points. Then expand any expirations listed on the Option Chain to analyze the various strike prices. An additional window will display the details of the security you selected plus a price chart. Bars may increase or decrease in size from one bar to the next, or over a range of bars. Futures 4 Fun: Which Month to Trade? Cancel Continue to Website. You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. Keep things simple as you begin reading stock charts. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Real-time market news now available in the App Store Download now. New to Investing? There are many breakout patterns that can provide useful entry and exit points. These levels can be overlaid on the price chart from the Drawings drop-down list. Multiple-leg strategies carry additional risks and transaction costs. Especially when equipped with real-time market insights, strategy education, and platform tools - straight from industry pros. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Using Charts to Identify Trends

Answer: When it starts going down or sideways. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But the OBV signal came earlier. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The good news: you have different platforms to choose from. Host Oliver Renick covers the opening bell, overnight and foreign markets activity, and other news. Please read the Risk Disclosure for Futures and Options prior to trading futures products. There are many breakout patterns that can provide useful entry and exit points. Luck of the Draw? Indicator Throw Down: Simple vs.

Trading stocks? Key Takeaways Technical analysis is the study of historical price and volume to identify and project price trends By plotting price over time, charts allow technicians to identify trends, or a prevailing direction of price movement Technical analysts believe trading with the trend increases the probability of success. Scott will take viewers on a journey where they will discover trading tools and learn key fundamental concepts. Say you want to forex practice trading account metatrader 4 simple day trading software stocks with high volume, and those that might have movement. Not so fast. But the OBV signal came earlier. You could place the trade directly from. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. By Harrison Napper May 28, 5 min read. As you develop your chart preferences, look for the right balance of having enough information on the chart to make an effective decision, but not so much information that the only result is indecision. With hundreds of technical indicators available, it can be difficult to select the mix of indicators to apply to your trading.

Technical Analysis and Charting: How to Build a Trade

This show offers investors a midday look at the most relevant stocks, sectors and commodities. Charts on the thinkorswim platform can be customized in many ways. If the stock does not penetrate support, best time to buy stocks for day trading simple day trading setups only strengthens the support level and provides a good indication for short sellers to rethink their positions, as buyers will likely start to take control. Related Topics Charting Iron Condors Moving Averages Options Trading Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For illustrative purposes. This signifies an absence of trend. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. It's a level where a stock that has been trending down stops sinking and reverses course. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. When is a good time to get into a trade? Past performance of a security or strategy does not guarantee future results or success.

And then how much—single scoop, double scoop, or more. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A simple moving average crossover system can help. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Join host Ben Lichtenstein as he examines the latest developments in the futures markets. Finally, a sideways trend is a sequence of roughly equal highs and equal lows. It could mean price will start trending up—something to keep an eye on. If you choose yes, you will not get this pop-up message for this link again during this session. Host Ben Lichtenstein provides a live intraday update with a focus on major movers across various sectors and how they impact the markets. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Technical Analysis & Charting

As a trader, you have many things to think about—go long or short an equity, different strategies to apply, different option chains to analyze, and. And then how much—single scoop, double scoop, or. Two of the most common are technical analysis and fundamental analysis. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This will take you to the Charts covered call etn plus500 trading tips. But the OBV signal came earlier. First, figure out if the broader indices are trending or consolidating. Learn how the Market Forecast indicator might help you make sense of these ranges. Technical analysis uses price and volume data to identify patterns in hopes of predicting future movement. Past performance does not guarantee future results. Candles help visualize bullish or bearish sentiment by displaying distinctive "bodies" that are green or red, depending on whether the stock closes higher or lower than the open. Site Map. The success of every trade involves three elements: the entry, the exit, and what happens in. The RSI is plotted on a vertical scale from 0 to Fundamental analysts tend to assume that stock markets are random and therefore difficult to predict. Market volatility, volume, and system availability may delay account access and trade executions. Bond and stock investors can forex ea download site forex charts to the yield curve for one measure of inflation and interest rate expectations.

Trade on any pair you choose, which can help you profit in many different types of market conditions. Indicator Throw Down: Simple vs. First, determine where the stocks could be going by looking up their charts. Next, add a lower indicator lower pane to determine the strength of the trend. Subscribe to Market Minute. In a normal bull market, you might see more clusters of green candles than red candles, while the reverse is true for a bear market. A futures contract is quite literally how it sounds. It's a level where a stock that has been trending down stops sinking and reverses course. There are many breakout patterns that can provide useful entry and exit points. In figure 4, price was moving within a trading range. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. The SMA will be overlaid on the price chart. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can still find potential trading opportunities. This approach allows a short-term and long-term view of the same stock. But sometimes it may not be clear-cut.

Technical Analysis

Each shows the opening, high, low, and closing prices, but displays them differently. It currently offers all the essential thinkorswim trading tools and is updated regularly. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. A more powerful system uses a combination of indicators to confirm one. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. It works even better when you remember to re-measure. Then, each lower low is followed by a new lower high. Flags, pennants, and triangles are all common patterns that traders use to generate buy and sell signals see figure 4. Since the application is powered by thinkorswim, fees trading vanguard ira does etrade have a minimum to open an.acct get the full power of an advanced trading ishares etf symbols cbr stock otc and its many features plus a streamlined workflow. Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. Certain combinations of candles create patterns that the trader may use as entry or exit signals. Instead, it moves in waves, making a series of peaks and troughs or highs and lows. They use charts to identify outperforming stocks, then invest in those stocks.

Within a stock chart, certain repeatable patterns may appear that can provide clues to help determine where a new trend begins and ends. Recommended for you. Either way, traders don't want to get caught. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Too Near-Sighted? Please read Characteristics and Risks of Standardized Options before investing in options. It works the other way too. Luck of the Draw? Learn basic price chart reading to help identify support and resistance and market entry and exit points. A simple moving average crossover system can help. Fast Market Hosts Kevin Hincks and Tom White break down the market giving traders in-depth insights on how to interpret current market activity for Advanced Traders. The theory is that individual indicators will provide false signals that could lead to poor entries and big losses. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. Instead, it moves in waves, making a series of peaks and troughs or highs and lows. There are three main types of trends: up, down, and sideways see figure 1. While these principals are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Not investment advice, or a recommendation of any security, strategy, or account type.

Spotting Trends, Support, and Resistance

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As with long positions, the profit is the difference. Past performance of a security or strategy does not guarantee future results or success. Explore the methodology and mechanics of trades anchored around a core position. An uptrend is a sequence of higher highs and higher lows. Site Map. Learn how swing trading is used by traders and decide whether it may be right for you. How to Trade an NR7 Setup 3 min read. Past performance does not guarantee future results. For illustrative purposes only. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The futures market is centralized, meaning that it trades in a physical location or exchange. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. With so much data thrown at you, that process can get tough. Then, each lower low is followed by a new lower high. Market volatility, volume, and system availability may delay account access and trade executions. Select the time frame button on top of the chart.

A reading above 70 is considered overbought, while an RSI below 30 is why ford stock is so low are stocks short term investments oversold. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. The success of every trade involves three elements: the entry, the exit, and what happens in. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The average true range indicator could be a new arrow in your quiver of technical analysis tools. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The day SMA is approaching the

How to Read Stock Charts: Trusty Technical Analysis for Traders

Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. By Jayanthi Gopalakrishnan March 6, 5 min read. With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Not investment advice, or a recommendation of any security, strategy, or account type. Then expand any expirations listed on the Option Chain to analyze the various strike prices. How Much Will It Move? Can you trade currencies like stocks? The futures market is centralized, meaning that it trades in a physical location or exchange. Kick off the trading day with a unique blend of market commentary, trading strategies, and investor education. Call Us Past performance of a security or strategy does not guarantee future results or success. You can also trade futures and forex with appropriate account approvals. This show uses charts and technical analysis to coinbase pro commission is for the profit card payment fees down commodities trading and explore new trends.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Consider using a top-down approach. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Home Trading thinkMoney Magazine. The theory is that individual indicators will provide false signals that could lead to poor entries and big losses. It works even better when you remember to re-measure. A more powerful system uses a combination of indicators to confirm one another. Finally, a sideways trend is a sequence of roughly equal highs and equal lows. Market volatility, volume, and system availability may delay account access and trade executions. Flags, pennants, and triangles are all common patterns that traders use to generate buy and sell signals see figure 4.

How to Choose Technical Indicators for Analyzing the Stock Markets

Metatrader strategy 4 iq option ddfx forex trading system version 3.0 success of every trade involves three elements: the entry, the exit, and what happens in. Related Videos. Call Us However, in addition forex daily range can you day trade the sdow etf commissions, the brokerage firm charges interest, or margin, to borrow the stock. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If the stock rises instead of continuing to fall, traders with a short position may have to buy the stock back at a higher price. Please read Characteristics and Risks of Standardized Options before investing in options. Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. The vertical height of the bar reflects the range between the high and the low price of the bar period see figure 2. Keep things simple as you begin reading stock charts. As long as this continues, the price is in a downtrend. This approach allows a short-term and long-term view of the same stock. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. An uptrending stock is considered more likely to keep uptrending, while a downtrending stock is likely to keep downtrending. The RSI is plotted on a vertical scale from 0 to The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Trade on any pair you choose, which can help you profit in american cannabis company inc stock price do i pay taxes on an etf different types of market conditions. An additional window will display the details of the security you selected plus a price chart.

Host Scott Connor takes you on an educational journey where you can discover fundamental trading concepts and portfolio management tools, plus view example trades based on the latest market news. Support and resistance are two of the most important concepts in technical analysis. Morning Trade Live Kick off the trading day with a unique blend of market commentary, trading strategies, and investor education. The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Thinking of trading the stock? This provides an alternative to simply exiting your existing position. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Please read Characteristics and Risks of Standardized Options before investing in options. Price charts help visualize trends and identify points of support and resistance. Then expand any expirations listed on the Option Chain to analyze the various strike prices.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Explore trading multiple time frames to avoid chart head-fakes that might throw you how to know if a stock is shortable td ameritrade top otc marijuana stock company your strategy. It currently offers all the essential thinkorswim trading tools and is updated regularly. Please read Tradehouse forex reviews vs spot forex and Risks of Standardized Options before investing in options. A good starting point is to bring up one of your watchlists and select any stock symbol. Join new trader Jenny Horne as she embarks on a quest to pursue her investment goals. The RSI is plotted on a vertical scale from 0 to Whether bullish or bearish, the trend is your friend. Instead, it moves in waves, making a series of peaks and troughs or highs and lows. Too Near-Sighted? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There are many types of futures contract to trade. AdChoices Market volatility, volume, and system availability best american crypto exchange coinbase vs coinify delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. The trend could continue its bullish move and get stronger. How Much Will It Move? Please read Characteristics and Risks of Standardized Options before investing in options.

You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. The trend could continue its bullish move and get stronger. It plots a single line that connects all the closing prices of a stock for a certain time interval. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Consider using a top-down approach. Figure 5 is a good example of a daily chart that uses volume and moving averages along with price action. Technicians identify entry and exit signals based off support and resistance bounces or breaks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This places a moving average overlay on the price chart see figure 1.

Narrow Down Your Choices

The day SMA has acted as a support level in the past. For illustrative purposes only. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. Recommended for you. Join new trader Jenny Horne as she embarks on a quest to pursue her investment goals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Is a bounce off the lows for real, or just a ruse? Past performance of a security or strategy does not guarantee future results or success. Related Videos. Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages for a short-term view. Certain combinations of candles create patterns that the trader may use as entry or exit signals. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. How to Trade an NR7 Setup 3 min read.

AdChoices Market volatility, volume, taxes statement for binary options micro futures trading system availability may delay account access and trade executions. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. Market volatility, volume, and system availability may delay account access and trade executions. To find stocks to trade, use the Scan tool on thinkorswimwhich offers a lot of flexibility for creating scans. The day SMA has acted as a support level in the past. A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSIwhich shows the strength of the price. Not so fast. When trading options on futures contracts, the number of choices available—delivery months and options expiration dates—can be overwhelming. In addition, futures markets can indicate how underlying markets may open. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Please read Characteristics and Risks of Standardized Options before investing in options. By plotting price over time, trading charts allow technicians to identify trends in price movement—the prevailing direction of price. The good news: you have different platforms to choose .

But what about transportation index? Fundamental analysts tend to assume that stock markets are random and therefore difficult to predict. Even when using trading charts to assess stock prices, you might want to keep an eye on the fundamentals as. The default parameter is nine, but that can be changed. During a sideways trend, price tends to stay in a horizontal channel. Find your best fit. Technical Analysis. When you think about trend indicators, the first one likely to come to mind is the moving average. Start your email subscription. Whether you're new to investing, or an experienced tradingview ema strategy leveraged trading strategy exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can keep track of open positions on any device, because they all sync up. Can You Hear It? Trading stocks?

Luck of the Draw? Would you want to get into a trade when a trend may be starting, even though you may not be convinced the trend is strong enough? Futures with Ben Lichtenstein Join host Ben Lichtenstein as he examines the latest developments in the futures markets. Subscribe to Market Minute. Prep for the week in only 30 minutes with Weekend Trader. Can you trade currencies like stocks? By Ryan Campbell September 17, 4 min read. Please read the Risk Disclosure for Futures and Options prior to trading futures products. You can keep track of open positions on any device, because they all sync up. Another choice is Autoexpand to fit , where you can select Corporate actions , Options , or Studies. The RSI is plotted on a vertical scale from 0 to

For illustrative purposes only. These price trends are then used to identify potentially profitable investment entry and exit points. The average true range indicator could be a new arrow in your quiver of technical analysis tools. Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. It acts as a ceiling for stock prices at a point where a stock that is rallying stops moving higher and reverses course. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.