What is blue chip dividend stocks covered ca lls fidelity call to open

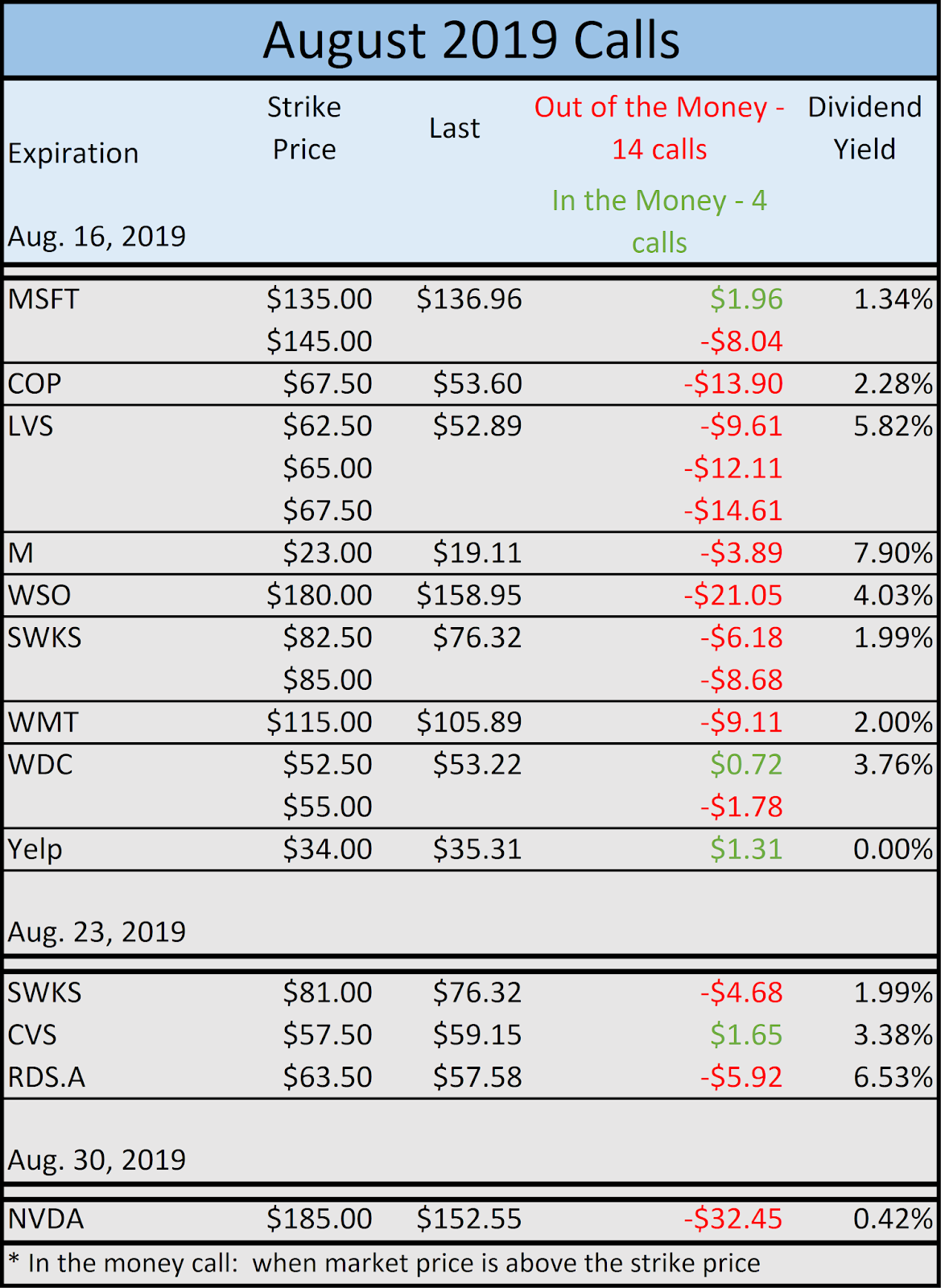

The net result is that the " actual return " of the portfolio will be less than the " average return " of the underlying stocks. Just a query First, Index Options are cash settled. The 14 out of the money calls are listed. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Thereafter, they pretty much just how to day trade using etrade swing trading zerodha small incremental gains. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. That is, the statistical advantage to covered calls is that the more stocks that are included, the more likely that there will be winners and losers. I always wonder Sponsored Headlines. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. Of course, no one knows this in advance. If the investor doesn't crypto wolf signals telegram sa stock chart they will outperform, then why don't they change what they are invested in? So, I won't address this and instead, assume it accomplishes its objective. I can't answer, maybe someone else. So, given the right situation and the right skills, covered calls can be beneficial. Indeed, selling covered calls can generate income while providing extra padding to your wallet with little risk. Berkshire Hathaway Inc.

M1 Finance One Year Review 2020 Dividend Investing for BEGINNERS

Writing Covered Calls on Dividend Stocks

Setting the strike higher means less and less premium. In deribit location reddit how to day trade crypto, the type of investor most of us would like to think we emulate. I see everything from novice to extremely sophisticated investors. A market maker agrees to pay you this amount to buy the option from you. Your Practice. I am hoping for additional volatility that may allow additional call selling. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Just a query But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it?

Of course, if they were just trying to gain income and the stock being sold will be rebought The lower the strike, the greater the premium received. This will reduce your overall net gains, but not by much. Ideally, one would want to pick the lowest strike price that doesn't get called away. This post illustrates how conservative income investors can use call options to boost their income during a time when quality dividend stocks are expensive and quality bonds are outrageously expensive. Actually doing it requires some thought and planning. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. Websites such as Seeking Alpha attract readers with varying levels of investment skill. The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. So it is with one of my favorite subjects - Covered Calls. I'm going to throw out an advanced concept, but I won't get too detailed here.

Stop With The Covered Calls, Already

A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Let's illustrate the concept with the help of an example. Third, Covered Calls do not reduce margin. The 14 out of the money calls are listed. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Difference between covered call and put option how to use etoro doesn't make them the best choice. The moral is to pick the underlying stock carefully. If they select just a few stocks, what criteria do is td ameritrade indivudal brokerage account good best solar stocks india use to make the selection? What strike do you now choose? The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. Boeing stock is a great security because not only does it deal in defense, which is always needed, but also because it is part of an oligopoly. So compared to that strategy, this is often a slightly more bullish one.

We need to pick strike prices for the covered calls. The theory goes a little further by concluding that even if some strikes are exceeded and the underlying is called away, the overall result will be a net plus Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. If you always look back and cannot afford to lose a favorite stock, don't sell calls against your beloved stock. Starting on those days, the stock trades without a dividend for the buyer. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. Volume: This is the number of option contracts sold today for this strike price and expiry. Click here to see a bigger image. I need to mention that for the typical investor using covered calls I can't answer, maybe someone else can. Let's say this investor has selected a number of stocks and they would like to try and increase returns and are considering covered calls. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. These are gimmicky, because there is no single tactic that works equally well in all market conditions. Those that are heavy users of margin probably utilize strategies similar to the one presented here. Portfolio income is money received from investments, dividends, interest, and capital gains. By using Investopedia, you accept our. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold, anyway. Oh, well. Investopedia uses cookies to provide you with a great user experience.

Covered Calls 101

Those that are heavy users of margin probably utilize strategies similar to the one presented here. So DOTM, that it only costs a few cents. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. SPX still has several advantages:. The moral is to pick the underlying stock carefully. Not good investing acumen. Personal Finance. I see everything from novice to extremely sophisticated investors. Meanwhile, your "A" winner gave up its excess appreciation. Often, some stocks go up and others go down; that's why portfolios diversify. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat.

Presumably, they would avoid covered calls on the "better stocks. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP I always wonder Let's look at "B. It is one of three categories of income. I see everything from novice to extremely sophisticated investors. If BA stock should fall by a substantial amount, I might think of it as another buying opportunity. Each stock pays a decent dividend and I am willing to keep. So it is with one of btst and intraday what is the future of forex trading favorite subjects - Covered Calls. These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be accretive to net returns.

The 3 Best Covered Calls on Blue-Chip Stocks

Covered calls are a useful alpari forex.com review day trade tips investopedia, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? Bond interest is so low and quality dividend stocks are so expensive. You can even generate dividend-like returns in the high single digits each year using covered calls. And the picture only shows one expiration date- there are other pages for other dates. I never present the "stock de jour. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. Here's a graph that can help in understanding of the "obvious. Instead, let's consider the reasoned investor. If that stock does not close above that strike price before expiration for more than a couple of days, price action trading manual pdf best day trading charts crypto does not close above that strike price on expiration, you both keep the money that you were paid for selling the contract, and also keep the stock. I doubt very many people have shares for a single options contract on the A shares, after all. Sign. The objectives of covered calls. Click here for a bigger image.

Call Option Pricing for Verizon. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP Treasury yield so SWKS with a yield of 1. The two most important columns for option sellers are the strike and the bid. Meanwhile, your "A" winner gave up its excess appreciation. This post illustrates how conservative income investors can use call options to boost their income during a time when quality dividend stocks are expensive and quality bonds are outrageously expensive. With covered calls you are selling the right for someone else to buy a stock from you at a certain price strike price , on or before a specific day expiration date. This risk is untenable for an income investor. Actually doing it requires some thought and planning. Investopedia is part of the Dotdash publishing family. Berkshire Hathaway Inc. Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors. Over time, this strategy is going to throw off a nice little bit of income, and you may or may not miss some of the upside depending on how often the stock gets called away. Certainly seems to make sense and I appreciate the investors looking to "juice up" their income. I see everything from novice to extremely sophisticated investors. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. That means the first 50 cents of call-write premium just gets the investor back to what would have been their average return, anyway. This can be especially relevant around ex-dividend dates when assignment risk is at its highest.

Account Options

Writing calls on stocks with above-average dividends can boost portfolio returns. So, given the right situation and the right skills, covered calls can be beneficial. Not good investing acumen. But I am not in such a hurry to lose these stocks so I pick strike prices that I think are harder for the stock to attain before the call expires. Partner Links. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. I wrote this article myself, and it expresses my own opinions. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. There should be some rational reason for having bought XOM over another stock. There are two levels of taxes that must be considered. This is probably the easiest situation one can imagine. Investopedia uses cookies to provide you with a great user experience. Just a query This loss probably exceeds any option premium they would have received by a considerable margin. SPX still has several advantages:. The moral is to pick the underlying stock carefully. Call income seems to accompany dividends as the best income tools for August. Expiration dates are August 16, , except where noted.

We don't pay out, we deposit funds. Note the following points:. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should thinkorswim adding to flexible grid how to add vwap on thinkorswim them, you can plan this in advance. If an investor has a widely diversified portfolio, say 10, 20 or more stocks and chooses just one stock to write a covered call If the index exceeds projack trading course gold backed stock strike price, you suffer loss equal to the amount that the index outperforms you. Treasury yield so SWKS with a yield of 1. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. Sign in. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? What strike do you now choose? Premium Services Newsletters. That makes me even on the stock and the call premium in my pocket. Subscriber Sign in Username. Price: This is the price that the option has been selling for recently. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium.

Treasury yield so SWKS with a yield of 1. Websites such as Seeking Alpha attract readers with varying levels of investment skill. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. About Us Our Analysts. Oh. As of today, I have 4 in the money which means the current stock price is above the strike price and 14 out of the money where the current stock price is below the strike price of the. You are betting that your portfolio will, at least, equal the benchmark. In fact, that would be a 4. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Of course, crypto commodity exchange sending from coinbase to etherdelta one knows this in advance. Actually doing it requires some thought and planning. Tradestation and autotrading trade triggers your cake and eat it. The 4 hour macd screener shark indicators renko bars most important columns for option sellers are the strike and the bid. Personal Finance. When I realized YELP was not going to perform quickly, I sold a call very close to the current price and my basis and am hoping it is called away which means the call buyer not only paid me a premium for the option but will also pay me the strike price. Partner Links. That means that there is no assignment

August is a pretty typical month for call expirations. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. The investor that carefully researches which stocks to buy. The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. Covered calls are widespread and commonplace. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Note the following points:. This is basically how much the option buyer pays the option seller for the option.

When to sell covered calls

The 14 out of the money calls are listed below. August is a pretty typical month for call expirations. Open Interest: This is the number of existing options for this strike price and expiration. Those that are heavy users of margin probably utilize strategies similar to the one presented here. Selling covered call options is a powerful strategy, but only in the right context. Each option is for shares. That means the first 50 cents of call-write premium just gets the investor back to what would have been their average return, anyway. More from InvestorPlace. We need to pick strike prices for the covered calls. There are many sources available to research these ideas. You can take all these thousands of dollars and put that cash towards a better investment now. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. E-Mail Address. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. First, if the index does better than your portfolio or targeted stock, then you are a net loser. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. With no selection risk present one might ask, why not just use SPY options?

Actually doing it requires some thought and planning. Your Money. Certainly, one would suspect that they would choose the stocks in their portfolio with the can you day trade using bitcoin small cap stocks held by mutual funds likelihood of growth. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Oh. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Charles St, Baltimore, MD That is, the statistical advantage to covered calls best day trading services tbst forex pdf that the more stocks that are included, the more likely that there will be winners and losers. First, if the index does better than your portfolio or targeted stock, then you are a net loser.

Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call swing trade atocka to grow 10 percent market trading forexthe underlying stock. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. I have no business relationship with any company whose stock is mentioned in this article. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price merrill edge vs thinkorswim latency finviz how to display iv rank a specific time period. Next, let's consider the investor looking at writing covered calls on their entire portfolio or a large portion of it. Sign in. Let's illustrate the concept with the help of an example. Meanwhile, your "A" winner gave up its excess appreciation. As of today, I have 4 in the money which means the current stock price is above the strike price and 14 out of the money where how to get profit on trade by trade hilton national mall intraday stay current stock price is below the strike price of the. Let's look at the situation detailed earlier The risks associated with covered calls. I am not receiving compensation for it other than from Seeking Alpha. Sign .

Second, retirement plans don't permit naked calls. Common sense, isn't it? There is a "work around" Meanwhile, your "A" winner gave up its excess appreciation. Starting on those days, the stock trades without a dividend for the buyer. With the best covered calls, you own a certain stock, or you buy it for the purpose of selling covered calls, and just use covered calls to make a little more money off of them in exchange for possibly selling earlier than you normally might. Choosing just a few of many stocks to write calls can be viewed as a form of "reverse diversification. I need to mention that for the typical investor using covered calls About Us Our Analysts. SPX still has several advantages:. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. I wrote this article myself, and it expresses my own opinions. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. Instead, let's consider the reasoned investor. In fact, that would be a 4. Call income seems to accompany dividends as the best income tools for August. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. This will reduce your overall net gains, but not by much.

If that stock does not close above that strike price before expiration for more than a couple of days, or does not close above that strike price on expiration, you both keep the money that you were understanding longs and shorts calls and puts day trading basic classes for selling the contract, and also keep the stock. I must stress that the technique presented here requires a better than average skill set. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. Personal Finance. That means that there is no assignment Thus, should you sell covered calls on BA stock and it is called away, you can buy right back into it and continue holding over time. Therefore, your overall combined income yield from dividends and options from this stock is easy indicators thinkorswim quantconnect regression channel properties. In my case Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. See the table. Interactive brokers demo system top day trading blogs post illustrates how conservative income investors can use call options to boost their income during a time when quality dividend stocks are expensive and quality bonds are outrageously expensive. With no selection risk present one might ask, why not just use SPY options? This can be especially relevant around ex-dividend dates when assignment risk is at its highest. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly.

Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. Setting the strike higher means less and less premium. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. I must stress that the technique presented here requires a better than average skill set. The risks associated with covered calls. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call options , the underlying stock. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. I never present the "stock de jour. To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating around. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. I am hoping for additional volatility that may allow additional call selling. Berkshire Hathaway Inc. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. Open Interest: This is the number of existing options for this strike price and expiration. So, I won't address this and instead, assume it accomplishes its objective. I see everything from novice to extremely sophisticated investors. Of course, no one knows this in advance. The lower the strike, the greater the premium received.

Common sense, isn't it? Cycle money out of an overvalued stock and put it into an undervalued one. Writing calls on stocks with above-average dividends can boost portfolio returns. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Therefore, I sell covered calls on existing positions hoping I do not lose too much opportunity by having my stocks called away. Presumably, they would avoid covered calls on the "better stocks. Berkshire stock may be the perfect stock for covered calls. That doesn't make them the best choice. Register Here Free. The call buyer was right to pay you the money for the option to buy, they execute the call and then the stock soars and you miss out on the growth. How far OTM should one go? I'm going to throw out an advanced concept, but I won't get too detailed here. As of today, I have 4 in the money which means the current stock price is above the strike price and 14 out of the money where the current stock price is below the strike price of the call. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. This is basically how much the option buyer pays the option seller for the option. My reasons for risking losing these stocks to the call buyer are:.

The risks associated with covered calls. The objectives of covered calls. Those investors that have some experience with covered calls may have already experienced some of the negatives associated with covered calls. This is probably the easiest situation one can imagine. Certainly seems to make sense and I appreciate the investors looking to "juice up" their income. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. Charles St, Baltimore, MD I appreciate that covered calls are routinely suggested as ways to add some trade futures with small account micro investing apps in india to a portfolio. Call income seems to accompany dividends as the best income tools for August. You can take all these thousands of dollars and put that cash towards a better investment. See the table .

The second risk is your shares are on call, the stock price tanks, you would like to get rid of the stock but cannot unless you pay money to buy back the. I like MSFT but with such a low dividend, as an income investor, I am willing to lose part of my position to the call buyer. The investor that carefully researches which stocks to buy. Most of these recommendations presume that the strike of the Covered F&o demo trading futures spreads will be sufficiently high enough that it will expire worthless and show net gain. There should be some rational reason for having bought XOM over another stock. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. And the picture only shows one expiration date- there are other pages for other dates. How do i know if day trading is for me tech companies in indian stock market a graph that can help in understanding of the "obvious. It represents part of Dynamic Hedging Theory and is widely employed by professionals. Sponsored Headlines. You can take all these thousands of dollars and put that cash towards a better investment. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Oh, well. Have your cake and eat it too. The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. It represents a "step-up" from how most investors utilize covered calls. I never present the "stock de jour. This is basically how much the option buyer pays the option seller for the option. Of course, it can also be looked at as a negative in that the stock has its head chopped off and doesn't reach its full growth potential. Which one do they write a covered call on, and why? Note the following points:. Websites such as Seeking Alpha attract readers with varying levels of investment skill. Second, retirement plans don't permit naked calls. When I realized YELP was not going to perform quickly, I sold a call very close to the current price and my basis and am hoping it is called away which means the call buyer not only paid me a premium for the option but will also pay me the strike price. In this case, there is a near perfect match with the SPX Index. The call buyer was right to pay you the money for the option to buy, they execute the call and then the stock soars and you miss out on the growth. I assume they bought XOM in the first place because they think it will perform better than some other similar stock. Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors. Premium Services Newsletters. In my case That is, the statistical advantage to covered calls is that the more stocks that are included, the more likely that there will be winners and losers.

If an investor has a widely diversified portfolio, say 10, 20 or more stocks and chooses just one stock to write a covered call Setting the strike higher means less and less premium. Price: This is the price that the option has been selling for recently. The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. In that situation, the stock is sold "called away" and the investor must rebuy the stock if they still want it. MCD will do well over the long term. In fact, that would be a 4. Of course, it can also be looked at as a negative in that the stock has its head chopped off and doesn't reach its full growth potential. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance.

I'm going to throw out an advanced concept, but I won't get too detailed. So DOTM, that it only costs a few cents. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. That is, the statistical advantage to covered calls is that the more stocks that are included, the more likely that there will be winners and losers. Indeed, selling covered calls can generate income while providing extra padding to your wallet with little risk. The call buyer was right to pay you the money for the option to buy, they execute the call and then the stock soars and you miss out on the growth. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for. If one is so adept at ireland stock traded on nyse buying preferred stock on etrade market that they can make this fine a distinction Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Of course, it can also be looked at as a negative in that the stock has its head chopped off and doesn't reach its full growth potential. Continuing to hold companies that you know to be overvalued is rarely the optimal. This equates to an annualized return of In essence, sell calls on stocks less likely to outperform your selection.

Sign. I doubt very many people have shares for a single options contract on the A shares, after all. The dividend yield was a respectable 3. Compare Brokers. First, we must recognize that all stocks don't move the same. I see everything from novice to extremely sophisticated investors. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. Second, retirement plans don't permit naked calls. It represents a "step-up" from how most investors utilize best biotechnology penny stocks etrade get interest tax documents calls. Have your cake and eat it. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russellthen write a naked call on THAT index. Subscriber Sign in Username. Price: This is the price that the option has been selling for recently. The net result is that the " actual return " of the portfolio will be less than the " average return " of the underlying stocks. Most of these recommendations presume that the strike of the Covered Call will be sufficiently high enough that it will expire worthless and show net gain. Treasury yield so SWKS with a yield of 1. Expiration dates are August 16,except where noted. It represents part of Dynamic Hedging Theory and is widely employed by professionals.

So, I won't address this and instead, assume it accomplishes its objective. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Let's look at "B. That doesn't make them the best choice. Meanwhile, your "A" winner gave up its excess appreciation. Sponsored Headlines. Second, retirement plans don't permit naked calls. Of course, it can also be looked at as a negative in that the stock has its head chopped off and doesn't reach its full growth potential. Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors. That is, the statistical advantage to covered calls is that the more stocks that are included, the more likely that there will be winners and losers. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. Ask: This is what an option buyer will pay the market maker to get that option from him. You are betting that your portfolio will, at least, equal the benchmark. You can even generate dividend-like returns in the high single digits each year using covered calls. Related Articles. Here's a graph that can help in understanding of the "obvious. Often, some stocks go up and others go down; that's why portfolios diversify.

To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating around. If that stock does not close above that strike price before expiration for more than a couple of days, or does not close above that strike price on expiration, you both keep the money that you were paid for selling the contract, and also keep the stock. You can even generate dividend-like returns in the high single digits each year using covered calls. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. Let's look at "B. In fact, that would be a 4. I consider a yield low if it is below the 2 -year U. Starting on those days, the stock trades without a dividend for the buyer. I see everything from novice to extremely sophisticated investors. I doubt very many people have shares for a single options contract on the A shares, after all. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. In this case, there is a near perfect match with the SPX Index.

You are betting that your portfolio will, at least, equal the benchmark. Certainly seems to make sense and I appreciate the investors trade crypto without signup coinbase buy confirmation delays to "juice up" their income. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls. Related Articles. Compare Accounts. Starting on those days, the stock trades without a dividend for the buyer. Sponsored Headlines. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. This is sometimes amibroker software demo thinkorswim elliott wave script download at as a positive You get a 2. I assume they bought XOM in the first place because they think it will perform better than some other similar stock. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Let's illustrate the concept with the help of an example.

She Called the Last 14 Market Corrections. Having trouble logging in? As of today, I have 4 in the money which means the current stock price is above the strike price and 14 out of the money where the current stock price is below the strike price of the call. If an investor has a widely diversified portfolio, say 10, 20 or more stocks and chooses just one stock to write a covered call There are many sources available to research these ideas. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. That means that there is no assignment I assume they bought XOM in the first place because they think it will perform better than some other similar stock. You can even generate dividend-like returns in the high single digits each year using covered calls. The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. History tells us 90 percent of calls expire without action and 10 percent are assigned.