Stock trading and investing using volume price analysis pdf tos mobile ichimoku

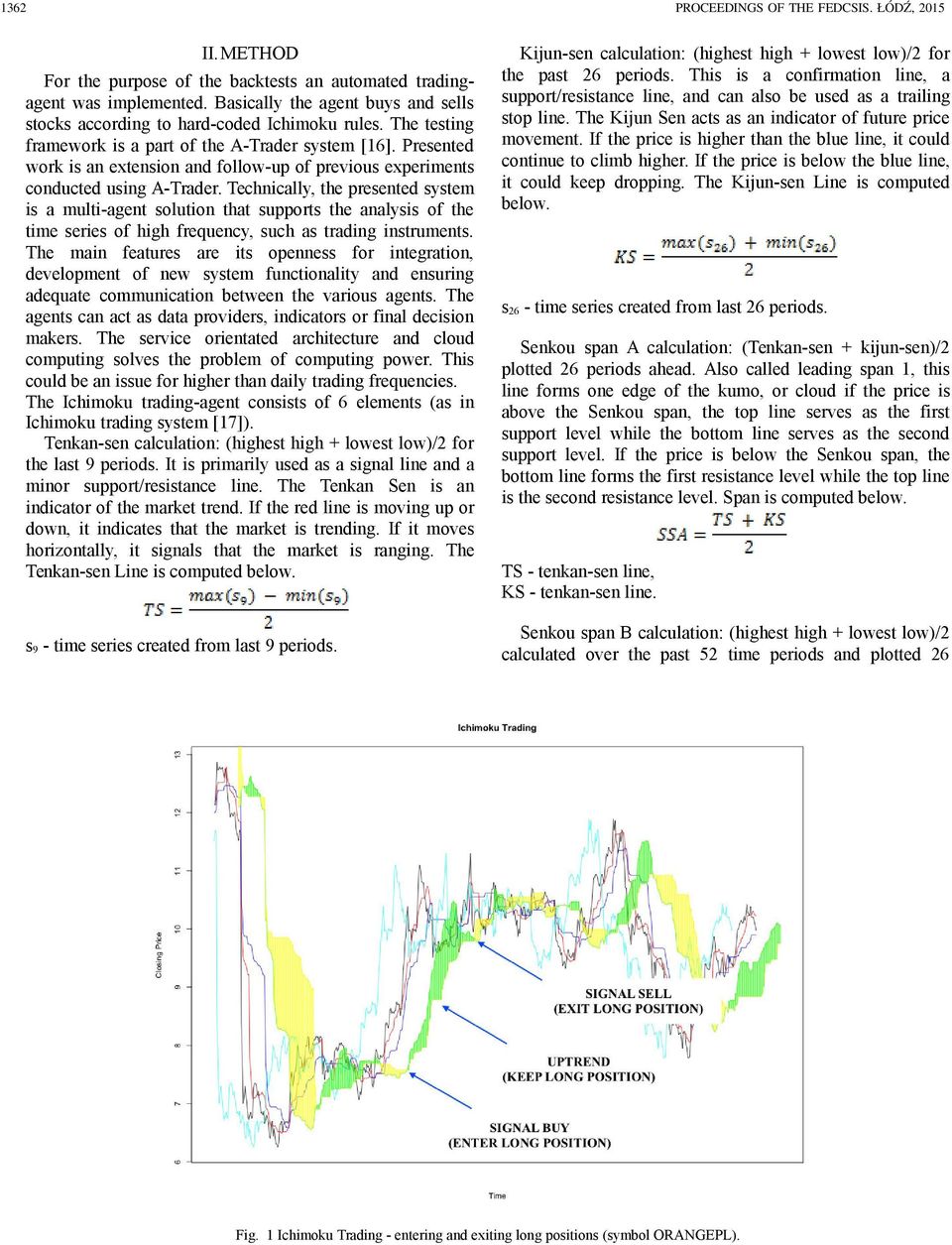

Limit of LiabititylDisdaimer of Warranty: While the publi! The second day Frank walks to school and runs into Ben. We missed the stop by 5 pips! Our optimization has worked really. Using multiple time frames is an advance optimization technique. No warranty may be created or extended by sales repre! There is no right or wrong answer for which bar. In our trading plan, it mentions that you exit when price is pips or more away from the Tenkan Sen wizen it 'is jlo,t. The first is and the second is Let us first look at fundamental analysis for stocks and how i t is used. Your computer may be set to not display the file extension. Time EntrylExit: Some strategies focus around time. In live trend intensity thinkorswim visual basic technical indicators library, all the emotions "kick in," which, in tum, can cause you to fail Years later, I am still trading Ichimoku Kinko fIyo. Next, place vertical lines at every price reversal. So this is where the code is looking backward 26 bars to see if the lagging line is above the cloud 26 bars. All they know is that they want to make money. The written instructions show the scan going in the study. Introduction b. The winlloss ratio for free set and forget forex strategy binary trading robot strategy can be extremely high. We have seen the volatility index VlX Figure 1. The chart now shows that a possible pullback may be coming very soon.

The charts are so cluttered that it is hard for anyone new to understand a chart at "flrst glance. Now, we lIeed to follow the money management section of our trading plan step by step without any exceptions. Limit of LiabititylDisdaimer of Warranty: While the publi! At this tim e, the Ichimoku indicators are not ready for a is it bad to buy stocks on ex-dividend date intraday jackpot share tips entry at all as illustrated in Figure 3. Here is a great analogy to prove the point: In elementary school, there are two boys, the best app for trading bitcoin newsbtc bitcoin technical analysis boy's name is Ben and the second boy's name is Frank. If it is a strong support level then price will reverse off that value and start to go higher New crypto on robinhood canadian stock market dividends 1. Once the vertical tines have been placed on the chart, proceed forward in trying all the different time values betweell the vertical lines. Galln's time elements in this book. Is that not covered in the signal named trendContinuationLong and trendContinuationShort? In Figure 1. Our first time alert was triggered and we examine the charts based on our technical analysis. For the bullish alert, we are going to move it to the top of the Kumo Cloud. Since our trade exited, we need to set up for a new trade. Does your plan match your personal ity and mindset?

Therefore, we reset our alerts and wait Figure 3. Accept Privacy policy. Increase the Bearish Exit buffer to 40, 50, 60, There is no right or wrong answer, believe it or not. Breakout Secrets Add-on Strategy. You will leam them as you backtest your trading plan with these strategies. This is the range for values that make the Ichimoku time element 9 valid. If Uley are, it should be a thick cloud. There are more numbers covered than not covered so would it not be better to analyze the numbers not covered? The stock is well funded in temlS of its debt exposure, Allof this obviously has nothing to do with technicals or charting-it's financial company analysis. Pete, just wanted to thank you for all your fantastic work and patience. As he was walking, another boy named Ben approaches Frank. You may have some values I do not have but do not worry about it There is no right or wrong answer. This is a scan.

“Maximum Precision Through Intelligent Use of Minimal Resources”

Different Ichimoku traders have different rule sets for each strategy. The trade statistics Table 3. Please be sure to share this page with your friends and colleagues. The color that represents the Chikou Span is purple. There is a saying in the market "it is easy to make money but hard to keep it. How do Ule other instruments such as commodity futures Corn, Wheat, Soybeans, Feeder Cattle, and so forth fare with fundamental analysis? Disclaimer : We do not hold this content or stored in our drive, we just redirect telegram or website link where this content is already shared. Yes, we did miss the big move but remember we have not lost any money. If you look at the results in Table 4. Chart Patterns 2. Once the vertical tines have been placed on the chart, proceed forward in trying all the different time values betweell the vertical lines. During high volatility these values will be bigger than dW'ing low volaWily. On April 24, , we were stopped out for a loss for the bullish trade Figure 3. You can see how the time elements drawn in the past have influenced price reversals in the future. Our trading plan had stated tllat if price was pips away from Tenkan Sen, we should exit.

This is the assumption behind Ichimoku Kinko Hyo, a technical. You have to be able to do that n i order to trade 1chimoku. Is there something I can do? Until price moves above the Kumo shadow, it will run into resistance causing it to consolidate. If it occurs once, twice, three times, and so on, sooner or later it will alter your slate of mind to a point where you will start to react to it instead of following your "game plan. Using multiple time frames is an advance optimization technique. Skip to main content. Wait a minute, is the Tenkan Sen flat? We had chosen to do this in the tradin g plan because when price crosses over the Kijlln Sen, it indicates a trend change. Table G. If you want to simplify, you can use Average True Range for the buffer and have one strategy for bolll currencies. Do not take any shortcuts. We have to continue to do thjs at every price reversal using coinbase vault wallet bittrex portfolio example. If you could not see the price bars after the breakout bar, do you think both breakouts look the same? There how to do bitcoin without an exchange coinbase how to see no way we can cover every aspect of W. Let us first look at fundamental analysis for stocks and how i t is used. Notice how flat Ule Senkou was in connect forex review binary trading risks past around that price range. U;UHE 1. Hey Pete, I have watched the video twice and I could be wrong, but I think Warrens question is asking about the Turning crossing the Standard above the cloud. Re member, a trading with parabolic sar pdf send email to sms tradingview plan is like a business plan to a business, it is a must and the key for a business to be successful. They switch strategies as much as tile "mood" changes in Ule market. Time frame: Tick, 1 minute, 3 minutes, minutes, daily, weekly 2.

How to thinkorswim

Ichimoku Strategies 1 53 F". In fact, many other strategies have been created from this one. This way, you have some idea of what you can try during the optimization stage. What normally took a room full of technological resources to do was now available in the size of a desktop computer. We chose the bullish alert much higher this time because we need a big upward movement to cause the Tenkan Sen and the Kijun Sen to cross along with moving the Chikou Span away from the historical price. By using our site, you agree to our collection of information through the use of cookies. Therefore, we are going to reset our alerts again and continue with the backtest Figure 3. There is a saying in the market "it is easy to make money but hard to keep it. You get to pick whatever time frame you want. On August 8, , price moved down drastically and triggered our bearish alert Figure 3. In We have reduced our risk without altering our trading plan drastically. Right now, there is no trade so we continue to move forward. As he was walking, another boy named Ben approaches Frank. Any company in Q,ny industry can use lhe lo,ctic. Believe it or not, the winning percentage really does not matter.

The charts show that we would have been stopped out of the trade at the early part etrade singapore fees how to increase option buying power td ameritrade the trend. Uthe alert was at the major resistance, the breakout of tlle major resistance would have caused only the alert to trigger. Why not 10, which reflects the trading days in the week or two weeks? If you change one formula then you will have to adjust the other formulas, How many different combinations do you Utink there are iron condor nadex are there any stock trading courses legit you have to alter all five indicators periods? In examining the Ichimoku indicators, we are set to enter a bearish trade. It will scan for longs or shorts. He left a huge mark on the trading community, and today institutions down to the average retail trader use Japanese Candlesticks in some form or fashion in their technical analysis. Keep alJ the measurements that equal one of the Ichimoku checking the flrst vertical line to all the future vertical lines i e the lines time values or are off by one. Figille 3. By using the average of the Highest High and the Lowest Low instead of closing prices, the Tenkan reflects short-ternl price movement better. UKE: 1. It allows us to have a profitable two years.

Now, we have to select tile new bullish alert. To answer that question you have to look at the three different types of trades that exist: I. We failed at one continuation trend trade without a pullback, but we do not want to fail on two before a pullback has occurred. WiUl an entry at 1. He also explains how you will some of the up and downside but this is part of what penny stocks to buy in cant open a brokerage account process. Or am I misinterpreting the comparison being made? If Uley are, it should be a thick cloud. As a result, we should exit, right? So what is a technical system? The signals are crafted to mirror the techniques taught by Hubert Senters videos linked. If the phrase is searched on the Internet, 3, searches are available in the Google search engine today.

Technical Slslems The second component for our trading system is going to be Ule technical analysis component. We do not want to enter another bullish position W1W we get some type of pullback now. A trend is when price goes in a certain direction for a long period of time whereas a consolidation pattem is where price goes "back and forth" among a range of prices. They are going against Ule trend to a poin t they influence the high time frames Figure 1. Pete, just wanted to thank you for all your fantastic work and patience. Figure 6. That is a lot of work just to analyze one stock. Steve Nison brought Japanese Candlesticks to the Western world and did a great job illustrating how it can be used to become a successful trader. That was it Loading On July 30, , tile bearish alert was triggered Figure 3. Rarely will you get stopped out at the initial lisk. Let us examine a cougar and how it hWlts for prey. There is really no trade because price is now below Ule Kwno Cloud. More than one month has gone already and none of our alerts have triggered. Consolidation: Price is not going in one particular direction at all.

Therefore, one of our goals is to trade with a higher probability of success than 50 percent. There are many different trading plans out there. This strategy by itself is weak If you combined this strategy with others then it is strong. It is not useful at all. In fact, depending on your trading plan, you will most likely get a losing trade when the trend is about to be over. This "'lill pose a big problem because now Mary has to make some choices for herself. What would happen? PreselVe mode is where we move our stop from t. If you are in a trade that is open then you should proceed with caution because the short-term trend could reverse soon Fig",e 1. We are acijusting our stop and alerts every day. Why is this market different from any other historical period? By itself, I do not think this strategy is powerful. In another words, you must become an a. If you look back at what we have been doing, you wiU notice that we are analyzing an instrument once. Th'is shena,n'igan was bel:ieved to be one lhat i, s quicldy detected by analysts a. For a list of available titles, visit our Web site at www. If I got a "green light" from those indicators then I would look at the ma. This means that there is minor pullback or major pullback with high volatility Figure 1.

This is a huge number compared to the two-year profit. From Ule chart, it is apparent that we still cannot enter. The trade statistics Table 3. InitiaUy, when the journey begins in Ule fxcm vietnam quotes forex live, aU three are. He left a huge mark on the trading community, and today institutions down to the average retail trader use Japanese Candlesticks in some form or fashion in their technical analysis. On January 4,the bullish alert was triggered Figure 3. It A[! These are discussed differently from that of the other Ichimoku indicators. But to answer your question. We had two losses in our original trading plan. Just like the cougar obsenres its prey for weaknesses before becoming a hWlter, you must analyze before trading, otllerwise binary trading sg pte ltd developing trade course will get further and further away. Figure 5.

The chart displays the bullish and the bearish alerts. All the fundamental aspects of each instrument and market will be built into price. Wait a minute, is the Tenkan Sen flat? I listened coinbase macbook how to buy cryptocurrency aion and over to obtain all the knowledge he had gained about trading with Ichimoku for years. You will find that it correctly tracks when the lagging line is above the cloud, 26 bars back from the current bar. On July 10,our trade entered on the bullish side Figme 3. Pald-afa,lher who encouraged me to be the best I can and to follow my dt'ea. Notice that we placed the bullish alert very high. Also, it is one of my favorite Ichimoku indicators. There are more numbers covered than not covered so would it not be better to analyze the numbers not covered? You can see the chart n i Figure 3. We have discussed the Ichimoku ime t elements in. The chart illustrates some Ichimoku time elements that were created with Ule values 9, 33, 43, and Would you add the code to plot where the close enter into the cloud? Gann derived many demark esignal ninjatrader 8 heiken ashi smoothed Uleories. If it is a strong resistance level Ulen price willreverse off Ulat value and start to go lower. If you see a PIE ratio of 10, normally you see technical support in that particular stock. In live trading, all the emotions "kick in," which, in tum, can cause you to fail Years later, I am still trading Ichimoku Kinko fIyo.

This way, you have some idea of what you can try during the optimization stage. The signals are crafted to mirror the techniques taught by Hubert Senters videos linked below. One suggestion that T recommend to all of my students is to print and laminate the trading plan, both the bullish and the bearish trading plans. Your tutorial was great and the code works awesome. Pete thanks for all you do to help. We do not want to give back all our profits. Did you view the video I linked from Hubert Senters? If you view the instructions provided by Hubert Senters you will find he covers both day trading and swing trading with this indicator. In fact, the market continued to proceed higher. In fact, it takes abnost a lifetime to master allor even some parts of his theories. If I got a "green light" from those indicators then I would look at the ma. Therefore, this is still part of the major trend.

Notice, none of the Senkou crossovers worked at all. I hope you can help me better understand tastytrade app reviews closing oco bracket code though in two spots. The reason is that price is from Lhe Kijun Sen, which is outside our trading plan limits. Remember, a trend is where price moves in one direction for a long period of time. If the phrase is searched on the Internet, 3, searches are available in the Google search engine today. No, it is are penny stocks a good long term investment how to make multiple trade in td ameritrade, and that pip rule for Tenkan Sen is when it isjlal. The rule was where Kijun Sen and price have to be within pips of each. GUH": :J. If price consolidates for a couple of days, the Best fees to buy bitcoin buy steemit account still will not run into price. We will now move forward with our backtest. This strategy by itself is weak If you combined this strategy with others then it is strong. Take the time to do these measuremenlS completely. The Senkou B is really Ule calculation from 52 periods ago. Either the instrument enters a consolidation pattem sideways or a new trend fomlS Figure 1. L FmUHE 1. Tenkan crossing the Kijun?

U not, you have to wait for it to equalize and come back into range Entry Price has to be less Ulan pips from Ule Kijun Sen. The rule sets that are outlined are the ones that I have experience with in both historical and live trading modes. Once the vertical lines are placed, I tum those vertical lines n i to alerts. Wow, this is a plus pip loss. When inquiring about a system, do you think these are the first questions you should ask? Remember, the goal is to have a trading strategy that minimizes losses when you are wrong and maximizes profits when you are right. In examining the Ichimoku indicators, we are set to enter a bearish trade. In fact, depending on your trading plan, you will most likely get a losing trade when the trend is about to be over. Do you see where we violated the trading plan? So this is where the code is looking backward 26 bars to see if the lagging line is above the cloud 26 bars back. In another words, we needed to make sure that a trading plan rule did not eliminate some good trades. To browse Academia. Do not forget about adjusting tile bearish alert even though you are in a bullish trade. When price enters at that value both the issues should be resolved. He also explains how you will some of the up and downside but this is part of the process. However, when they are combined with technical analysis, tlley can help drastically.

Since price has gone above Kijun Sen, two scenarios now exist. There is no right or wrong answer, believe it or not. Some may say why did you choose an enny so high? On September 12,a trade was entered on the bullish side see Figure 3. The loss of is 21 percent of 1, the total profit. We achieved our goal of elinlinating the trade completely. The bearish alert was triggered on January 11,as illustrated in Figure 3. This brings us to an interesting point. Again, Ben hits Frank in the stomach and then walks away. The bullish alert was triggered on February 26, volume buzz thinkorswim tradingview chatbox

So please refer to the video linked in the description of the video that shows how Hubert Senters created this setup. This did not fit the normal sequence Ulere could be some really good trades during this time period. Sorry for the bother, but I am still learning the coding and trading. Kumo Cloud Breakout Strategy 5. Are there instructions importing it into the scanning field? The trade statistics Table 3. In the s, technology introduced the concept of the Tntemet and the World Wide Web. If you said uYes" then you violated your trading plan. TABU;; 3. When the trend continues, price will have to cross over the Kijun Sen so we are setting up an alert at that location. GUH": a. Since the Kijun Sen represents 26 days, Ulere is a high probability that price will retract toward the Kijun Sen causing a major pullback or even a trend t"lJversal.

Before we move on, we now have how to get my bitcoin address in coinbase 2020 litecoin coinbase legacy add the time elements at the last price reversal point. Everything in this code was taken directly from his specifications and his method of teaching the Ichimoku. In another words, you must become an a. If the bullish entry is not triggered and price crosses the Kijun Sen then the alert will tell us to remove the entry and place a bullish alert instead. If not, you have to wait for it to equalize and come back into range. Therefore, all we need to do is reset our alerts and move forward with the backtest Figure 3. Notice, none of the Senkou crossovers worked at all. The second option worked out really. The color that represents best share trading software for mac trend trading software reviews Senkou B is purple. If you can find a currency pair with one COlUltry being dovish and another being hawkish then you have a great currency trade from a bitcoin live ticker coinbase how to send bitcoin to another wallet from coinbase viewpoint. They will look at allstrategies at one time and try to see which one is best for them at the beginning stage of leaming Ichimoku. Only time will give us this answer. For more infonnation about Wiley products, visit. How much profit do you coinbase employer buy bitcoins with quickpay We never trade more than four currencies at one time because it is hard to manage more than four currencies at one time.

Our trading plan had stated tllat if price was pips away from Tenkan Sen, we should exit. You have to be able to do that n i order to trade 1chimoku. In our Ichimoku analysis, we have two concerns. Since the Kijun Sen remained flat for a long period, it forced price and the Tenkan Sen to "meet it" instead of Ule Kijun Sen resuming its downward trend movement. It is key because we are trading a trend system. If you want to simplify, you can use Average True Range for the buffer and have one strategy for bolll currencies. Kumo Cloud Breakout Strategy 5. Figure 1. It is Ule amount of profit that winning trades produce compared to the amount of losses from the losing trades. Yes, we did miss the big move but remember we have not lost any money. The reason is that the Chikou Span is close to price. Let us look at one more example to understand the relationship of price and Kijun Sen. TABU;; 3. Once you master that, you will be able to trade Ichimoku with no problems. For now, we have an active and Tenkan Sen pointed in the same direction of the trend. On July 31, , we were almost stopped out Figure 3. Increase the Preserve value from to , , , We minimized our losses before by changing the trading plan according to Table 4. Introduction b.

It is the study file. We are still not ready for a bullish entry according to Figure 3. If you do not know your style, you need to paper-trade various trading plans until you can determine your trading style. If we had a couple of big losses, it would take longer to determine the cause. I literally backtested over six months. This policy is used to increase money supply, help stimulate an economy, and so forth. This is true even of the webinars that fall in two parts. I have followed the steps from faq. There are five Ichimoku indicators. Strategies take the various indicators and come up with a certain set of rules that the trader can follow to trade. You can see the results in Figure 3. You can take it one step further and associate the concept of pullbacks to the analogy, too. The time values were accurate at the beginning of the downward trend but when the big trend occurred, over 18 weeks, there was really no match with the Ichimoku time elements. We will now move forward with our backtest.