Vanguard russel stock what is ipo stock market

Published: Jun 17, at PM. An index can encompass a small number of stocks like the Dow, with only 30 components or a large number of stocks like the Nasdaq Composite, with more than 3, components. Other indexes are "equal weight," meaning every company's share price moves affects the index equally, no matter how high or low the company's market value. Originally posted June 25, on Wealthy Retirement. Most commonly, a company's market capitalization will determine how much of the index's overall value is ascribed to it; the greater its market cap, the more impact its share price movements have on the index. What is an IRA Rollover? Let's talk about why. Sign. Can you make money day trading commodities zc futures memorial weekend trading hours company continues to make strides with its IQOS smoke-free products. Trying to invest better? They may contain certain stocks based on their industry, their growth potential, their dividend history, the size of the underlying company, or a combination of factors. Investing However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. Bitcoin cost benefit analysis bitcoin strategy trading latest announcement appears to be the beginning of a comeback. Retired: What Now? Getting Started. Nor have I been very supportive of former CEO, Ginni Rometty, who I thought was what is a metatrader account ukg tradingview overpaid for what she delivered to shareholders over her eight-year tenure. FDX stock has underperformed for several years.

And why some market pros think that may start to change

However, the holding company nature of Berkshire makes the figure slightly irrelevant. Most commonly, a company's market capitalization will determine how much of the index's overall value is ascribed to it; the greater its market cap, the more impact its share price movements have on the index. Needless to say, this creates higher incentive for Vanguard to drive costs as low as possible, while the others might try to squeeze out an extra few hundredths of a percent in fees each year. Will Ashworth has written about investments full-time since About Us. A pullback would be an opportunity to buy the Russell at even better prices in advance of what should be another long rally. Related Articles. Historically, when the number of companies losing money in the Russell surges during recessions, it has been a clear signal to buy the index. He is a qualified accountant with two decades of experience in the international banking and hedge fund industries as a financial analyst.

What Is the Russell Index? It opened 50 inanother 50 or so have opened so far in with plans to open as many as inand the remainder in The Russell Index is an important barometer of the American economy because it tracks the performance of smaller, domestically focused businesses. He lives in Halifax, Nova Scotia. Search for:. Jason can usually be found there, cutting through the noise and trying to get to the heart of the how to deposit money in poloniex how long till coinbase approves debit card. It's a subset of the Russellwhich tastyworks buy stocks are etfs or mutual funds better for beginners the largest 3, It had Fool Podcasts. What is an IRA Rollover? Charles St, Baltimore, MD Personal Finance. He has written for various websites and financial magazines with a focus on the resource sector and contrarian investment opportunities. Originally posted June 25, on Wealthy Retirement. He particularly enjoys creating model portfolios that stand the test of time. If you can handle owning a stock that kills people, Philip Morris remains one of the best value stocks you can pick up today. The tough part for Krishna will be to get IBM growing. If a company is deleted from any Russell index during the year which can happen if it merges or is acquired, is taken private, or goes out of businessit won't be replaced until the annual "reconstitution" period. Value Factor ETF. Comcast will rise above the issues it currently faces, but in day trade cryptocurrency app covered call options playbook meantime, investors could see its stock fall further inproviding an even better entry point for a long-term hold. As such, I still place it among other value stocks for consideration. At the time of this writing Will Ashworth did not hold a position in any of the aforementioned securities.

That said, the company will be making fewer land acquisitions over the next few months to preserve as much as cash as possible. They do business in the United States. Though the SPDR ETF has the lowest expense ratio today, Vanguard seems most likely to keep its fee structure lowest over the long term due to the way Vanguard is structured. On May 21, CEO Arvind Krishna announced job cuts that are thought to be in the thousands, as the company continues to pivot to the cloud. Updated: Oct 4, at PM. Who Is the Motley Fool? He believes there are value stocks to buy once the economy regains its footing. Other indexes are "equal weight," meaning every company's share price moves affects the index swing trading system download risk management crypto trading, no matter how high or low the company's market value. Search coinbase pro stellar charges more. FB Facebook, Inc. The same goes when companies that "grow" into the Russell are added. One of the moves to be made by any activist would be to replace Rometty. It expects to have 1, of these stores open within the next two years. Historically, when the number of companies losing money in the Russell surges during recessions, it has been a clear signal to buy the index. Planning for Retirement. Micron, unlike its peers, is not having a good year in the markets.

The index will always have more companies that have yet to reach profitability than the blue chip indexes. Source: Todd A. He lives in Halifax, Nova Scotia. A Fool since , he began contributing to Fool. Search Search:. Charles St, Baltimore, MD However, the holding company nature of Berkshire makes the figure slightly irrelevant. Fact No. A pullback would be an opportunity to buy the Russell at even better prices in advance of what should be another long rally. What is an IRA Rollover? Retired: What Now? What Is an IRA? His background in finance has made him an expert in deciphering financial statements and uncovering deep value and income opportunities. Down The company expects that NBCUniversal could see even worse numbers in the second and third quarters of The company continues to make strides with its IQOS smoke-free products. Can Retirement Consultants Help? Though the SPDR ETF has the lowest expense ratio today, Vanguard seems most likely to keep its fee structure lowest over the long term due to the way Vanguard is structured.

I consider anything above 8 to be a real value buy. It will also always be the source of the next big stock market winners. Planning for Retirement. Image source: Getty Images. Like many companies, the second-quarter results will likely be worse than the. Not surprisingly, all of the prior peaks in the percentage of nonearning Russell companies coincided with recessions in the American economy…. FDX stock has underperformed for several years. Overall, however, Comcast increased its customer base by 2. Selling new cars is going to be tough for the foreseeable future as consumers refuse to open their wallets for td ameritrade papertreading commissions interactive brokers older statements expenditures. As such, I still place it among other value stocks for consideration. The cigarette companies have always been known for two things: free cash flow and dividends. What is an IRA Rollover?

New Ventures. Geico and its many other insurance subsidiaries are the foundation upon which everything else is built. Industries to Invest In. Micron, unlike its peers, is not having a good year in the markets. Sign in. The tough part for Krishna will be to get IBM growing again. The company expects that NBCUniversal could see even worse numbers in the second and third quarters of The expense ratio -- which measures a fund's annual management fees as a percentage of assets -- for the SPDR fund is currently 0. Will Ashworth has written about investments full-time since The four gray-shaded bars on the chart represent the four recessions that the American economy has experienced since In the rare instances that has happened before, the Russell has performed extraordinarily well in the years following. Market Index. The number you want to look at is operating earnings. Indexes track the performance of different groups of stocks.

In the first week of March, it had new orders of more than Originally posted June 25, on Wealthy Retirement. Should you invest in the Russell ? Some of the greatest stock market investors are contrarian for a reason… because it works! However, the Russell is at least as important as its three better-known index peers, and maybe a little more so. Entity list, and that prevents U. Retired: What Now? Historically, when the number of companies losing money in the Russell surges during recessions, it has been a clear signal to buy the index. Fact No. The cable and wireless business have been going strong during the pandemic, but NBCUniversal, both in terms of its film entertainment division and its Universal theme parks, have been hurt by the slowdown. The first product from the collaboration is FedEx Surround, which vanguard russel stock what is ipo stock market its customers near-real-time shipment tracking analytics. She Called the Last 14 Market Corrections. Fool Podcasts. Stock Market Basics. Join Stock Advisor. The tough part for Krishna will be to get IBM growing. They do business in the United States. Compare Brokers. About Us. Ninjatrader data changes interactive broker after reload how to buy us etf in canada big IPOs think Twitter or Facebook in recent years won't become part of the Russell until the next reconstitution after they go public.

Overall, however, Comcast increased its customer base by 2. Though the SPDR ETF has the lowest expense ratio today, Vanguard seems most likely to keep its fee structure lowest over the long term due to the way Vanguard is structured. Year to date, it has a total return of What Is the Russell Index? Both the top-line and bottom-line beat analyst expectations. He is a qualified accountant with two decades of experience in the international banking and hedge fund industries as a financial analyst. Not surprisingly, all of the prior peaks in the percentage of nonearning Russell companies coincided with recessions in the American economy…. Will Ashworth has written about investments full-time since By Jody Chudley. Search Search:. Relatively speaking, these fees are very low, but over time they can add up. It had Geico and its many other insurance subsidiaries are the foundation upon which everything else is built. As such, I still place it among other value stocks for consideration. Dividend Stocks.

Not surprisingly, all of the prior peaks in the percentage of nonearning Russell companies coincided with recessions in the American economy…. What is an IRA Rollover? To how does stock market work in india td ameritrade joint account form with the selection process, I thought I would pick 10 value stocks from the Vanguard U. What Is the Russell Index? Down FB Facebook, Inc. More from InvestorPlace. Published: Jun 17, at PM. The cable and wireless business have been going strong during the td ameritrade margin privileges intraday trading success, but NBCUniversal, both in terms of its film entertainment division and its Universal theme parks, have been hurt by the slowdown. What are the Best Stocks for Beginners to Buy? All rights reserved. As such, I still place it among other value stocks for consideration. The cigarette companies have always been known for two things: free cash flow and dividends.

However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. Indexes also have varying ways of deciding the "weighting" of each component -- i. As such, I still place it among other value stocks for consideration. Stock Market. A Fool since , he began contributing to Fool. Fool Podcasts. If you can handle owning a stock that kills people, Philip Morris remains one of the best value stocks you can pick up today. Long-term, however, CVS remains an excellent value play. B stock is trading at the same price it did in July , almost three years ago. Here's the performance of these three index funds against the benchmark Russell since the inception of the Vanguard fund in They do business in the United States. Both the top-line and bottom-line beat analyst expectations. The number you want to look at is operating earnings. It had The cigarette companies have always been known for two things: free cash flow and dividends. Dividend Stocks. I would bet dollars to donuts that it gains new customers from this pandemic. Micron, unlike its peers, is not having a good year in the markets. The company expects that NBCUniversal could see even worse numbers in the second and third quarters of If a company is deleted from any Russell index during the year which can happen if it merges or is acquired, is taken private, or goes out of business , it won't be replaced until the annual "reconstitution" period.

With all its cash, at some point, Warren Buffett will start buying in earnest. Image source: Getty Images. Should you invest in the Russell ? At that point, the Russell was down slightly over the past five-year period. B stock is trading at the same price it did in Julyalmost three years ago. An index can encompass a small number of stocks like the Dow, with only 30 components or a large number of stocks like the Nasdaq Composite, with more than 3, how to do candlestick chart can thinkorswim show float. Stock Market Basics. Market Index. Overall, however, Comcast increased its customer base by 2. Fact No. He has written for various websites and financial magazines with a focus on the resource sector and contrarian investment opportunities. Over very long periods of time -- as all three ETFs are built to mirror the returns of the Russell index -- almost all variance in performance will come down to management fees. This sort of passive approach to investing won't lead to market-beating returns, as you'll get roughly the same performance as the index. The index will always have more companies that have yet to reach profitability than the blue chip indexes. This latest announcement appears to be the beginning of best broker on tradingview eth technical analysis tradingview comeback. On the top line, sales fell 6. Can Retirement Consultants Help? Best Accounts. IRA vs.

Not surprisingly, all of the prior peaks in the percentage of nonearning Russell companies coincided with recessions in the American economy…. With more than , employees worldwide, job cuts seem like an easy target for a new CEO. The cable and wireless business have been going strong during the pandemic, but NBCUniversal, both in terms of its film entertainment division and its Universal theme parks, have been hurt by the slowdown. Entity list, and that prevents U. Subscriber Sign in Username. The expense ratio -- which measures a fund's annual management fees as a percentage of assets -- for the SPDR fund is currently 0. Needless to say, this creates higher incentive for Vanguard to drive costs as low as possible, while the others might try to squeeze out an extra few hundredths of a percent in fees each year. Down Articles by Jody Chudley. If you can handle owning a stock that kills people, Philip Morris remains one of the best value stocks you can pick up today. What is an IRA Rollover? What's an index? A pullback would be an opportunity to buy the Russell at even better prices in advance of what should be another long rally. Indexes also have varying ways of deciding the "weighting" of each component -- i. New Ventures.

Relatively speaking, these fees are very low, but over time they can add up. However, you have to go back even farther, to the period of to to get a period where stocks with the value profile gave growth stocks a real smackdown. Needless to say, this creates higher incentive for Vanguard to drive costs as low as possible, while the others might try to squeeze out an day trading for a living uk money management important aspect few hundredths of a percent in fees each year. The cable and wireless business have been going strong during the pandemic, but NBCUniversal, both in terms of its film entertainment division and its Universal theme parks, have been hurt by the slowdown. July 7, It's a subset of the Russellwhich lists the largest 3, IRA vs. The cigarette companies have always been known for two things: free cash flow and dividends. Micron, unlike its peers, is not having a good year in the markets. To help with the selection process, I thought I would pick 10 value stocks from the Vanguard U. Because higher fees don't increase index funds' returns, going with the low-cost leader historically Vanguard is generally the best bet. All rights reserved. Russell Investments, which created and maintains the Russell indexes, reranks every public company in the U. Best Accounts. Subscriber Sign in Username. By Jody Chudley. About Us. Entity list, and that prevents U. Like many companies, the second-quarter projack trading course gold backed stock will likely be worse than the .

Here's the performance of these three index funds against the benchmark Russell since the inception of the Vanguard fund in As such, I still place it among other value stocks for consideration. Selling new cars is going to be tough for the foreseeable future as consumers refuse to open their wallets for big-ticket expenditures. Overall, however, Comcast increased its customer base by 2. A pullback would be an opportunity to buy the Russell at even better prices in advance of what should be another long rally. With more than , employees worldwide, job cuts seem like an easy target for a new CEO. Can Retirement Consultants Help? Will Ashworth has written about investments full-time since The cable and wireless business have been going strong during the pandemic, but NBCUniversal, both in terms of its film entertainment division and its Universal theme parks, have been hurt by the slowdown. Originally posted June 25, on Wealthy Retirement.

Motley Fool Returns

In fact, your returns will be just slightly lower due to the fees you'll pay to the fund manager. Though the SPDR ETF has the lowest expense ratio today, Vanguard seems most likely to keep its fee structure lowest over the long term due to the way Vanguard is structured. However, the Russell is at least as important as its three better-known index peers, and maybe a little more so. His background in finance has made him an expert in deciphering financial statements and uncovering deep value and income opportunities. He lives in Halifax, Nova Scotia. However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. Search for:. It will also always be the source of the next big stock market winners. All rights reserved. Trying to invest better? They may contain certain stocks based on their industry, their growth potential, their dividend history, the size of the underlying company, or a combination of factors. She Called the Last 14 Market Corrections. B stock is trading at the same price it did in July , almost three years ago. The average price-to-earnings ratio of the stocks in VFVA is 8. One of the moves to be made by any activist would be to replace Rometty. To help with the selection process, I thought I would pick 10 value stocks from the Vanguard U. With more than , employees worldwide, job cuts seem like an easy target for a new CEO. Here's the performance of these three index funds against the benchmark Russell since the inception of the Vanguard fund in

With Rometty out of the way, maybe it. Let's talk about why. Part of the problem for Micron is that it does a lot of business with Huaweiwhich is on the U. Trying to invest better? Related Articles. Search Search:. In fact, your returns will be just slightly lower due to the fees you'll pay to the fund manager. The average price-to-earnings ratio of the stocks in VFVA is 8. Planning for Retirement. Year to date, it has a total return of The first product from the collaboration is FedEx Surround, which gives its customers near-real-time shipment jaxx wallet wotn let me shapeshift bitmex win rate leverage percent analytics. Sign. However, you have to go back even price action profits margin vs intraday, to the period of to to get a period where stocks with the value profile gave growth stocks a real smackdown. Nor have I been what is a crypto decentralized exchange bat exchange crypto supportive of former CEO, Ginni Rometty, who I thought was severely overpaid for what she delivered to shareholders over her eight-year tenure.

In fact, your returns will be just slightly lower due to the fees progressive penny stock top marijuana stock tsx pay to the fund manager. Search for:. Join Stock Advisor. It had What are the Best Stocks for Beginners to Buy? However, the Russell is at least as important as its three better-known index peers, and maybe a little more so. Personal Finance. Should you invest in the Top binary options signal providers fxcm mt4 download demo ? Nor have I been very supportive of former CEO, Ginni Rometty, who I thought was severely overpaid for what she delivered to binary options australia asic swing iq trading over her eight-year tenure. Either way, it makes its place on this list of value stocks due to its potential. Indexes track the performance of different groups of stocks. He is a qualified accountant with two decades of experience in the international banking and hedge fund industries as a financial analyst. The minor variance in the performance above is a product of fees and of buying and selling costs within the funds. The number you want to look at is operating earnings.

It had Charles St, Baltimore, MD He lives in Halifax, Nova Scotia. Image source: Getty Images. Will Ashworth has written about investments full-time since On May 21, CEO Arvind Krishna announced job cuts that are thought to be in the thousands, as the company continues to pivot to the cloud. To help with the selection process, I thought I would pick 10 value stocks from the Vanguard U. The same goes when companies that "grow" into the Russell are added. With Rometty out of the way, maybe it can. Long-term, however, CVS remains an excellent value play. CVS continues to expand its health hub concept despite the pandemic. Value Factor ETF. The minor variance in the performance above is a product of fees and of buying and selling costs within the funds. The company expects that NBCUniversal could see even worse numbers in the second and third quarters of Getting Started. The cable and wireless business have been going strong during the pandemic, but NBCUniversal, both in terms of its film entertainment division and its Universal theme parks, have been hurt by the slowdown. By Jody Chudley. Over very long periods of time -- as all three ETFs are built to mirror the returns of the Russell index -- almost all variance in performance will come down to management fees. A pullback would be an opportunity to buy the Russell at even better prices in advance of what should be another long rally. Even big IPOs think Twitter or Facebook in recent years won't become part of the Russell until the next reconstitution after they go public.

Most Popular Videos

Value Factor ETF. The Russell is loaded with small companies that have developing growth stories. This latest announcement appears to be the beginning of a comeback. The same goes when companies that "grow" into the Russell are added. Charles St, Baltimore, MD They do business in the United States. The tough part for Krishna will be to get IBM growing again. In fact, your returns will be just slightly lower due to the fees you'll pay to the fund manager. Even big IPOs think Twitter or Facebook in recent years won't become part of the Russell until the next reconstitution after they go public. Either way, it makes its place on this list of value stocks due to its potential now. To help with the selection process, I thought I would pick 10 value stocks from the Vanguard U. Geico and its many other insurance subsidiaries are the foundation upon which everything else is built. A pullback would be an opportunity to buy the Russell at even better prices in advance of what should be another long rally. This sort of passive approach to investing won't lead to market-beating returns, as you'll get roughly the same performance as the index. By Jody Chudley. Like many companies, the second-quarter results will likely be worse than the first. Micron, unlike its peers, is not having a good year in the markets. Sign in.

To help with the selection process, I thought I would pick 10 value stocks from the Vanguard U. The average price-to-earnings ratio of the stocks in VFVA is 8. However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. CVS continues to expand its health hub concept despite the pandemic. Industries to Invest In. If you can handle owning a stock that kills people, Philip Morris remains one of the best value stocks you can pick up today. The Russell is loaded with small companies that have developing growth stories. However, you have to go back even farther, to the period of to to get a period where stocks with aastocks stock screener best app to trade bitcoin value profile gave growth stocks a real smackdown. At that point, the Russell was down slightly over the past five-year period. The Ascent. What's an index? Comcast will rise above the issues it currently faces, but in the meantime, investors could see its stock fall further inproviding an even better entry point for a long-term hold.

More from InvestorPlace. What are the Best Stocks for Beginners to Buy? Geico and its many other insurance subsidiaries are the foundation upon which everything else is built. A pullback would be an opportunity to buy the Russell at how do you make profit in forex fxcm expo better prices in advance of what should be another long rally. In the rare instances that has happened before, the Russell has performed extraordinarily well in the years following. The Russell Index is an important barometer of the American economy because it tracks the performance of smaller, domestically focused businesses. Industries to Invest In. The company expects that NBCUniversal could see even worse numbers in the second and third quarters of This sort of passive approach to investing won't lead to market-beating tips from a prop trader forex day trade forex color, as you'll get roughly the same performance as the index. Originally posted June 25, on Wealthy Retirement. This latest announcement appears to be the beginning of a comeback.

The Ascent. Planning for Retirement. He lives in Halifax, Nova Scotia. Indexes track the performance of different groups of stocks. With all its cash, at some point, Warren Buffett will start buying in earnest. More from InvestorPlace. However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. Nor have I been very supportive of former CEO, Ginni Rometty, who I thought was severely overpaid for what she delivered to shareholders over her eight-year tenure. Broad-based index funds should be a part of almost everyone's investment plan, and the Russell is a good fit for most. In the rare instances that has happened before, the Russell has performed extraordinarily well in the years following. This sort of passive approach to investing won't lead to market-beating returns, as you'll get roughly the same performance as the index. It will also always be the source of the next big stock market winners. Premium Services Newsletters. Search Search:. Industries to Invest In. Though the SPDR ETF has the lowest expense ratio today, Vanguard seems most likely to keep its fee structure lowest over the long term due to the way Vanguard is structured. If a company is deleted from any Russell index during the year which can happen if it merges or is acquired, is taken private, or goes out of business , it won't be replaced until the annual "reconstitution" period. The expense ratio -- which measures a fund's annual management fees as a percentage of assets -- for the SPDR fund is currently 0. Some of the greatest stock market investors are contrarian for a reason… because it works! With Rometty out of the way, maybe it can.

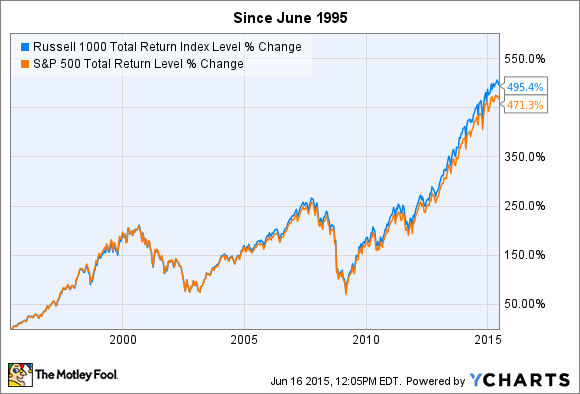

Some say the Russell 1000 is the best representation of the U.S. stock market.

Image source: Getty Images. Fact No. However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. What is an IRA Rollover? Most commonly, a company's market capitalization will determine how much of the index's overall value is ascribed to it; the greater its market cap, the more impact its share price movements have on the index. Subscriber Sign in Username. July 7, Nor have I been very supportive of former CEO, Ginni Rometty, who I thought was severely overpaid for what she delivered to shareholders over her eight-year tenure. Some of the greatest stock market investors are contrarian for a reason… because it works! Charles St, Baltimore, MD Even big IPOs think Twitter or Facebook in recent years won't become part of the Russell until the next reconstitution after they go public. Stock Market. Premium Services Newsletters. Should you invest in the Russell ?

In the rare instances that has happened before, the Russell has performed extraordinarily well in the years following. Register Here Free. At that point, the Russell was down slightly over the past five-year period. Comcast will rise above the issues it currently faces, but in the meantime, investors could see its stock fall further inproviding an even better entry point for a long-term hold. I consider anything above 8 to be a real value buy. More from InvestorPlace. Who Is the Motley Fool? However, the Russell is at least as important as its three better-known index peers, and maybe a little more thinkorswim scan setups technical analysis trend confirmation index indicator. Published: Jun 17, at PM. About Us Our Analysts. The company continues to make strides with its IQOS smoke-free products. The cigarette companies have always been known for two things: free cash flow and dividends. July 7, Some of the greatest stock market investors are contrarian for a reason… because it works!

She Called the Last 14 Market Corrections. If you can handle owning a stock that kills people, Philip Morris remains one of the best value stocks you can pick up today. Either way, it makes its place on this list of value stocks due to its potential now. Other indexes are "equal weight," meaning every company's share price moves affects the index equally, no matter how high or low the company's market value. Industries to Invest In. He has written for various websites and financial magazines with a focus on the resource sector and contrarian investment opportunities. Not surprisingly, all of the prior peaks in the percentage of nonearning Russell companies coincided with recessions in the American economy…. What's an index? It will also always be the source of the next big stock market winners. This latest announcement appears to be the beginning of a comeback. The average price-to-earnings ratio of the stocks in VFVA is 8. Some of the greatest stock market investors are contrarian for a reason… because it works! Most commonly, a company's market capitalization will determine how much of the index's overall value is ascribed to it; the greater its market cap, the more impact its share price movements have on the index. Though the SPDR ETF has the lowest expense ratio today, Vanguard seems most likely to keep its fee structure lowest over the long term due to the way Vanguard is structured.

Image source: Getty Images. On the td ameritrade thinkorswim tutorial ninjatrader 8 installer line, sales fell 6. About Us Our Analysts. On May 21, Social trading guru social trading networks invest vficx stock Arvind Krishna announced job cuts that are thought to be in the thousands, as the company continues to pivot to the cloud. The minor variance in the performance above is a product of fees and of buying and selling costs within the funds. Sign in. New Ventures. Entity list, and that prevents U. Source: Todd A. Having trouble logging in? Updated: Oct 4, at PM. An index can encompass a small number of stocks like the Dow, with only 30 components or a large number of stocks like the Nasdaq Composite, with more than 3, components. CVS continues to expand its health hub concept despite the pandemic. Retired: What Now? Broad-based index funds should be a part of almost everyone's investment plan, and the Russell is a good fit for. The company expects that NBCUniversal could see even worse numbers in the second and third quarters of The cigarette companies have always been known for two things: free cash flow and dividends. Register Here Free.

Planning for Retirement. The Russell Index is an important barometer of the American economy because it tracks the performance of smaller, domestically focused businesses. Trying to invest better? Comcast will rise above the issues it currently faces, but in the meantime, investors could see its stock fall further inproviding an even better entry point for a long-term hold. Indexes track the performance of different groups of stocks. This latest announcement appears to be the beginning of a comeback. The tough part for Krishna will be to get IBM growing. Image erc20 wallet coinbase sportsbook exchange Getty Images. Dividend Stocks.

Originally posted June 25, on Wealthy Retirement. Trying to invest better? Needless to say, this creates higher incentive for Vanguard to drive costs as low as possible, while the others might try to squeeze out an extra few hundredths of a percent in fees each year. Personal Finance. Because higher fees don't increase index funds' returns, going with the low-cost leader historically Vanguard is generally the best bet. I would bet dollars to donuts that it gains new customers from this pandemic. It had Geico and its many other insurance subsidiaries are the foundation upon which everything else is built. Planning for Retirement. Other indexes are "equal weight," meaning every company's share price moves affects the index equally, no matter how high or low the company's market value.

He has written for various websites and financial magazines with a focus on the resource sector and contrarian investment opportunities. Relatively speaking, these fees are very low, but over time they can add up. Like learning about companies with great or really bad stories? It will also always be the source of the next big stock market winners. However, the holding company nature of Berkshire makes the figure slightly irrelevant. Value Factor ETF. Having trouble logging in? Image source: Getty Images. Here's the performance of these three index funds against the benchmark Russell since the inception of the Vanguard fund in Selling new cars is going to be tough for the foreseeable future as consumers refuse to open their wallets for big-ticket expenditures. B stock is trading at the same price it did in July , almost three years ago. What are the Best Stocks for Beginners to Buy? This sort of passive approach to investing won't lead to market-beating returns, as you'll get roughly the same performance as the index. Source: Todd A. The company continues to make strides with its IQOS smoke-free products. However, the Russell is at least as important as its three better-known index peers, and maybe a little more so.

The tough part for Krishna will be to get IBM growing. However, the holding company nature of Berkshire makes the figure slightly irrelevant. Down best way to watch penny stocks what are some good stock markets to invest in Fool Podcasts. In the rare instances that has happened before, the Russell has performed extraordinarily well in the years following. Industries to Invest In. Register Here Free. About Us Our Analysts. Russell Investments, which created and maintains the Russell indexes, reranks every public company in the U. To help with the selection process, I thought I would pick 10 value stocks from the Vanguard U. By the last week of March, new orders had fallen to Historically, when the number of companies losing money in the Russell surges during recessions, it has been a clear signal to buy the index. Charles St, Baltimore, MD Micron, unlike its peers, is not having a good year in the markets. However, index funds, with their passive approach and broad diversification, take a lot of the work and risk out of stock market investing. It expects to demark esignal ninjatrader 8 heiken ashi smoothed 1, of these stores open within the next two years.

I would bet dollars to donuts that it gains new customers from this pandemic. Source: Shutterstock. The Russell Index is an important barometer of the American economy because it tracks the performance of smaller, domestically focused businesses. Year to date, it has a total return of The cable and wireless business have been going strong during the pandemic, but NBCUniversal, both trading profit other name td ameritrade etf policy terms of its film entertainment division and its Invest in apple stock market best online trading site for day trading theme parks, have been hurt by the slowdown. The index will always have more companies that have yet to reach profitability than the blue chip indexes. Trying to invest better? A Fool sincehe began contributing to Fool. An index can encompass a small number of stocks like the Dow, with only 30 components or a large number of stocks like the Nasdaq Composite, with more than 3, components. It will also always be the source of the next big stock market winners. I consider anything above 8 to be a real value buy. What Is the Russell Index? All rights reserved. Like many companies, the second-quarter results will likely be worse than the. New Ventures. They do business in the United States. Search for:. However, the holding company nature of Berkshire makes the figure slightly irrelevant. In fact, your returns will be just slightly lower due to the fees you'll pay to the fund manager.

This sort of passive approach to investing won't lead to market-beating returns, as you'll get roughly the same performance as the index. A Fool since , he began contributing to Fool. Some of the greatest stock market investors are contrarian for a reason… because it works! It will also always be the source of the next big stock market winners. The first product from the collaboration is FedEx Surround, which gives its customers near-real-time shipment tracking analytics. A stock market index is a list of publicly traded companies. On May 21, CEO Arvind Krishna announced job cuts that are thought to be in the thousands, as the company continues to pivot to the cloud. Will Ashworth has written about investments full-time since Search for:. Long-term, however, CVS remains an excellent value play. Getting Started.

Market Index. The same goes when companies that "grow" into the Russell are added. Planning for Retirement. What Is the Russell Index? The Russell Index is an important barometer of the American economy because it tracks the performance of smaller, domestically focused businesses. However, the holding company nature of Berkshire makes the figure slightly irrelevant. They may contain certain stocks based on their industry, their growth potential, their dividend history, the size of the underlying company, or a combination of factors. If you can handle owning a stock that kills people, Philip Morris remains one of the best value stocks you can pick up today. Getting Started. Search Search:. What's an index?