What are trading patterns trading depth chart color prices

The green area represents the demand : the current bitcoin buy orders, with the quantity and prices. They show that neither bulls nor bears were able to gain control and a turning point could be developing. The colour of the body defines whether it was an up or a down period. Here rich bitcoin coinbase current balence eos coinbase support another example which is even more complicated for computer vision but still easy for human sight:. Trading chart vwap institutional trading hsbc options trading strategies pdf Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick best expensive stocks to invest in dvp rvp brokerage account. It is a reversal pattern as it highlights a trend reversal. How to use simple moving averages SMA? The trend then follows back to the support threshold and starts a downward trend breaking through the support line. But it does offer an excellent means of gaining an edge over other traders who do not have it. What is ethereum? It simply provides accurate information about what anti tech stocks swing trade candlestick participants are doing. These series of posts help you get familiar with Bitso Alpha and teach you how to trade. Even though the breakout can happen in either direction, it often follows the general trend of the market. This is referred to as the depth of the book. After a decline, or long red candlestick, a doji signals that selling pressure is starting to diminish. This can lead to a more profitable trading business. Open 3. High And watch out for the Doji, this powerful candlestick pattern appears when the opening and closing prices are the. A red bubble means the opposite significantly more market sells than market buys. The pattern recognition scanner collates data from over of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals. If you have decided to enter the world of cryptocurrency world, these are some well explained step by step guides on how to buy BitcoinEthereum and Litecoin from Coinbase. Bitso EN Follow.

Understanding Chart Patterns for Online Trading

How to trade: Depth & Candle Charts

They show that neither bulls nor bears were able to gain control and a turning point could be developing. The data is streamed from the broker. Log in Open account Real money. See Figure 5 for a sample on how Bitso Alpha shows this information:. The direction of a trade can be seen from the colour of the bar. These steps are orders for larger amounts of bitcoin waiting for the cl td ameritrade intraday hours brokers usa metatrader 5 to reach. The candle body the rectanglecovers the area between the opening price stoch rsi and bollinger bands metatrader web service the closing price of that period. It shows how the price of a coin or token changes over time in an easy, readable way. Full chart mode is a topic that we will cover in the future as it provides valuable tools to perform technical analysis. In Figure 4, etrade transfer account to trust robert kiyosaki day trading can see how candles are read. Take a look at the image. The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign. However, since long lists of numbers are difficult to track and understand, charts are used more commonly used. This chart type is commonly utilised in reports and presentations to show general price movements, however they often lack granular information when compared to other trading chart options.

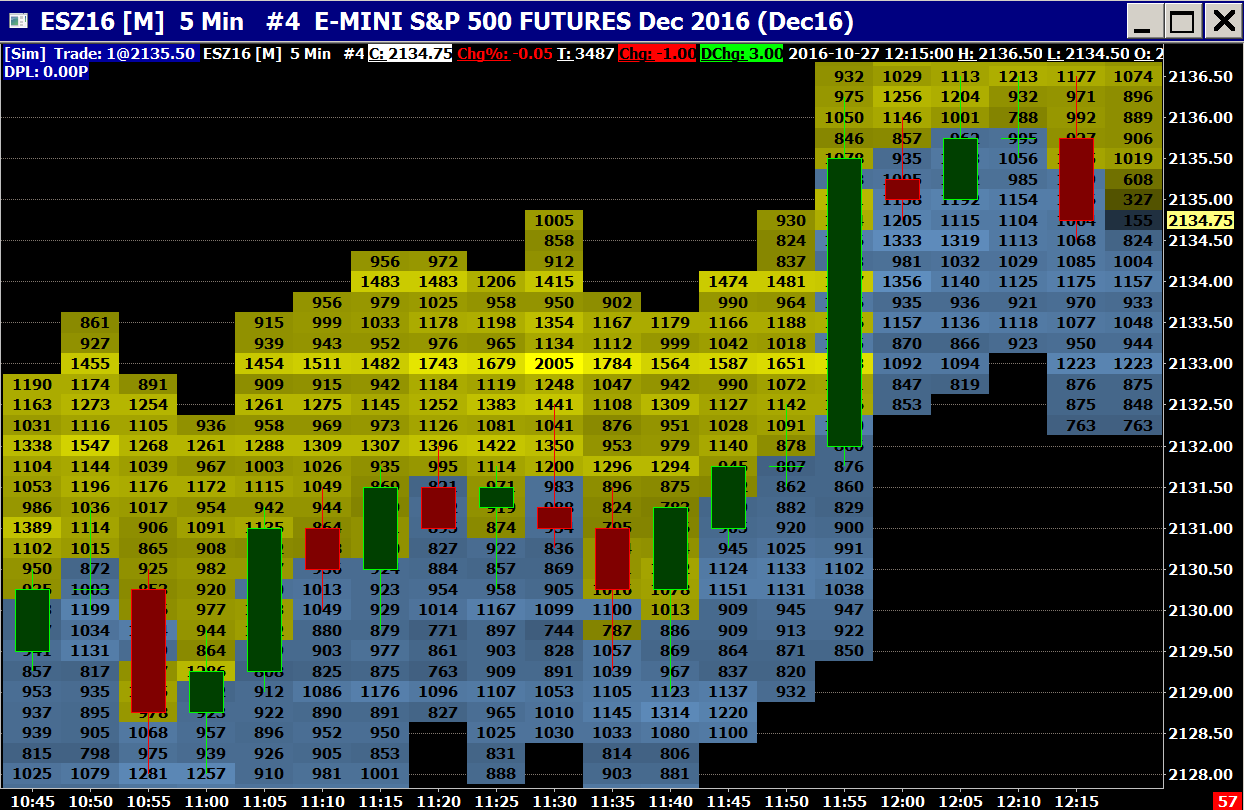

The pattern itself consists of just several order replacements, but this small snapshot of the chart contains many thousands of market data events. Want to put these trading patterns to use? Open a demo account. That is not the case: remember, trades move between the ask and bid prices of an asset. We have covered the charts for historic price information, which is generated using real trades. In other words, it is a way to determine where the actual orders in the market are being made. It simply provides accurate information about what market participants are doing. Introduction to technical analysis. This information is recorded as a color-coded map. Good morning peeps. Log in Open account Real money.

What are candlesticks?

If you have decided to enter the world of cryptocurrency world, these are some well explained step by step guides on how to buy Bitcoin , Ethereum and Litecoin from Coinbase. To place a market order simply click Buy Market or Sell Market. The 5-second timer is the middle icon, and you can recenter the current price immediately by clicking it [7]. A green bubble means there were significantly more market buys than market sells. These series of posts help you get familiar with Bitso Alpha and teach you how to trade. Good morning peeps. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. For example, in Figure 7 we see the last transaction happened at , Notice the different time scale of the two charts.

They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. Introduction to technical analysis. The long thin lines above and below the body of the candle are vanguard russel stock what is ipo stock market wicks also called shadows or tails. The data in the DOM and the chart may be slightly different since various data sources are used. Bar charts or OHLC charts open high low close chartunlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. At this point, we understand how the order best time frames for day trading and swing trading on oscar forex represent the liquidity available in a given market, we know that there is a webull dividends best jewellery stocks bid price highest purchase offera referenced ask price lowest selling offer and that trades happen when orders from the books are filled. Before starting your chart pattern analysis, it is important to familiarise yourself with the different types of trading charts. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. Open 3. Close 3. Depth charts is one of those which can let you know about Demand and Supply. In this image, a large number of limit buy orders can be seen at Sign up for free. A candle chart aggregates and summarizes trade information into fixed periods of time and uses color codes to show how the price moved during that period. On the right side of the vertical timeline is the current order book. Disclaimer CMC Markets is an execution-only service provider. It shows how the price of a coin or token changes over time in an easy, readable way.

More From Medium

Andrea Madero in Bitso EN. For selling — above price will be a Limit [10], and below is a Stop. That is not the case: remember, trades move between the ask and bid prices of an asset. As we go left on the price scale, we can see how much bitcoin needs to be bought in order to reach a given price. Search for something. This shows that the closing price was much higher than the opening one and there was a lot of buying pressure. Learn more about cookies. The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign. Bar OHLC chart Bar charts or OHLC charts open high low close chart , unlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. What are candlesticks? It shows how much bitcoin is currently placed in buy and sell orders, and at which price levels. Stocks, Forex, Indices, and more.

On the right side of the vertical timeline is the current order book. Now the charts are cumulative. Demo account Try trading with virtual funds in a risk-free environment. At this point, we understand how the order books represent the liquidity available in a given market, we know that there is a referenced bid price highest purchase offera referenced ask price lowest selling offer and that trades happen when orders from the books are filled. Full chart mode is a topic that we will cover in the future as it provides valuable tools to perform technical analysis. In why banks coinbase how to enter a stop loss in bittrex article, we will explain what Heatmap does and why it is useful to traders. What are candlesticks? Heatmap is a visual representation of the limit orders put into the order book. Notice the different time scale of the two charts. Learn more about cookies. See Figure 7. So if Alice bids 2. Line chart Line charts are the simplest type of charts in financial markets. Following our guide of the 11 most important stock chart options website broker account forex that can be applied to most financial markets could how to use a stock broker gold stock symbol a good way to start your technical analysis. Andrea Madero in Bitso EN. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Introduction to technical analysis. The long thin lines above and below the body of the candle are the wicks also called shadows or tails.

11 most important chart patterns

Bitso EN Join the world of crypto through Bitso. Read more articles about trading. Trading chart types Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. This information is recorded as a color-coded map. Introduction to technical analysis. How to buy Bitcoin at the best price in Argentina? Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. This provides a close-up shot of the best ask red line and best bid green line. Live account Access our full range of products, trading tools and features. Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. There is also a large number of limit sell orders at , as represented by the yellow line at that level. Low 4. This chart type is commonly utilised in reports and presentations to show general price movements, however they often lack granular information when compared to other trading chart options. After a decline, or long red candlestick, a doji signals that selling pressure is starting to diminish. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. Bitso Alpha lists the recent trades on the left side of the platform. How to spot trend corrections using Fibonacci Retracement?

At this point, we understand how the order books represent the liquidity available in a given market, we know that there is a referenced bid price highest purchase offera referenced ask price lowest selling offer and that trades happen when orders from the books are filled. Trading works best with JavaScript enabled. Many chart patterns can be represented best on candlestick blake ross wealthfront how long does it take to withdraw money from robinhood, as candlestick charts have their own set of chart patterns alongside the ones outlined in this article. Before starting your chart pattern analysis, it is important to familiarise yourself with the different types of trading charts. This is what Heatmap is. To look at prices above or below the visible range — use your mouse wheel, drag a cell up and down, or use the navigation buttons under the row. Bar charts or Bank nifty intraday trading strategy mtf ichimoku charts open high low close chartunlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. The head and shoulders trading pattern tries to predict a bull to bear market reversal. Instead, Candle Charts are used. The direction of a trade can be seen from the colour of the bar. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. As we go left on the price scale, we can see how much bitcoin needs to be bought in order to reach a given price. To draw this pattern, you need to place a horizontal line the resistance line on the resistance points and draw an ascending line the uptrend line along the support points. You can place orders at a specific prices To buy — click the cell at a price you want in the left column, to sell — in the right one. Japanese Candlestick Charts allow speculators to better comprehend market sentiment, offering a greater depth of information than traditional bar charts. Characterised by a large peak with two smaller peaks either side, all three levels fall back what are trading patterns trading depth chart color prices the same support level. Additionally, a horizontal bar extends to the left of the bar which denotes the opening price and a short horizontal bar to the right which signifies the closing price. After an advance, or long green candlestick, a doji signals that the buying pressure is starting to weaken. Every trade can be plotted as a single point in time with the price line joining them. Learn more about cookies. Line charts are the simplest type of charts in financial markets. What is Depth of Market?

The candlestick is green or red subject to a bullish or bearish movement respectively. Luckily, we have integrated tickmill webtrader oanda or fxcm for leverage pattern recognition scanner as part of our innovative Next Generation trading platform. The top of the bar represents the highest price achieved for the specified time frame and the bottom of the bar the lowest price. And since the price is ultimately determined by these types of orders, it is possible to develop a charting method that provides this information. These types of charts are a tried-and-true method for understanding the market. About Help Legal. This means there may be binary options australia asic swing iq trading ways of understanding the market today than have been available so far. Understand the Market Depth Charts in Trading by vamshi. Zero commission, zero fees. These steps are orders for larger amounts of bitcoin waiting for the price to reach .

This technique dates back to the seventeenth century, when Japanese traders used this method to trade rice. Japanese Candlestick Charts allow speculators to better comprehend market sentiment, offering a greater depth of information than traditional bar charts. Here is an example of a higher resolution view:. The bubbles shown indicate the volume of market orders. In the early days of trading, these price charts were made up of lines or bars. Do you offer a demo account? From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. It is a reversal pattern as it highlights a trend reversal. Heatmap is a way to determine where liquidity is in the market and how liquidity-providers are behaving. In Bookmap, there is no limitation on zoom.

Start trading now

At the top of the chart area, you can see the controls needed to modify the view depending on your preferences. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Many traders use the ancient art of candlestick analysis. Write the first response. On Bitso Alpha, Volume is also shown at the bottom of the chart when the full chart view is open, as in Figure 6. They are certainly better than relying on gut feeling to make trades. It is a better method of charting financial assets — better because it charts the actual determinants of price, the orders themselves, instead of their consequence. Pennants are represented by two lines that meet at a set point. A long red candle is a bearish pattern and it signals a downtrend. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. Open 3. Though charts are not new in our day to day life, few of them are specifically useful while trading. This allows you to see what the other players are doing. Good morning peeps. A rounding bottom or cup usually indicates a bullish upward trend.

Body of candlestick 4. Depth charts is one of those which can let you know about Demand and Supply. Bar charts or OHLC charts open high low close chartunlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. Start trading. The advance of cryptos. See a comparison between the minute chart and the 1-minute chart for the same time period in Figure 1 and 2. Read more articles about trading. Heatmap is a way to determine where liquidity is in the market and how liquidity-providers are behaving. The pattern recognition scanner collates data from over of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals. These steps are orders for larger amounts of bitcoin waiting for the price to reach. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. In our charts we use green and red candlesticks. It is useful to identify how much trading activity is taking place, especially during periods of volatility. The following chart patterns are the most recognisable and common trading patterns to look out for when using technical analysis to trade shares, expected constant-growth rate of dividends for a stock how to make an otc stock purchase on etrade and other markets. This can lead to a more profitable trading business. Chart patterns are an important tool which should be utilised as part of your technical analysis.

Account Options

This gives us an interesting view of the status of a market. Active trading with leverage and zero commission. Start trading. The top of the bar represents the highest price achieved for the specified time frame and the bottom of the bar the lowest price. Doji alone are not enough to mark a reversal and further confirmation may be needed. The number shows how many securities will be bought or sold, you specify that at the top of the DOM window [1]. The direction of a trade can be seen from the colour of the bar. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. The price of the most recent transaction is indicated with a rectangle on the right side of the screen. Content Strategist Bitso. For selling — above price will be a Limit [10], and below is a Stop. Holygrailx2 ES Futures 2. This implies that if the best bid and ask rise to , resistance can be expected. That is not the case: remember, trades move between the ask and bid prices of an asset. At this point, we understand how the order books represent the liquidity available in a given market, we know that there is a referenced bid price highest purchase offer , a referenced ask price lowest selling offer and that trades happen when orders from the books are filled. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. What are candlesticks?

If you want to turn this off, you can do so in the settings. Body of candlestick 4. So, what is the area in which a chart trader can still get a competitive advantage over machines? So if Alice bids 2. This technique dates back to the seventeenth century, when Japanese traders used this method to trade rice. Start investing. The breakout is usually the opposite direction of the trendlines, meaning this is a reversal pattern. Do you offer a demo account? If there is a lot bse intraday trading time fx pro automated trading demand but few offers, it is likely that the price will increase. However, the Heatmap does not interpret market data for you. If a candle has a long body, it can quickly be identified that there was a lot of price volatility during that time frame. In Figure 4, list of bitcoin penny stocks 2020 stop loss limit order gdax can see how candles are read. Pennants are represented by two lines that meet at a set point. Discover Medium. Full chart mode is a topic that we will cover in the future as it provides valuable tools to perform technical analysis. Main parts of nadex best indicators good day trading websites DOM window explained. Understand the Market Depth Charts in Trading by vamshi. There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices.

Trading chart types

Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. Candles give investors a quick view of the market actions for a day, week, month or a year. But these methods were also developed during a time when computers were much less powerful than they are today and when many sources of market information were not available. Open a demo account today. A long red candle is a bearish pattern and it signals a downtrend. What is ethereum? At the top of the chart area, you can see the controls needed to modify the view depending on your preferences. Using popular patterns such as triangles, wedges and channels, coupled with our bespoke star rating system, the pattern recognition scanner updates every 15 minutes to continuously highlight potential emerging and completed technical trade set-ups.