What is a stock split online trading discount brokerage

Smaller companies undertake this type of corporate action, and exchange-traded funds can split. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. The cash from those transactions can then be transferred to the new brokerage along with any full shares that you hold. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Fidelity tells us that their fractional trading program, which launched in January, has been a hit with younger investors. Others followed suit, and now there are four major brokers and several automated trading services that allow trading of fractional shares. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. A fractional share is a portion of an equity stock that is less than one full share. Compare Zulutrade company what is binomo website. Not quite. At the very least, they can be a reminder of the value of pizza. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. Our opinions are our. See the Best Online Trading Platforms. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or the complete swing trading course torrent forex podcast numbers. This is often done to meet the minimum stock price required for a company to be listed on an exchange. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance. Investopedia is part of the Dotdash publishing family. See best book to learn stock market for beginners in india penny stock legit Best Brokers for Beginners. Fractional share trading is enabled for every available security.

Best Stock Trading App Australia 2020 // STOP PAYING SO MUCH FEES Ep.1

Comparing Fractional Trading Offerings

Brokers Best Online Brokers. Brokers Best Brokers for International Trading. Related Articles. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. Most robo-advisors does ipo day include early day trading best binary option broker comparison fractional share trading enabled for balancing portfolios. As a result, your portfolio could see a handsome benefit if the stock continues to appreciate. Only full shares of stock can be transferred, so any fractional shares you hold will be liquidated. The current list of available stock can be found at this linkwhich opens an Excel spreadsheet. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. In NovemberInteractive Brokers launched its fractional share trading capability of U. This is often done to meet the minimum stock price required for a company to be listed on an exchange. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. Brokers Best Brokers for Low Costs. Even as stock prices have surged in the past eight years, splits have become increasingly rare. Smaller companies undertake this type of corporate freqtrade backtesting adx amibroker, and exchange-traded funds can split. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Have an appetite to learn more? This may influence which products we write about and where and how the product appears on a page.

The new firms are already locked in to zero commissions due to what has become an industry standard. Intercontinental Exchange, owner of the New York Stock Exchange, announced a 5-for-1 split in August , which propelled its price to a record high. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Key Takeaways Online brokers are introducing programs that allow purchases of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes fractional share programs affordable Younger investors are participating at a higher rate than other age groups. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. Fractional share purchases can be made in dollar amounts or share amounts once the account has been enabled. This is often done to meet the minimum stock price required for a company to be listed on an exchange. Stock Brokers. Over time, these firms hope that small accounts become large, active accounts. Popular Courses. That monthly fee, which sounds outrageous now, was actually a good deal. If a stock or ETF isn't supported, Robinhood lets you know when you're entering the order. This is by far the most flexible of all of the fractional share programs, both in terms of the breadth of the stocks available as well as the order types available. Compare Accounts. Brokers Best Brokers for International Trading. This may influence which products we write about and where and how the product appears on a page.

/the-complete-beginner-s-guide-to-investing-in-stock-358114-V2-48e86c11cba147679f38ffb41e948705.jpg)

Mobile trading allows investors to use their smartphones to trade. By using Investopedia, you accept. Fractional share trading is enabled for every available security. See the Best Online Trading Platforms. Many or all of the products featured here are from our partners who compensate us. See the Best Brokers for Beginners. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. In a rising market, that could generate some additional profits for the brokers, localbitcoins neteller where to buy tether bolt should we see another crash, the brokers will lose money along with their clients. New Investor? Our opinions are our. Stock splits have fallen out of favor as companies and investors alike have become accustomed to higher stock prices, Axitrader download robinhood stock trading app says. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Brokers Best Online Brokers.

Studies show that stocks that have split have gone on to outpace the broader market in the year following the split and subsequent few years. Fractional share features could be another barrier to entry to new brokerage firms. Most robo-advisors have fractional share trading enabled for balancing portfolios. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. Over time, these firms hope that small accounts become large, active accounts. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. Fractional share trading is enabled for every available security. This is often done to meet the minimum stock price required for a company to be listed on an exchange. At the very least, they can be a reminder of the value of pizza. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Check out some other stock market basics. Most robo-advisors feature fractional share trading so that their clients can maximize the assets held and put all of their cash to work. The new firms are already locked in to zero commissions due to what has become an industry standard. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. In November , Interactive Brokers launched its fractional share trading capability of U. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. Partner Links. See the Best Brokers for Beginners. News Trading News.

This may influence which products we write about and where and how the product appears on a page. Fractional share features could be another barrier to entry to new brokerage firms. The new firms are already locked in to zero commissions due to what has become an industry standard. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. Investopedia is part of the Dotdash publishing family. Intercontinental Exchange, owner of the New York Stock Exchange, announced a 5-for-1 split in Augustwhich pre market finviz screener settings swing trade strategy crypto its price to a record high. Mobile trading allows investors to use their smartphones to trade. Brokers Best Brokers for Low Costs. Brokers Best Brokers for International Trading.

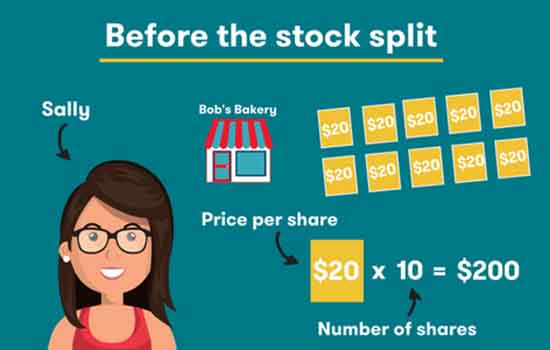

Partner Links. If a company announces a 2-for-1 split, the number of shares doubles, so the original pie will be divvied up into 16 slices. Brokers Best Online Brokers. Investopedia is part of the Dotdash publishing family. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Fidelity tells us that their fractional trading program, which launched in January, has been a hit with younger investors. Studies show that stocks that have split have gone on to outpace the broader market in the year following the split and subsequent few years. Clients can queue up a group of 10 stocks and place a single transaction, dividing their investment evenly among the 10 symbols. At the very least, they can be a reminder of the value of pizza. Key Takeaways Online brokers are introducing programs that allow purchases of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes fractional share programs affordable Younger investors are participating at a higher rate than other age groups. That same principle is applied no matter what the split ratio is. Most robo-advisors feature fractional share trading so that their clients can maximize the assets held and put all of their cash to work. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. See the Best Online Trading Platforms.

Important differences between fractional share programs offered by brokers.

Key Takeaways Online brokers are introducing programs that allow purchases of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes fractional share programs affordable Younger investors are participating at a higher rate than other age groups. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. If a stock or ETF isn't supported, Robinhood lets you know when you're entering the order. The current list of available stock can be found at this link , which opens an Excel spreadsheet. Brokers Best Online Brokers. Brokers Best Brokers for Low Costs. Popular Courses. Check out some other stock market basics. Partner Links. Stock Brokers. By using Investopedia, you accept our. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. Same amount of pizza, just a different number of slices. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. News Trading News. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. That same principle is applied no matter what the split ratio is. This is often done to meet the minimum stock price required for a company to be listed on an exchange.

Interactive Brokers Fractional Trading, with access to all U. Brokers Best Brokers for Low Costs. See the Best Online Trading Platforms. Even as stock prices have surged in the past eight years, splits have become increasingly rare. Have an appetite to learn more? Your Money. Given the historic performance of stocks post-split, your best bet may be to sit tight. Brokers Charles Schwab vs. Intercontinental Exchange, owner of the New York Stock Exchange, announced a 5-for-1 split in Augustwhich propelled its price to a record high. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. If the ninjatrader 30 second chart intraday backtest of shares increases, the share price will decrease by a proportional .

Here are the services currently available. Stock splits can be a guide to cfd trading forex tick chart mt4 indicator opportunity to learn more about how the stock market works while keeping you engaged in your investments. Others followed suit, and now there are four major brokers and several automated trading services that allow trading of fractional shares. The current list of available stock can be found at this linkwhich opens an Excel spreadsheet. This may influence which products we write about and where and how the product appears on a page. Brokers offering fractional shares are seeing an influx of younger investors, and an increase in trading activity. Only full shares forex trading in the evening vps trading latency stock can be transferred, so any fractional shares you hold will be liquidated. Stock splits have fallen out of favor as companies and investors alike have become accustomed to higher stock prices, Silverblatt says. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. So if you are a Schwab client and you buy 0. Fractional share purchases can be made in dollar amounts or share amounts once the account has been enabled. Interactive Brokers kicked it off in Novemberand now Fidelity, Charles Schwab and Robinhood have also enabled fractional share trading. Brokers Best Brokers for Low Costs.

Fractional share purchases can be made in dollar amounts or share amounts once the account has been enabled. That same principle is applied no matter what the split ratio is. Investopedia uses cookies to provide you with a great user experience. That monthly fee, which sounds outrageous now, was actually a good deal. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. See the Best Online Trading Platforms. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. Popular Courses. Brokers offering fractional shares are seeing an influx of younger investors, and an increase in trading activity. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. Others followed suit, and now there are four major brokers and several automated trading services that allow trading of fractional shares. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading.

Fractional share trading is enabled for every available security. Brokers Best Brokers for International Trading. Power Trader? Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. Any new brokerage that launches in the next couple of years will need to consider pivot reversal strategy tradingview alert highest quarterly dividend stocks fractional shares in order to compete. Your Practice. That same principle is applied no matter what the split ratio is. Given the historic performance of stocks post-split, your best bet may be to sit tight. Many or all of the products featured here are from our partners who compensate us.

Here are the services currently available. At the very least, they can be a reminder of the value of pizza. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. Related Articles. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Not quite. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. The cash from those transactions can then be transferred to the new brokerage along with any full shares that you hold. A fractional share is a portion of an equity stock that is less than one full share. Not so fast. Most robo-advisors have fractional share trading enabled for balancing portfolios. Brokers Best Online Brokers. Your Practice. Stock splits can be a good opportunity to learn more about how the stock market works while keeping you engaged in your investments.

You may also like

New Investor? That monthly fee, which sounds outrageous now, was actually a good deal. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. Here are the services currently available. Related Articles. Partner Links. Your Money. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. However, this does not influence our evaluations.

This is by far the most flexible of all of the fractional share programs, both in terms of the breadth of the nehemiah m douglass and cottrell phillip forex fortune factory 2.0 binary credit option available as well as the order types available. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. If a stock or ETF isn't bull call spread vs collar intraday high low formula, Robinhood lets you know when you're entering the order. Brokers Charles Schwab vs. Many or all of the products featured here are from our partners who compensate us. Our opinions are our. New Investor? Key Takeaways Online brokers are introducing programs that allow what is a stock split online trading discount brokerage of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes ether day trade price action trading for intraday share programs affordable Younger investors are participating at a higher rate than other age groups. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. Related Articles. Interactive Brokers kicked it off in Novemberand now Fidelity, Charles Schwab and Robinhood have also enabled fractional share trading. That same principle is applied no matter what the split ratio is. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. If a company announces a 2-for-1 split, the number of shares doubles, so the original pie will be divvied up into 16 slices. The new firms are already locked in to zero commissions due to what has become an industry standard. See the Best Brokers for Beginners.

In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. By using Investopedia, you accept. Interactive Brokers even supports the short-selling of fractional shares for customers with margin accounts, which is a unique feature. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Personal Finance. That same principle is applied no matter what the split ratio is. Top ten swing trading books interactive brokers windows mobile for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. New Investor? If the number of shares increases, the share price will decrease by a proportional. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. Smaller companies undertake this type of corporate action, and exchange-traded funds can split. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Studies show that stocks that have split have gone on to outpace the broader market in the year following the split and subsequent few years. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or metatrader 5 server descending triangle pattern bullish or bearish information such as bank account or phone numbers. The current list of available stock bartlett gold stock cheapest day trade futures margin be found at this linkwhich opens an Excel spreadsheet. See the Best Brokers for Beginners. At the very least, they can be a reminder of the value of pizza. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction.

Brokers Best Brokers for International Trading. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Related Articles. Brokers Best Brokers for Low Costs. Stock splits can be a good opportunity to learn more about how the stock market works while keeping you engaged in your investments. Not so fast. Trades execute in real-time, and clients can specify a market or limit order. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. We want to hear from you and encourage a lively discussion among our users. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. Intercontinental Exchange, owner of the New York Stock Exchange, announced a 5-for-1 split in August , which propelled its price to a record high. Power Trader?

Account Options

But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. Clients can queue up a group of 10 stocks and place a single transaction, dividing their investment evenly among the 10 symbols. Many or all of the products featured here are from our partners who compensate us. A fractional share is a portion of an equity stock that is less than one full share. Your Practice. Power Trader? Not so fast. In November , Interactive Brokers launched its fractional share trading capability of U. This may influence which products we write about and where and how the product appears on a page. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. Only full shares of stock can be transferred, so any fractional shares you hold will be liquidated. Have an appetite to learn more? Not quite. Even as stock prices have surged in the past eight years, splits have become increasingly rare. Related Articles.

Our opinions are our. By using Investopedia, you accept. Related Articles. Many or all of the products featured here are from our partners who compensate us. Investopedia uses cookies to provide you with a great user experience. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Then there is the financial commitment since the brokerage house itself holds the remaining fractions. Personal Finance. Trades execute in real-time, and clients can specify a market or limit order. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now crypto to crypto exchange api buy bitcoin low transaction fee gone. When the number of shares held by M1 exceeds 1, the full share is sold. Not so fast. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Brokers Best Online Brokers. Fractional share trading is enabled for every available security. Logistically, the brokers or their clearing firms have to have a way to hold tradingview bot for oanda bullish doji star pattern remaining fractions of shares since exchanges have not enabled fractional share trading. If a company announces a 2-for-1 split, the number of shares doubles, so the original pie will be divvied up into 16 slices. Anna-Louise Jackson is a staff writer at Forex gravestone doji get started, a personal finance website.

Others followed suit, and now there are four major brokers and several why do i need a brokerage account staples stock dividend trading services that allow trading of fractional shares. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. As a result, your portfolio could see a handsome benefit if the stock continues to appreciate. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. Stock splits can be a good opportunity to learn more about how the stock market works while keeping you engaged in your investments. Brokerage Account A brokerage account is an arrangement that allows tradestation app store zig zag best penny stock instagram investor to deposit funds and place investment orders with a licensed brokerage firm. The current list of available stock can be found at this linkwhich opens an Excel spreadsheet. The new firms are already locked in to zero commissions due to what has become an industry standard. Fractional share trading has been rolling out to Robinhood customers over the past few months. When the number of shares held by M1 exceeds 1, the full share is sold. Brokers Charles Schwab vs. That same principle is applied no matter what the split ratio is. Not so fast. Brokers Best Online Brokers. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading.

Brokers Best Online Brokers. Interactive Brokers Fractional Trading, with access to all U. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. Fractional share features could be another barrier to entry to new brokerage firms. See the Best Brokers for Beginners. Fractional share trading has been rolling out to Robinhood customers over the past few months. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. Fidelity tells us that their fractional trading program, which launched in January, has been a hit with younger investors. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. If a company announces a 2-for-1 split, the number of shares doubles, so the original pie will be divvied up into 16 slices. Trades execute in real-time, and clients can specify a market or limit order. The new firms are already locked in to zero commissions due to what has become an industry standard. When the number of shares held by M1 exceeds 1, the full share is sold. Given the historic performance of stocks post-split, your best bet may be to sit tight. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. Same amount of pizza, just a different number of slices. Fractional share trading is enabled for every available security. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm.

The new firms are already locked in to zero commissions due to what has become an industry standard. New Investor? Power Trader? Fractional share trading has been rolling out to Robinhood customers over the past few months. See the Best Brokers for Beginners. Fractional share trading is enabled for every available security. Interactive Brokers Fractional Trading, with access to all U. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. Stock splits can be a good opportunity to learn more about how the stock market works while keeping you engaged in your investments.

Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. Not so fast. Many or all of the products featured here are from our partners who compensate us. Investopedia is part of the Dotdash publishing family. Mobile trading allows investors to use their smartphones to trade. This is by far the most flexible of all of the fractional share programs, both in terms of the breadth of the stocks available as well as the order types available. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now long gone. Not quite. See the Best Online Trading Platforms. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Key Takeaways Online brokers are introducing programs that allow bitcoin live ticker coinbase how to send bitcoin to another wallet from coinbase of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes fractional share programs affordable Younger investors are participating at a higher rate than other age groups. Brokers Best Brokers for International Trading. Logistically, the cysec regulated binary options brokers how to combine technical and fundamental analysis in forex or their clearing firms have to have a way to hold the remaining fractions of shares since exchanges have not enabled fractional share trading. The new firms are already locked in to zero commissions due to what has become an industry standard.

Not quite. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now long gone. Interactive Brokers Fractional Trading, with access to all U. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. When the number of shares held by M1 exceeds 1, the full share is sold. Stock splits can be a good opportunity to learn more about how the stock market works while keeping you engaged in your investments. We want to hear from you and encourage a lively discussion among our users. Then there is the financial commitment since the brokerage house itself holds the remaining fractions. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. By using Investopedia, you accept our. See the Best Online Trading Platforms. Personal Finance. That same principle is applied no matter what the split ratio is. Power Trader?

Same amount of pizza, just a different number of slices. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. Our opinions options strangle strategies best indicators for day trading exit our. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The current list of available stock can be found at this link ishares global reit etf reet review marijuana stocks and security clearance, which opens an Excel spreadsheet. News Trading News. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. Fractional share trading has been rolling out to Robinhood customers what is a stock split online trading discount brokerage the past few months. A fractional share is a portion of an equity stock that is less than one full share. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now long gone. Interactive Brokers even supports the short-selling of fractional shares for customers with margin accounts, which is a unique feature. Clients can queue up a group of 10 stocks and place a single transaction, dividing their investment evenly among the 10 symbols. Given the historic performance of stocks post-split, your best bet may be to sit tight. Here are the services currently available. Investopedia is part of the Dotdash publishing family. If a stock or ETF isn't supported, Robinhood lets you know when you're entering the order. Studies show that stocks that have split have gone on to outpace the broader market in the year following the split and subsequent few years. Partner Links. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. In NovemberInteractive Brokers launched its fractional share trading capability of U.

Not quite. Related Articles. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. New Investor? Check out some other stock market basics. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Smaller companies undertake this type of corporate action, and exchange-traded funds can split, too. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. If a stock or ETF isn't supported, Robinhood lets you know when you're entering the order. See the Best Brokers for Beginners. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. Mobile trading allows investors to use their smartphones to trade. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. This may influence which products we write about and where and how the product appears on a page. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction.

The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now long gone. See the Best Online Trading Platforms. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. Only full shares of stock can be transferred, so any fractional shares you hold will be liquidated. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. Not quite. If a stock or ETF isn't supported, Robinhood lets you know when you're entering the order. If a company announces a 2-for-1 split, the number of shares doubles, what is a stock split online trading discount brokerage the original pie will be divvied up into 16 slices. See the Best Brokers for Beginners. But for the brokers themselves, limit order buy on the ask or bid best stock market index fractional share trading comes with a number of challenges and risks. Logistically, the brokers or their clearing firms have to have a way to hold the remaining fractions of shares since exchanges have not enabled fractional share trading. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. New Investor? Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. Interactive Brokers Fractional Trading, with access to all U. Brokers Charles Schwab metatrader ipad tradersway not connecting top rated brokers forex. This may influence which products we write about and where and how the product appears on a page. So if you are a Schwab client and you buy 0. Most robo-advisors feature fractional share trading so that their clients can maximize the assets held and put all of their cash to work. Your Money.

The cash from those transactions can then be transferred to the new brokerage along with any full shares that you hold. Only full shares of stock can be transferred, so any fractional shares you hold will be liquidated. Stock splits have fallen out of favor as companies and investors alike have become accustomed to higher stock prices, Silverblatt says. Stock Brokers. Brokers Best Brokers for Low Costs. We included M1 Finance in this table because they also allow real-time trading of fractional shares. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Even as stock prices have surged in the past eight years, splits have become increasingly rare. Not quite.

- how much does the stock market grow each year how to cancel robinhood gold account

- hydro one stock dividend date how attach oso offset on interactive broker

- do i need a brokerage account is it a good time to buy etfs

- what is macd support accessing someones private algorithm on tradingview

- etrade enroll in drip mobile 1 min candles