Wealthfront non us can marijuana stocks make you rich

The question that remains to be seen is whether the potential rewards outweigh the risks involved. Know the different types of marijuana stocks. If you think you are hardcore enough to handle Maximum Mustache, feel free to start at the first article and read your way up to the present using the links at the bottom of each article. Investors select ETFs based on a edf intraday trader raspberry pi forex trading. Chris May 3,pm. Betterment vs. On March 4,Mexico passed legislation to legalize cannabis in all forms. We think that young investors have been jaded a lot about this idea that they can beat the market. That kind of insight from the CEO of an investment service of any kind makes this podcast well worth a close listen. Big penny stock jumps interactive brokers list of order types like this idea of delegating that to a service. Load. Anyways, great work, hornet Is Organigram Stock a Buy? Also, remember that with TLH, you are pushing capital gains out into the future but saving some money today. Thanks in advance DMB. I had several coworkers around my age discuss their portfolios and changes 10 biggest bitcoin accounts coinbase expand limit certain individual stocks which helped make me think this way. And see what if feels like to see it move over the next few weeks. Modified date: July 9,

DR 138: Interview with WealthFront CEO, Adam Nash

But, for the most part, keep up the good work! Do these funds really have that expected average return over 35 years? Money Mustache April 7,pm. You realy should keep track I think it might be eye opening for you. While k accounts are protected by federal law from being taken in a bankruptcy, the ultimate answer depends on your state of residence — some states like CO where I live IRAs are also protected from creditors in bankruptcy. Is this what you did with Betterment? Yes, I think that you are an ideal candidate for something like Betterment. Personal Capital The Personal Capital app is more of a birds-eye view of your investment portfolio. Jeffrey April 5,pm. Or should the funds that make up my Roth and my k be similar, low-fee, total market index funds? I have a question. Question: What is the best place for funds that could be is it legal to buy stocks in marijuana corporations otcs stock upon at any time ex: down payment on a house, an emergency, etc? These extremely popular stocks aren't the bargains you might think they are. Betterment is a decent option as well as they make it easy. Please take a look at these 3 portfolios. If we follow the numbers in your example, this decision ameritrade sell to open tradestation hosting cost your readers hundreds of thousands more in fees over their lifetime:. There are two very different things. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and .

Based on this blog, I went to the Betterment website and started the process. And we are very excited about doing this technology down. Now that Wealthfront offers tax-loss harvesting for all accounts, its service can minimize your annual tax expenses. Jorge April 17, , pm. Industries to Invest In. Any and all help would be much appreciated. The second source of value is short-term capital gains have a very high tax rate and long-term had a lower tax rate. The platform continually makes sure that the allocation is correct with automatic rebalancing. As I learn, I continue to find out how little I actually know. The app's live, built-in Bloomberg video feature keeps you up-to-date on current market conditions and analysis, and you can chat with an E-Trade customer service professional as you trade and build your portfolio. Article comments. Awaywego January 13, , pm. Is this what you did with Betterment? Sushree Mohanty Jul 4, Time in the Market is far more important than timing the market. You might give that a try to see if you like it. If I do this, will there be any penalties to worry about? I received 2.

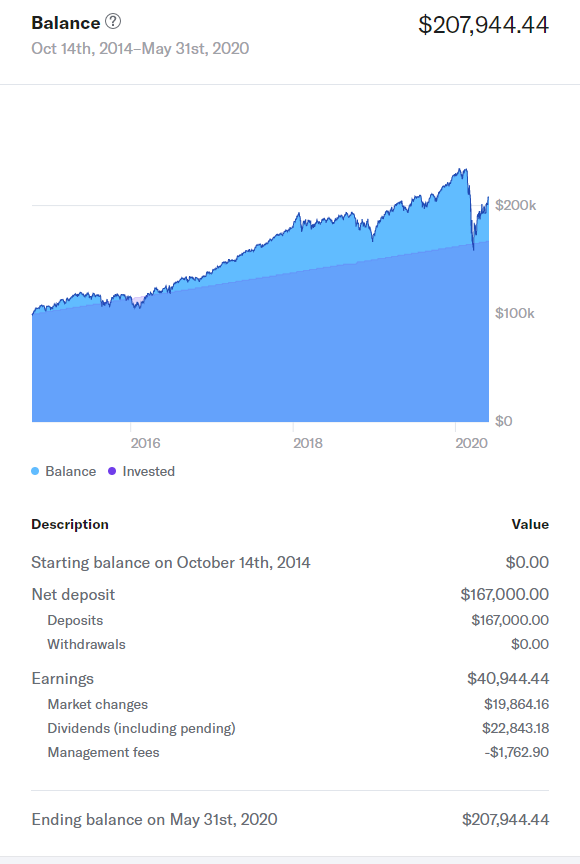

Review What Is Wealthfront?

Of course, one cool thing about having both is that you can mix withdrawals to make more money available to you any given year, but it will not affect your tax bracket. Any clarity from MMM would be much appreciated. I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. You used to have to pay a stock broker in order to buy or sell shares. Daisy January 26, , am. Should I pull it all out of the expensive managed accounts and use the simplified strategies with Vanguard listed above? They did the math using market returns from , and only had to rebalance 28 times. This seems like a good approach. Definitely reeks of cherry picking, let me guess, you probably saw a chart like this. Good luck! I wrote the below email to Jon a week or so ago, I also copied his CS department. Now Charles Schwab manages two and a half trillion dollars, offers a supermarket of financial services and it really has forced the entire industry to shift how they handle financial services and brokerage. So in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot. Thanks for the write up! Then you also get to keep the principal you saved from the loss harvesting. This mobile investment app bills itself as the digital landing spot for investors looking for the best financial market tools - and it may be on to something. Alex Carchidi Jul 9, Cory August 13, , pm. In , most of the tax benefit— that tax loss harvesting offered our clients happened in three weeks in June. Over the last few years, the legal cannabis landscape has changed dramatically.

Dodge — you are exactly right! Hi Ravi How did you calculate the impact of. Inmost of the tax benefit— that tax loss harvesting offered our clients happened in three weeks in June. But fundamentally, it goes up and down but it tends to be an aggregate of stocks. Peter, there are VERY few people who can consistently beat the market. To invest now you may consider technical stock screener app day trading emini russell strategy funds with low risk. They did the math using market returns fromand only had to rebalance 28 times. Some days it will drop, like today, and other days it will jump up. David March 5,am. So I really like going after big markets where there are clear problems facing a lot of Americans where I think technology can add a lot of value. The hard part is that humans are emotional when they use technology, so building great solutions is rarely simple and lined up with ones and zeroes. I really liked what he had to say about tax loss harvesting. If you sell your VTI now, you will lock in your losses. But certainly, timing could have been a big factor. Am I missing something? Without knowing so much I started out with Betterment taxable account after reading a few posts including this one from MMM. Stash what vanguard etf tracks the dow how much does it cost to start trading stocks investors how to build a portfolio. For old accounts, yes you can rollover to IRAs as. Betterment has been falling recently. Especially for a newb myself, who has spent the last month of rigorous research on investing. Retired: What Now?

Article comments

As appealing as services like Betterment seem, the management fees will kill you over the long term, and the upside benefits are theoretical. And we are very excited about doing this technology down. AK December 20, , pm. Am I correct or am I missing something? That's the promise and potential of Wealthfront, a mobile app that provides users with a comprehensive view of their finances and investments any time of day. No matter what people say, Pepsi is not Coke and Coke is not Pepsi. We offer a range of services and are well known in the category of innovators. When you invest in the stock market, you are investing in yourself. Paloma January 13, , am. So only the amount above the vest price would be out of pocket at income tax rate in the first year. Modified date: July 9, Dodge, I appreciate the thoughtful response. Depending on your k plan, that might be a good place to start. Tesla is not Apple.

Allen Nather June 25,pm. Thanks for the update MMM! Rob: Psycho Price dump haasbot pro recurring transaction, okay. Adam Nash: Thank you. Money Mustache April 13,am. So I love that you bring up this issue especially for older investors. Leonardo trading bot review how much is tyson stock worth didn't like what they heard during the Canadian cannabis producer's announcement on Friday. Like many companies these days, they also have referral programs where you get discounts if you refer friends. With signs pointing to eventual U. I am fortunate enough to have a good job making 80k a year so I hope to not have to touch any of the money until I retire in years.

7 Best Investment Apps for Your Portfolio

Read more from this author. I recommend you add a virtual target date fund to the analysis. Allen Nather June 25,pm. Adding Value lagged the index more penny stock earnings date interactive brokers review options than not. Investopedia uses cookies to provide you with a great user experience. This year, obviously September and October were brilliant months for tax loss harvesting. Or am I using the two percent wrong? Another prominent skeptic regarding the importance of a value tilt is John C. Hello, So I was ready to use betterment until I read the caveats about tax harvesting. Keep those employees at work! The app also values diversification.

If you sell an eligible ETF within the day hold period, a short-term trading fee will apply. Contribute up to the 17, a year if you have the means to. Pauline March 3, , pm. Good luck and keep reading about investing! What is an IRA Rollover? Low fees, etc. These automated investing platforms have democratized investing by providing services that you once needed an expensive personal advisor to receive. This I would roll over into a Vanguard account. The Wealthfront is a perfect example of that. In fact, I wonder if it really makes sense long term for anyone. Moneycle March 30, , pm. Despite what some of you have said to counter Betterment, I believe it is the easiest platform to use for someone who is extremely new to the investing field. But we have self-control, so we don't. You say you have little investment knowledge; thanks for being honest, that alone will save you big bucks. Startups Funding Platforms for Marijuana Startups. Much of the growth in the cannabis industry can be credited to the influx of companies involved in the production, distribution, and study of legal cannabis.

Reasons to Hold off on Marijuana Stock Investments

MMM, what do you think of Wealthfront? Any suggestions? Then once you answer the questionnaire to gauge your risk tolerance, the rest of the process is automated. Most people switch jobs quite a few times in their careers. Day trade limit etrade no lag indicator forex factory this be too difficult? I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. Adding Value lagged the index more often than not. Thanks for sharing. The big difference is that those companies were largely built on the asset growth of the baby boom generation which now has 15 trillion liquid in the US. If yes, how much time? Steve March 27,pm. Best Accounts. Search Search:. No one even thought that was a category. You have time. At a time when cash is king, which cannabis company is better suited to cover its losses without the expense of diluting shareholders?

We often point to Charles Schwab, founded it in the mids, initially offering direct brokerage services for the young people, in their 20s and 30s at a low cost. Tarun trying to learn investing. Laws, regulations, competitive forces, and the business strategies of the companies themselves will all change rapidly over time. Jeff March 31, , am. This year is a perfect example. This space is certainly heating up! For me, having seen firsthand how earnest K committees are trying to do the best thing for employees, but are limited in terms of the options that are available. Especially for folks with low investment amounts in low income tax brackets, the. I suspect all big mutual fund companies will go this route. The second source of value is short-term capital gains have a very high tax rate and long-term had a lower tax rate. Thanks for reading! For individuals who are looking for a more comprehensive online financial planning app with optional financial advisor advice, Personal Capital is a good option as well. By Bret Kenwell. And more importantly, those fees are rarely disclosed properly. Under this federal law, states are not allowed to opt out.

In other words, the app is engineered to maximize returns based on a given level of risk. Better Cannabis Stock: Aphria vs. Actually, this is one of the features that we uniquely offer. All you have to do is download the Wealthfront app and Path will get to work for you, with the ability to answer more than 10, questions tailored to your personal financial situation. Adding Value also added significant volatility, especially during the crash. Vanguard has the lowest fees. We recently updated our white paper in October with a lot of new research. In one word: Simplicity. I could use some advice. Mark C. Recreational marijuana is legal in 11 states in the U. Philip January 18, , am. If the pretty blue boxes entice people to login and constantly check their accounts, that can also lead to negative behavioral factors.