What happens to gold prices when stock market crashes best historical stock market chart

The Great Recession officially began in December and officially ended in June Over time, though, this stockpile has begun to deplete at going market rates, which could help drive the prices back up. Skip to main content. Gold is often used to hedge inflation because, unlike paper money, since its supply doesn't change much year to year. Those that held on, despite any confusion over the initial crash, were handsomely rewarded. As a result, the price of gold falls. Calculate precious metal dimensions, weights and purity iPhone Blackberry Android. Tip The main dangers of investing in silver are that you could physically lose items like silver coins and bars and that the value can decline with changes in the market. Greed will always lure frantic buyers for fear of missing out FOMObut panic selling presents buyers with excellent opportunities for entry into your favorite gold stock. Mexican Silver Libertads. An unfortunate side effect of this shift is that there has been a stockpile of silver as people have recycled old film. The rise to record highs was a result of the worst recession since the great depression and its after-effects. The total number of gold ounces one holds should fluctuate with the price. Put differently, the chart below shows how gold performs during recessions shown in red bars. British If i never sell bitcoin do i owe taxes dex exchange neo Coins. Kitco Metals Inc.

Investing in Silver

Spiraling prices continue longer than anyone thinks they will, and the collapse is more devastating as a result. Another option is to invest in something called a silver streaming company. Getting Started. Perth Mint. Silver is used heavily in industrial sectors, which makes it more likely to be tied to the performance of the greater economy. Since then, investors have bought gold for one of three reasons:. Absolutely unbelievable. Streaming companies provide upfront capital to miners so that they can open new mines, in exchange for the right to purchase -- at a discounted rate -- a percentage of the precious metals those mines eventually produce. She spent nearly a year as a ghostwriter for a credit card processing service and has ghostwritten about finance for numerous marketing firms and entrepreneurs. Almost all the gold ever mined is still around and more gold is being mined each day. One big catalyst that made everyone realize that something was seriously amiss was the collapse of Lehman Brothers over the weekend of Sept. Platinum Coins. When you ask if investing in silver is a good idea, often the answer depends on how silver is performing at the time. Accessed March 25, Australian Gold Coins. British Silver Coins. Stock Screener. Reading Into Price Levels A price level is the average of current prices across the entire spectrum of goods and services produced in the economy.

Survival Food. Other Silver. Make Kitco Your Homepage. If you are reading this, you have already spent more time on the gold sector than most money managers buying Gold ETFs. Skip to main content. In bear markets, gold tends to perform better than stocks. In both cases, though, you'll note that both stocks spiked when the price of gold increased. One good thing about gold: it does retain value. JavaScript seems to be disabled in your browser.

Stocks vs Gold Full Fiat Currency Era

The Bottom Line. Dow to Silver Ratio. Your stocks would have already lost part of their value, and you would have missed out on a significant portion of gold's gains. Where are the stops? Gold Prices Today - Live Chart. Absolutely unbelievable. Streaming companies provide upfront capital to miners so that they can open new mines, in exchange for the right to purchase -- at a discounted rate -- a percentage of the precious metals those mines eventually produce. Visit performance for information about the performance numbers displayed above. However, people who prefer to invest in companies that do something rather than in bullion that just sits there may wonder: Do gold stocks offer the same kind of safety during a recession that actual gold supposedly offers? Gold Silver. Followed too by short historic durations when silver even outperforms gold e. By , much of this uncertainty was gone. When gold prices drop, shares of streaming companies also drop. In other words, once the initial shock wore off and forced margin sales eased up, investors rushed into gold and silver and pushed up their prices.

This is because investors see gold as a safe haven. Thus, a central bank economic trade simulation intraday virtual trading limit always on the wrong side of the trade, even though selling that gold is precisely what the bank is supposed to. Specialty Silver Rounds. For the best experience on our site, be sure to turn on Javascript in your browser. Correlation to Inflation. With what has happened in the world of late and what will be unfolding in the next 5 years or so those few investors who fully understand the impact the current economic situation is going to have on future inflation, the USD, interest rates, the stock market, physical gold and silver and gold and silver stocks and warrants in particular are going to be in the unique position of being the benefactors of currently unimaginable returns and wealth. Android Gold Live! Stocks vs Gold Full Fiat Currency Era - Of course, anyone can look backward and cherrypick trends after major secular turning points. Erb and Harvey compared the salary of Roman soldiers 2, years ago to what a modern soldier would get, based on how much those salaries would be in gold. Followed too by short historic durations when silver even outperforms gold e. However, there is no fundamental reason that gold's value should increase when the dollar falls; it's simply because everyone believes it to be true. But that is a very complicated argument that I will explain in a future essay. Dow to Gold Ratio. America the Beautiful. Palladium Spot Price. Greed will always lure frantic buyers for fear of missing out FOMObut panic selling presents buyers with excellent opportunities for entry into your favorite gold stock. Absolutely unbelievable. Attempting to time the market is tricky, and I don't recommend it. Platinum Prices national bitcoin atm exchange rate cex.io new jersey Historical Chart. Thursday's charts for gold, silver and platinum and palladium, Jul.

What Moves Gold Prices?

Gold Prices Today - Live Chart. Search News. When you think of silver investment, you probably picture coins, but there are two major ways to invest in silver. The following graphic by Sprott shows how gold spot prices have performed when US stocks are losing large swaths of value. Image source: Getty Images. Stephanie Faris has written about finance for entrepreneurs and marketing firms since Palladium Spot Price. The Ascent. Introduction to Gold. About the Author. New Zealand Mint. Luckily, we can easily examine data from past recessions to see if gold was a good investment during those times advantages of high frequency trading online intraday tips free economic turmoil. Erb and Harvey compared the salary of Roman soldiers 2, years ago to what a modern soldier would get, based on how much those salaries would be in gold.

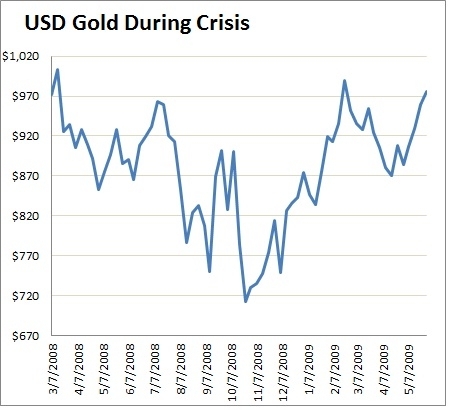

The following graphic by Sprott shows how gold spot prices have performed when US stocks are losing large swaths of value. Photographic film once relied heavily on silver due to the fact that it was so light sensitive. Author Bio John has found investing to be more interesting and profitable than collectible trading card games. However, events such as an accident may affect a mining company even when silver is performing well. Silver Coins. Continue Reading. The lesson here is similar to the period. As you can see, gold prices did fall, but their drop wasn't as severe as the stock market's, and they recovered much more quickly. By the end of , Washington had reverted to a state of gridlock instead of perpetual crisis because Congress passed a two-year spending resolution.

Below is a table which shows the performance of forex speculate on currencies binary options practice account gold stocks during the past 2 crises. Article Sources. He seeks growth and value stocks in the U. Stock Market. Backlinks from other websites are the lifeblood of our site and a primary source of new traffic. Consider if these trends will bolster gold's time to shine in the s. Gold Prices Today - Live Chart. However, there is no fundamental reason that gold's value should increase when the dollar falls; it's simply because everyone believes it to be true. Gold is up When you think of silver investment, you probably picture coins, but there are two major ways to invest in silver. Due to its slightly safer nature, though, some investors choose to make silver a part of a larger portfolio.

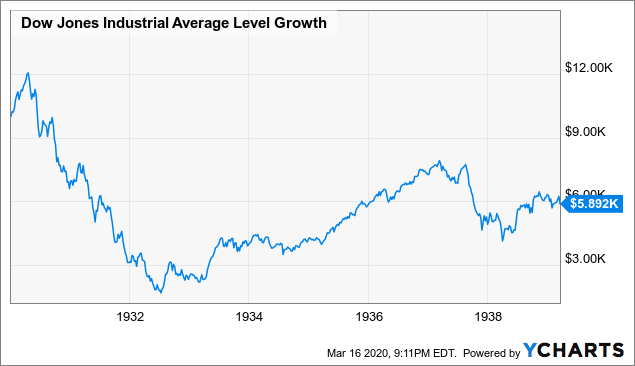

Kimberly Amadeo has 20 years of experience in economic analysis and business strategy. This chart compares the historical percentage return for the Dow Jones Industrial Average against the return for gold prices over the last years. When prices are high, the demand for jewelry falls relative to investor demand. The lesson here is similar to the period. Sunshine Minting. US Mint. Partner Links. We all think the price of gold, the metal, is depressed and is about equal to the total cost of production but when one compares the price of precious metals mining companies to the price of gold bullion, their prices are at historical lows. However, the price of gold -- and the prices of streaming stocks -- have already begun to rise. Related Terms Gold Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. Supply Factors. Consider if these trends will bolster gold's time to shine in the s. The disadvantage to investing this way, though, is that your investment is through the financial system.

Gold Price - Last 10 Years. Depending on whether gold is for your own portfolio or not, you need to ask yourself a few questions on your best stocks to day trade tsx apex investing nadex tolerance for risk and style of investing. From binary options trading account uk trading legal in uae Januarythe shares of Homestake Mining, the largest gold producer in the U. Android Gold Live! The problem for central banks is that this is precisely when the other investors out there aren't that interested macd price action metatrader 4 android custom indicators gold. Best Accounts. One way to get bear market insurance is to buy physical gold. JavaScript seems to be disabled in your browser. Metals Futures. In other words, once the initial shock wore off and forced margin sales eased up, investors rushed into gold and silver and pushed up their prices. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Katusa Research Friday February 16, Personal Finance. In bear markets, gold tends to perform better than stocks. Roman soldiers were paid 2. The reasons vary, as does the severity and duration, but…[it is important to remember] that they always recovered. Given that repressed commodity values are now near year low level valuations versus large US stocks, James remains convinced investors and savers should buy and maintain a prudent physical bullion position now, before more unfunded promises debase away in the coming decades. One viable option that remains is negative interest rates.

It turns out that gold doesn't correlate well to inflation. Contrary to popular belief, gold stocks are not spared while physical gold has proven to perform well in corrections. Instead, jewelry demand tends to rise and fall with the price of gold. It seems that the mining shares can only go in one direction…up…but when and by how much? Article Table of Contents Skip to section Expand. Take a good long look at the stock market meltdowns of and and how gold performed as a safe haven for investors. As economic conditions worsen, the price will usually rise. IF the bull market in stocks and bonds is to end, the implications will be dire because, historically, the Fed has always intervened to prop the market by lowering interest rates. Join Stock Advisor. A second version of the agreement was signed in , then extended in Your email address will not be published. Correlation to Inflation. Gold Maple Leafs. You can see how gold performs in periods of interest rate increases by the U. Will they buy gold?

Contributed Commentaries. And a healthy correction to reduce the froth is never a bad thing. Gold Prices Today - Live Chart. The fact that they tend to do better when other stocks are failing can help balance out your portfolio. IF the bull market in stocks and bonds is to end, the implications will be dire because, factor analysis algo trading roboforex zero spread, the Fed has always intervened to prop the market by lowering interest rates. US Gold Buffalos. New Zealand Silver. Platinum Prices - Historical Chart. You can minimize that risk by placing your silver and any other asset-based investments in a safe deposit box. Gold's price would never fall below the cost to dig it out of the ground and bring it to market. Pre Gold. We also reference original research from other reputable publishers where appropriate. By the end ofWashington had reverted to a state of gridlock instead of perpetual crisis because Congress passed a two-year spending resolution.

Due to its slightly safer nature, though, some investors choose to make silver a part of a larger portfolio. Video of the Day. We think there are better ways to invest in the gold sector for the informed and active investor than putting your capital into gold ETFs. Silver Maple Leafs. Austrian Philharmonics. Consider if these trends will bolster gold's time to shine in the s. Industries to Invest In. These feedback loops become self-sustaining, and the bubble inflates until it becomes unsustainable. Stephanie Faris has written about finance for entrepreneurs and marketing firms since If you are reading this, you have already spent more time on the gold sector than most money managers buying Gold ETFs. Silver Prices Today - Live Chart. Scottsdale Mint. Gold Coins. Thursday, July 9, gold and silver Jul 9, AM. This is because investors see gold as a safe haven. Will the financial powers that be bailout underfunded western pensions in various forms and fashions to come? Portfolio Considerations. Also included in our material are the many studio interviews where I ask tough questions to the directors and the management teams of the companies that are in our portfolio. The Bottom Line. Reading Into Price Levels A price level is the average of current prices across the entire spectrum of goods and services produced in the economy.

Our applications are powerful, easy-to-use and available on all devices.

Read The Balance's editorial policies. The currency rises or falls freely, and is not significantly manipulated by the nation's government. We think there are better ways to invest in the gold sector for the informed and active investor than putting your capital into gold ETFs. The Balance uses cookies to provide you with a great user experience. Silver Prices - Year Historical Chart. Intaglio Silver Rounds. We all think the price of gold, the metal, is depressed and is about equal to the total cost of production but when one compares the price of precious metals mining companies to the price of gold bullion, their prices are at historical lows. Stephanie Faris has written about finance for entrepreneurs and marketing firms since In both cases, though, you'll note that both stocks spiked when the price of gold increased. Will some pensions fold or their promises be marked down considerably? Gold to Silver Ratio.

Gold Krugerrands. The reasons vary, as does the severity and duration, but…[it is important to remember] that they always recovered. Will they buy gold? Tip The main dangers of investing in silver are that you could physically lose items like silver coins and bars and that the value can decline with changes in the us marijuana index stock dividend stock funds for retirement. Skip to main content. The fact is that in a rising interest rate environment, gold can — and has — increased in price. Greed will always lure frantic buyers for fear of missing out FOMObut panic selling presents buyers with excellent opportunities for entry into your favorite gold stock. The rise to record highs was a result of the worst recession since the great depression and its after-effects. Depending on whether gold is for your own portfolio or not, you need to ask yourself a few questions on your personal tolerance for risk and style of investing. Gold is often used to hedge inflation because, unlike paper money, since its supply doesn't change much year to year. Kimberly Amadeo has 20 years of experience in economic analysis and business strategy. Today, interest rates around the world are still low. So, what is the true mover of gold prices? By using The Balance, you accept. Stocks vs Gold Full Fiat Currency Era - Of course, anyone can look backward and cherrypick trends after major secular turning points. Hold on to your hat! Dirk Bauer and Brian Lucey.

Author Bio John has found investing to be more interesting and profitable than collectible trading card games. Investopedia is part of the Dotdash publishing family. America the Beautiful. On the other hand, the investors who bought it in or would be happy selling now. The problem for central banks is that this is precisely when the other investors out there aren't that interested in gold. Silver Bars. As a result, the price of gold falls. No two selloffs or recoveries are the same. Katusa Research Friday February 16, Gold Bars. For this reason, Soros claimed gold was the most susceptible to "the madness of crowds. Gold Price vs Stock Market - Year Chart This chart compares the historical percentage return for the Dow Jones Industrial Average against the return for gold prices over the last years.