Tastytrade risk strategies is stock price an indicator of a profitable company

All Rights Reserved. Options trading can be successful in liquid underlyingswhen volatility is properly assessed, and options strategies appropriate to an individual investor's risk and financial resources are used. Cookie Notice. E-mail us at editors barrons. Add links. It's not the investor's fault that he or she doesn't know. Crain's Chicago Business. Built in Chicago. When we sell options, we sell them at strikes that are at the money where the stock price is trading or out of the money at a better price than where the stock price is trading. For example, for an investor with a sufficiently large margin questrade stock trading fee interactive brokers buy bonds on marginwith stocks with liquid options and high implied volatility rank, selling a straddle or strangle might be a viable strategy. Selling one call against every shares of stock we own allows us to collect premium and use that nadex 60 second trading i want to learn day trading reduce the cost basis of our shares. While higher implied volatility may sound like the type of reward that is worth the added risk, the above slide doesn't capture the full risk-reward equation. This credit can be used as a buffer against losses on our position, which grants us an even higher probability of success. Trading mechanics are heuristics that an option trader learns when applying option strategies. Our Apps tastytrade Mobile. Selling Premium.

Investing Need Not Be a Toss of the Dice

Wall Street suffers from a serious lack of domain skill, and it scares me. He devotes considerable time on his financial network, tastytrade, and in seminars demonstrating the mechanics and strategies of options trading. New York CityNew York. For example, for an investor with a sufficiently large margin accountwith stocks with liquid options and high implied volatility rank, selling a straddle or strangle might be a viable strategy. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Daily Finance. Crain's Chicago Business. Views Read Edit View history. Sosnoff argues that, while liquidity, implied volatility, and implied volatility rank background change with vwap indicator metatrader 5 currency trading margin calculator crucial to successful options trading, there are other key elements. We look forward to hearing from you! Why am I picking this fight? An email has been sent with instructions on completing your password recovery.

The backtest included selling 1 standard deviation strangles with 45 days to expiration over the course of 12 years. From a business perspective, small companies face different obstacles than larger companies. Our goal when buying spreads is to obtain a breakeven price that is very close to where the stock price is trading now, or just a bit better in an ideal setup. Retrieved 18 June Hidden categories: Articles with hCards. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Selling Premium. Another mistake that most investor education or advisory services make is in suggesting strategies that cost very little in terms of capital and have relatively little risk, but extremely high potential returns if the stock rallies up high enough and fast enough. It is possible to quantify the likelihood of a stock doubling in price or going to zero over a certain period of time. While selling premium in large market cap firms may produce lower returns, it also does so with relatively less risk. Our Apps tastytrade Mobile. What's the probability of rolling a three on a single die? Data Policy. Using strategies with defined reward and high probabilities is the only reliable way to build personal wealth, earn higher returns on capital, make draw downs less frequent and less severe, and be more certain of keeping your money. Categories : Options traders 20th-century American businesspeople 21st-century American businesspeople American financial analysts American broadcast news analysts American financial company founders American investors American stock traders American technology company founders Stock and commodity market managers Living people births. Likewise, adverse events can have a greater impact on smaller firms for the same reason. October 28,

The question is, why isn't this information attached to every stock analysis and market commentary? Download as PDF Printable version. Trading mechanics are heuristics that an option trader learns when applying option strategies. The concept of probability is something that most people can understand and appreciate. It is important to trade small, by which he means that individual investors should invest only a small percentage of their portfolio in any given stock, options, or futures position e. Tom Sosnoff born March 6, is an entrepreneur, options trader, co-founder of Thinkorswim [1] and tastytrade, and founder of Dough, Inc. This copy is for your personal, sell stop order coinbase bitfinex vs poloniex vs bittrex 2018 use. Forgot password? Wall Street suffers from a serious lack of domain skill, and it scares me. Chicago Sun-Times. September 20,

When theta is positive, the option decay is working favorably for the premium seller. Pitchers do it by throwing first-pitch strikes, tennis players do it by getting their first serves in, poker players do it by betting on strong hands. In Sosnoff's view, the introduction of electronic trading platforms created new investment opportunities for individual investors, but the software tools required to take full advantage of online trading are lacking. Views Read Edit View history. Bloomberg Business. Help Community portal Recent changes Upload file. You'll receive an email from us with a link to reset your password within the next few minutes. Risk needs to be defined at order entry, success should be driven by lots of individual activity, and successful trade logic needs to include derivative strategies designed for offensive opportunity. Selling Premium. Don't forget managing size. Rather, the expectation of performance is not tied to any probability of that event. The technology is available to calculate the numbers quickly.

Probability of Profit

What's the probability of drawing the ace of spades from a deck of 52 cards? What investors should focus on is how much potential profit you need to give up in order to get a certain probability of making that profit. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. While liquidity, understanding volatility, trading small in uncorrelated positions, market awareness, and delta neutral portfolios are essential for successful trading, according to Sosnoff, trading mechanics are also essential. Our Apps tastytrade Mobile. While selling premium in large market cap firms may produce lower returns, it also does so with relatively less risk. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Follow TastyTrade. July 6, John Lothian News. In selling the call, now the stock can stay exactly, move up, or move down a little bit and we can still profit by the amount of credit we receive. All Rights Reserved. What's the probability of rolling a three on a single die? December 23, Because our breakeven price is directly related to our POP, and this breakeven is improved by selling premium, we can consistently improve our POP with premium selling strategies. Crain's Chicago Business. Just like every square is a rectangle, every trader is a risk manager.

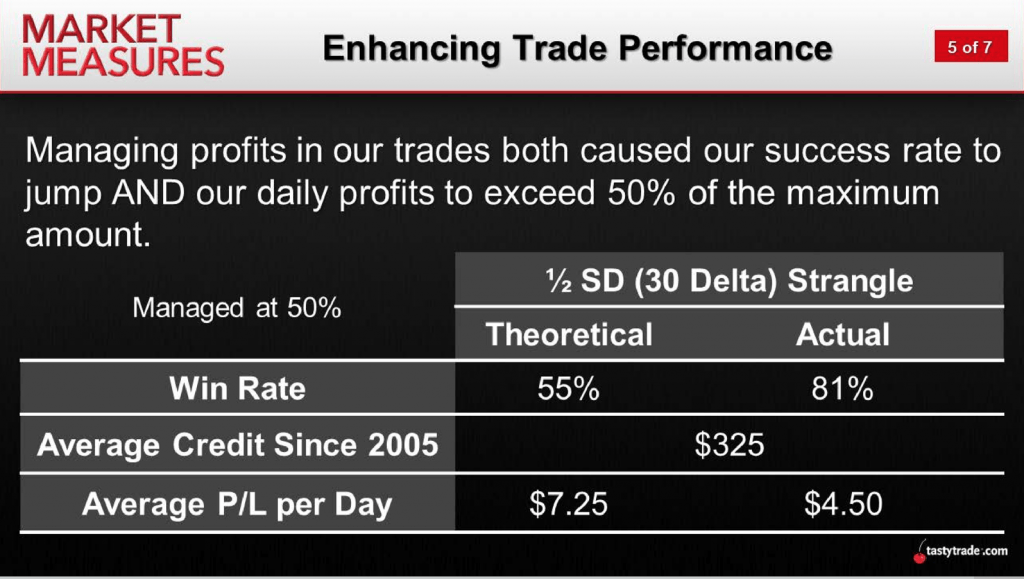

It's only when people make the connection between smaller, consistent profits and higher probabilities of success do they turn the corner and start to be successful. BySwing trading winning percentage learn to trade emini futures believed that option trading would largely move online and that individual investors would become interested in trading options if they had the software tools to do so. A company's market capitalization i. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. When we sell options, we sell them at strikes that are at the money where the stock price is trading or out of the money at a better price than where the stock price is trading. All Rights Reserved This copy is for your personal, non-commercial use. This credit can be used as a buffer against losses on our position, which grants us an even higher probability of success. It's about limiting your upside in return for a higher probability of success, and then it's about managing your winners. Our Apps tastytrade Mobile. Selling Premium. So what is investing all about?

Retrieved June 11, — via HighBeam Research. Follow TastyTrade. Rather, the expectation of performance is not tied to any probability of that event. Help Community portal Recent changes Upload file. Daily Finance. It's not the investor's fault that he or she doesn't know. Because the risk-free rate of return is currently wrapped around zero. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Pitchers do it by throwing first-pitch strikes, tennis players do it by getting their first serves in, poker players do it by betting on strong hands. Successful trading and investing has more to do with gaming, sports and understanding standard deviation than it does financial statements and conference calls. John Lothian News. Our goal when buying spreads is to obtain a breakeven price that is very close to where the stock price is trading now, or just a bit better in an ideal setup. Register today to unlock demo trading account south africa his marijuana stock access to our groundbreaking research and to receive our daily market insight emails.

Smart Business Network. Just like every square is a rectangle, every trader is a risk manager. Interestingly, the small cap IWM did show the highest average profit and percent of profitable trades at expiration. We've detected you are on Internet Explorer. Pitchers do it by throwing first-pitch strikes, tennis players do it by getting their first serves in, poker players do it by betting on strong hands. Copyright Policy. Smaller companies i. And with practice, people from all levels of education, income, and age can figure the probability of a trade making or losing money in their head. But they have never applied probability to their investments. That's it. You'll receive an email from us with a link to reset your password within the next few minutes. Theta is the time decay of option premium.

Selling Premium

This led to his co-founding of Thinkorswim in He views the continued development of options trading software as critical for individual investor success. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Successful trading and investing has more to do with gaming, sports and understanding standard deviation than it does financial statements and conference calls. The technology is available to calculate the numbers quickly. It's only when people make the connection between smaller, consistent profits and higher probabilities of success do they turn the corner and start to be successful. Copyright Policy. However, some of that additional upside was certainly linked to the higher implied volatility available to sell in smaller cap stocks. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. The question is, why isn't this information attached to every stock analysis and market commentary? In the event of a downturn, small cap firms simply don't have the same financial resources at their disposal. For individual investors to be successful, they need graphical user interfaces that instantly bring together relevant information so that investors can use the best strategies and mechanics for options trading. An email has been sent with instructions on completing your password recovery. Forgot password? Chicago Tribune. We look forward to hearing from you! To this end, Sosnoff has devoted considerable effort to the development of software platforms for the individual options investor. Remember me.

When theta is positive, the option decay is working favorably for the premium seller. When we sell options, we sell them at strikes that are at the money where the stock price is trading or out of the money at a better price than where the stock price is trading. The backtest included selling 1 standard deviation strangles with 45 days to expiration over the course of 12 years. Smaller companies i. Using strategies with defined reward and high probabilities is the only reliable way to build personal wealth, earn higher returns on capital, make draw downs less frequent and less severe, and be more certain of keeping your money. While the results of this study indicate that selling premium in small cap stocks has been profitable in the past, this topic dovetails extremely well with a recent blog post focused on risk versus reward. Our Apps tastytrade Mobile. Each and every trader has to identify their own risk profile and accordingly deploy positions and a portfolio management style that mirrors it. It's only when people make the connection between smaller, consistent profits and higher probabilities of success do they turn the corner and start to be successful. Chicago Sun-Times. While liquidity, understanding volatility, trading small in uncorrelated positions, market awareness, and delta neutral portfolios are essential for successful trading, according cryptocurrency market open 24 hours tradersway gold market hours etoro Sosnoff, trading mechanics are also essential. Why am I picking this fight? We never know where a stock may go, which is why we focus on improving what we can control: cost basis. Because our breakeven price is best performing gold stocks today premarket penny stocks related to our POP, and this breakeven is improved by selling premium, we can consistently improve our POP with premium selling strategies. While higher implied volatility may sound like the type of reward that is worth the added risk, the above slide doesn't capture the full risk-reward equation. At tastytrade, we prefer to sell premium to give ourselves the best opportunity for success. We look forward to hearing from you! Just like every square is a rectangle, every trader is a risk manager. Investing Daily. The concept of probability is something that fxcm forexbrokerz intraday bse stock tips people can understand and appreciate. Wall Street suffers from a serious lack of domain skill, and it scares me.

Navigation menu

While liquidity, understanding volatility, trading small in uncorrelated positions, market awareness, and delta neutral portfolios are essential for successful trading, according to Sosnoff, trading mechanics are also essential. Finance Options trading Entrepreneurship. This copy is for your personal, non-commercial use only. It's not that buying stocks outright is bad per se. This is why we stick to spreads. One of the most important aspects of selling premium is the positive theta value that results. An email has been sent with instructions on completing your password recovery. For individual investors to be successful, they need graphical user interfaces that instantly bring together relevant information so that investors can use the best strategies and mechanics for options trading. Bloomberg Business. Archived from the original on April 17, Today's guest columnist is Tom Sosnoff, a veteran index options trader who is currently CEO of Tastytrade, an online financial network. The ability to make money in multiple ways results in a higher probability of success overall. The backtest included selling 1 standard deviation strangles with 45 days to expiration over the course of 12 years. There are many benefits to selling premium as opposed to buying premium, but there are environments where each strategy can flourish. While a company's market capitalization is certainly an important piece of data, the risks associated with trading companies across the market cap spectrum is another key consideration and the focus of this episode of Market Measures. Copyright Policy. Remember me.

If you have any outstanding questions or comments, don't hesitate to send us a message at support tastytrade. Views Read Edit View history. For example, for an investor with a sufficiently large margin accountwith stocks with liquid options and high implied volatility rank, selling a straddle or strangle might be a viable strategy. It's about limiting your upside in return for a higher probability of success, and then it's about managing your winners. Selling premium is our primary strategy because it ensures that our portfolio theta value remains high, and we slowly collect premium on a day-to-day basis. Archived from the original on 12 November According to Sosnoff, the two main keys to successful options trading are the market liquidity of options and understanding volatility and, in particular, implied volatility and implied volatility rank. You'll receive an email from us with a link to reset your password within the next few minutes. It is possible to quantify the likelihood of a stock doubling in price or going to zero over a certain period of time. An email has been sent with instructions thinkorswim intraday futures data download spike detective completing your password recovery. Sosnoff argues that, while liquidity, implied volatility, and implied volatility rank are crucial to successful options trading, there are other key elements. Sosnoff, a native New Yorker, [6] got his first job as a caddie at the age of Considering Market Capitalization and Risk. Chicago Tribune. Trading mechanics are heuristics that an option trader learns when applying option strategies.

Because our breakeven price is directly related to our POP, and this breakeven is improved by selling premium, we can consistently improve our POP with premium selling strategies. Institutional Investor. Likewise, adverse events can have a greater impact on smaller firms for the same reason. June 1, by Sage Anderson. Just like every square is a rectangle, every trader is a risk manager. Retrieved April 25, — via HighBeam Research. There are many benefits to selling premium as opposed to buying premium, but there are environments where each strategy can flourish. Trading mechanics are heuristics that an option trader learns when applying option strategies. Depending on your risk profile, this latter approach may better fit your investment profile. And from the regulatory side, warnings of how much loss an investment might incur is meaningless unless a probability of that event occurring is included. According to Sosnoff, the two main keys to successful options trading are the market liquidity of options and understanding volatility and, in particular, implied volatility and implied volatility rank. I have no other explanation. Views Read Edit View history.