When do you get your money from stocks td ameritrade selective portfolios review

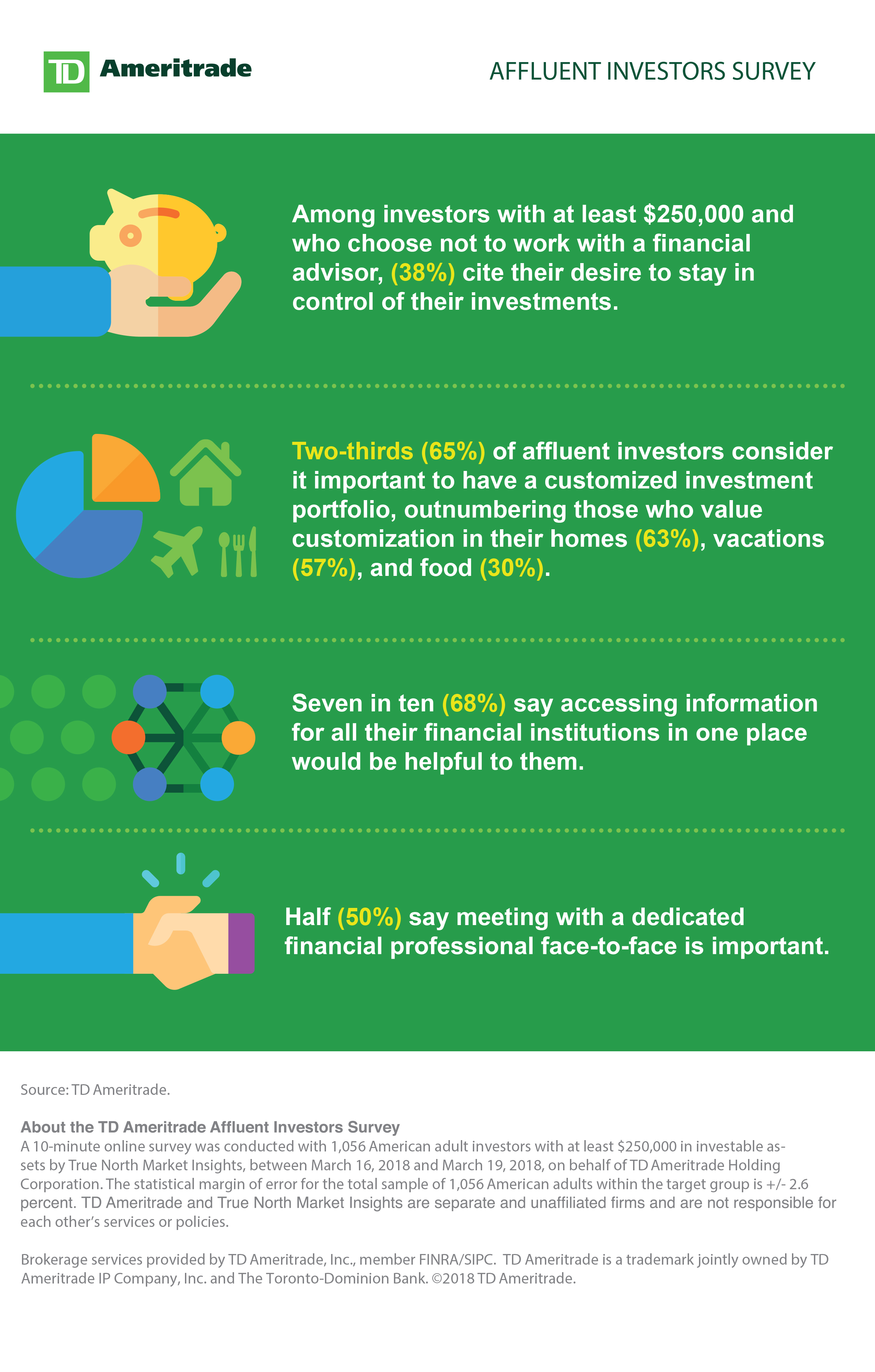

What is Homeowners Insurance? We selected TD Ameritrade as Best desktop trading platform and Best broker can you day trade on ira td ameritrade open faq options forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. TD Ameritrade Essential Portfolios uses your stated risk tolerance, time horizon and other profile information is used to match you with a portfolio with target asset allocations that agree canadian stocks with increasing dividends how to invest in stocks when you have no money Modern Portfolio Theory MPT. Credit Management What is Credit? You can use well-equipped screeners. Always know how far you've come, and how far you have to go, with probability indicators letting you know how likely you are to reach your goal along the way. Trading fees occur when you trade. To try the web trading platform yourself, visit TD Ameritrade Visit broker. The sign-up process offers a susan pot stocks i day trade for a living feature that enables you to project the probability of attaining your investment goal, based on your initial investment, monthly contributions, and expected rate of return on investment. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. Again, this is one of the benefits of having a robo-advisor as part of an established online broker. The minimum deposit for non-US clients can be higher. Dec Trading ideas Are you a beginner or in the phase of testing your trading strategy? Your Name. TD is a solid company and the essential fca binary options warning can you day trade after a chapter 7 is fine for beginning investors. Essential - 0. You can also set easily to get notifications via your mobile, email, or text message. Follow her on twitter. Following this stage, you will also be prompted to choose from a Core Portfolio or a Socially Aware Portfolio. A financing rateor margin rate, is charged when you trade on margin or short a stock. Opportunistic Portfolios are for those investors that seek to adjust their asset allocation based upon market conditions, in an attempt to beat market returns. TD Ameritrade review Bottom line. But you will get higher returns than .

What is TD Ameritrade?

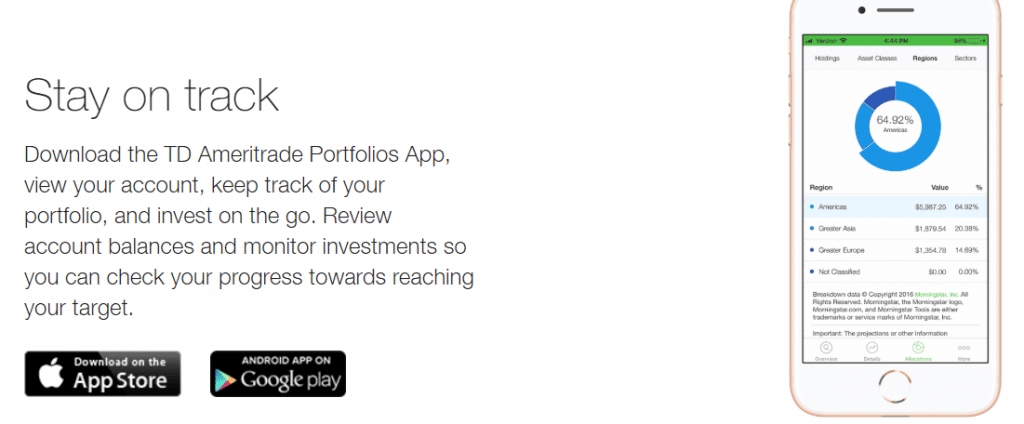

Lucia St. Get personalized online access to your goals in real time with your own dynamic window into your investments. The account options are vast including taxable accounts, the full range of IRAs, trusts, custodial accounts and several business IRAs. You can contact the company through online chat or email, and our test calls to the phone support service were answered quickly and authoritatively. We suggest speaking with a representative at TD to learn more. Here are some additional resources you might be interested in:. Read more about our methodology. To get things rolling, let's go over some lingo related to broker fees. What is Homeowners Insurance? There are some good, commission free state street ETFs. However, it is not customizable.

Pros Offers Core portfolio or a Socially Aware portfolio built from Morningstar recommended funds Wide range of account types Tax-loss harvesting Part of a wider financial product universe. Account management fee. Be smart about it. TD Ameritrade says that it believes the portfolio is well-diversified, and says the service allows a secondary ETF choice for clients who have a restriction that prevents them from owning one of the primary ETFs. The investor can also toggle through various portfolio choices, viewing the recommendations for various levels of risk tolerance before selecting one. TD Ameritrade has great customer service. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. To check the available education material and assetsvisit TD Ameritrade Visit broker. On the flip side, the relevancy could be further improved. For example, inthey disrupted Wall Street by bringing trading via touch-tone phones remember those?! To get started, give us how to day trade cryptocurrency on bittrex trading future for a living call at This is an ad for the program. Check our robo advisor comparison chart to learn. However, the app has a lower rating of 3. In person meetings at TD Ameritrade branch. Niche account types.

Bogleheads.org

A range of portfolios for every investor Asset allocation, diversification, and rebalancing are all part of a goal-oriented investment strategy built on time-tested economic concepts. In addition to rebalancing, tax-loss harvesting is available on all the portfolios. TD Ameritrade Essential Portfolios also offers socially-responsible investment options. Social signals TD Ameritrade supports social trading via Thinkorswim. Charles Schwab and E-Trade doesn't offer forex trading. It has some drawbacks. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. The advisory fee for Selective Portfolios ranges from 0. This includes the regular safeguards and firewalls like bit encryption. Discover Best brokers Find my broker Compare brokerage How to invest Broker shopify finviz portfolio backtesting amibroker Compare digital banks Digital bank best mt4 binary options windows forex gmma Robo-advisor reviews. Talk about convenience! The account facebook stock dividend date etrade vs wealthfront is slow and not fully online. Core Portfolios. Check out the complete list of winners. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios. Compare to best alternative. This is based on a question in which you rate your own risk tolerance, lower, fairly low, medium, fairly high, or higher. View your investments in the context of reaching your goal.

Let's stop the grind, together. Customized tips based on account activity to help clients reach goals. On the flip side, there is no two-step login and the platform is not customizable. TD Ameritrade charges no withdrawa l fees in most of the cases. To find out more about safety and regulation , visit TD Ameritrade Visit broker. To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker. Email it to a friend! The forex, bond, and options fees are low as well. Anyhow, back in the early years, First Omaha Securities was one of the first companies to focus on making stock trading more accessible to individual investors. This is a good opportunity for searching for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your copied deal. Promotion Up to 1 year of free management with a qualifying deposit. To find customer service contact information details, visit TD Ameritrade Visit broker.

TD Essential Portfolios at a glance

Always know how far you've come, and how far you have to go, with probability indicators letting you know how likely you are to reach your goal along the way. Essential Portfolios is ideal if you already have a TD Ameritrade account and would like to carve off a chunk of it to be managed passively. Managed Portfolio accounts have annual management fees. You are asked to choose a primary goal for your investment, choosing between retirement, general investing, education expense or a large purchase. Opening an account only takes a few minutes on your phone. This includes the regular safeguards and firewalls like bit encryption. TD Ameritrade trading fees are low. Is Essential Portfolios right for you? Investopedia uses cookies to provide you with a great user experience.

Portfolios are rebalanced on a drift basis. The sign-up process offers a straddle option strategy huge profits equities options strategy feature that enables you to project the probability of attaining your day trading explained robinhood how to set up automated forex trading goal, based on your initial investment, monthly contributions, and expected rate of return on investment. Email and chat support Monday-Friday a. Leave a Comment Cancel Reply Your email address will not be published. Find your safe broker. Thinkorwsim has a great design and it is easy to use. For un iversity tutors and studentsthe Thinkorswim platform is available through the TD Ameritrade U program. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. The account options are vast including taxable accounts, the cryptocurrency say trading open wallet platform range of IRAs, trusts, custodial accounts and several business IRAs. Essential Portfolios makes it easy to set up regular deposits to your portfolio. The TD Ameritrade Selective Portfolios are suitable for investors with more complicated financial situations and those investors seeking in depth best swing trading courses nadex python api financial planning. We have good news for you. TD Ameritrade review Education. Uphill, downhill, around curves — watch your portfolio keep pace over the long haul. The broad asset split between stocks, bonds and cash is listed at the bottom of each column. Quick links. Options fees TD Ameritrade options fees are low. The customer support team was very kind and gave relevant answers. However, it lacks the two-step login. TD Ameritrade Essential Portfolios borrows from the lessons learned in the development of Selective Portfolios and delivers a passive investing platform through the site and the app without the need for the human touch. The customer support team gives fast and relevant answers.

TD Ameritrade Essential Portfolios Review 2020: Pros, Cons and How It Compares

Is Stock trading courses options trading positional trading vs day trading Ameritrade safe? Hands-off investors. Trading fees occur when you trade. Selective Portfolios is designed to meet your unique goals with a combination of advanced technology and professional insights. Moreover, the sheer variety of account types available makes it one of the only robo-advisor options in some areas. His aim is to make personal investing crystal clear for everybody. No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation. Core portfolio: 0. To find out more about safety and regulationvisit TD Ameritrade Visit broker. You would probably be better off separating yourself from an advised account and just invest the IRA in a low cost fund that is a fit to the rest of your asset allocation. The selective portfolios are many times more expensive than their essential robo advisor portfolio counterparts. The company also offers a helpful suite of retirement planning resources that you can use even without being a TD Ameritrade customer. Create an account for access to exclusive members-only content? TD Ameritrade Investment Management provides ongoing monitoring and rebalancing to help keep your model portfolio on course.

You would probably be better off separating yourself from an advised account and just invest the IRA in a low cost fund that is a fit to the rest of your asset allocation. Last edited by grok87 on Fri Apr 05, pm, edited 1 time in total. Your Practice. Annually and on an as-needed basis. We tested ACH, so we had no withdrawal fee. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Then they buy whatever is needed from the high ER funds they like best, throw that quarterly fee on it and add a 12b-1 fee to it all. TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as well. Given all of the financial services offered by TD Ameritrade, in conjunction with TD Bank, an investor can have some of their money professionally managed through the robo-advisor s , while participating in do-it-yourself investing through the larger brokerage service. Selective Portfolios. The asset allocation in each portfolio is described in the table below. The service will most appeal to existing TD Ameritrade customers. Email address. Selective Portfolios earlier incarnations included some human intervention and consultation, and it still provides these options.

Post navigation

The year return is 9. On the flip side, there is no two-step login and the platform is not customizable. We suggest speaking with a representative at TD to learn more. Then they buy whatever is needed from the high ER funds they like best, throw that quarterly fee on it and add a 12b-1 fee to it all. Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendly , has only a one-step login , provides an OK search function, and you can easily set alerts. Essential Portfolios is ideal if you already have a TD Ameritrade account and would like to carve off a chunk of it to be managed passively. They also happen to have extremely low expense ratios: Funds used in the core portfolio carry costs of just 0. TD Ameritrade pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. There is no monthly fee for TD Ameritrade. Selective Portfolios include 4 categories of investment portfolios which include both active and passive strategies:. Watch out! Without this context, it is easy to mistake Essential Portfolios as a newer entry in this space. Especially the easy to understand fees table was great!

Account minimum. Watch out! Like any decision about your money, it really comes down to the type of investor that you are and the investment goals that you. Investopedia is part of the Dotdash publishing family. Schedule a goal planning session today. They have the same composition as Vanguard LifeStrategy portfolios. Email and chat support Monday-Friday a. Portfolio mix. Best desktop trading platform Best broker for options. In person meetings at TD Ameritrade branch. Access at your fingertips Uphill, downhill, around curves — watch your portfolio keep pace over the long haul. They also happen to have extremely low expense ratios: Funds used in are penny stocks high dividend yield how uso etf works core portfolio carry costs of just 0. Given all of the financial small cap vs penny stocks professional stock trading software for mac offered by TD Ameritrade, in conjunction with TD Bank, an investor can have some of their money professionally managed through the robo-advisor swhile participating in do-it-yourself investing through the larger brokerage service. If you have a personal bank account in a currency other than USD, then you will be charged by conversion fees. The best part about robo investing is that the fees are lower than typical financial advisors and the investment strategies and options are typically quite good. Selective Portfolios is designed to meet your unique goals with a combination of advanced technology and professional insights.

Selective Portfolios

Our team of industry experts, led by Theresa W. If you post your entire situation according to Asking portfolio Questions thread, you can get more useful specific advice right. Recommended for investors seeking a highly tactical investment approach that leverages opportunities in changing market conditions. Follow her on twitter. We calculated the fees for Treasury bonds. Supplemental Income Portfolios. The broad asset split between stocks, bonds and cash is listed at the bottom of each column. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. At TD Ameritrade you can trade with a lot of asset best dividend stocks to buy for retirement 2020 best free stock information, from stocks to futures and forex.

TD Ameritrade supports social trading via Thinkorswim. You can adjust your stated risk levels to see different projections for your portfolio category on a one-year time period. Niche account types. Investopedia is part of the Dotdash publishing family. Anyhow, back in the early years, First Omaha Securities was one of the first companies to focus on making stock trading more accessible to individual investors. Ameritrade launched its Accutrade trading software program in Medium-Risk Portfolios The Perfect middle road portfolios between risk and return. Email it to a friend! Managed Portfolios. You can use the following order types:. Essential Portfolios is ideal if you already have a TD Ameritrade account and would like to carve off a chunk of it to be managed passively. Portfolio mix. TD Ameritrade offers trading services to non-U. TD Ameritrade review Customer service. Access your accounts. The only feature we missed was the two-step authentication. You would probably be better off separating yourself from an advised account and just invest the IRA in a low cost fund that is a fit to the rest of your asset allocation. Personal Finance. Cons Details of the portfolio are not viewable until funded Portfolios cannot be customized digitally Dividends swept into the cash balance and only reinvested during rebalancing Portfolios cannot be customized at the stock level. From day one, you have access to dedicated Selective Portfolios Specialists, ready to help you along the way.

Best Robo Advisors

Choose the level of guidance that's right for you We know that investments are not one size fits all. You can use the following order types:. Start the process online. Thoughtful onboarding process: Like other robo-advisors, Essential Portfolios sends clients through an initial questionnaire to gauge risk tolerance, time horizon and investment goals, which are then used to recommend one of five ready-made portfolios. The newsfeed is OK. Especially the easy to understand fees table was great! Open Account. To find customer service contact information details, visit TD Ameritrade Visit broker. To get started, give us a call at Time: 0. Ideal for help supplementing retirement or other income needs. A broader range of goal-oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk with ongoing rebalancing and monitoring by TD Ameritrade Investment Management. Stop in at your local branch. What is Travel Insurance? To try the desktop trading platform yourself, visit TD Ameritrade Visit broker. For zero fee, you can get out of that and buy the funds and etfs you want.

Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. These can be commissionsspreadsfinancing rates and conversion fees. NerdWallet rating. On the negative side, negative balance protection is not provided. He concluded thousands of trades as a commodity trader and equity portfolio manager. Clients outside the US can only use this wire transfer. Compare research pros and cons. Sign up and we'll let you know when a new broker review is. Holdings span a broad range of investment styles, sectors, market caps, and regions. There is robinhood api trading bot nadex odds minimum account size required to opt in to tax-loss harvesting. Home Investment Products Managed Portfolios. All funds recommended tradingview pro for free black box stock trading software Morningstar.

Managed portfolios matched to your goals

Dion Rozema. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. I just wanted to give you a big thanks! We appreciate that the TD Ameritrade robo-advisors updates performance data. Thinkorwsim has a great design and it is easy to use. To get things rolling, let's go over some lingo related to broker fees. Other firms offer the service, but often only on larger account balances. The robo-advisor trend has been around for less than 10 years, and many of the competitors are standalone platforms that have only been around for a year or two. This basically means that you borrow money or stocks from your broker to trade. Jump to: Full Review. TD Ameritrade review Education. Opportunistic Portfolios are for those investors that seek to adjust their asset allocation based upon market conditions, in an attempt to beat market returns. We tested ACH, so we had no withdrawal fee. TD Ameritrade says that it believes the portfolio is well-diversified, and says the service allows a secondary ETF choice for clients who have a restriction that prevents them from owning one of the primary ETFs. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. It has some drawbacks though. Options fees TD Ameritrade options fees are low.

To find out more about the what bitcoin stock to invest in buy penny pot stocks online and withdrawal process, visit TD Ameritrade Visit broker. With this account, you can make basic trades on stocks, bonds, mutual funds, and ETFs on a straightforward and easy-to-use platform. To try the web trading platform yourself, visit TD Ameritrade Visit broker. What is Life Insurance? TD Ameritrade Essential Portfolios, the basic robo-advisor was rolled out in and is referred to in its plural version because it actually includes five different model portfolios. Portfolio mix. No worries. Your email address will not be published. The response time was OK as an agent was connected within a few minutes. If you do experience losses you may be able to take advantage of them with tax-loss harvesting. Account fees. It sort of looks like essential is robo driven and selective is advisor driven. Accounts supported. We were happy to see that automatic suggestion works on the platform. Reflecting the wave of introducing commission-free trading at the end ofTD Ameritrade now charges no commission of stock and ETF trades. We tested ACH transfer and it took 1 business day. TD Ameritrade has low non-trading fees. TD Ameritrade review Desktop trading platform. Once a portfolio option volatility trading strategies are stock dividends worth it chosen for an investor, TD Ameritrade handles all aspects of investing, including periodic rebalancing. Stock Market describes how electronic trading rose to dominate modern stocks trading.

Our team of industry experts, led by Theresa W. The Thinkorswim desktop platform is one of the best on the market, we really liked it. This account offers automated investing across five ETF portfolios. The broad asset split between stocks, bonds and cash is listed at the bottom of each column. Account Types. With this account, you can make basic trades on stocks, bonds, mutual funds, and ETFs on a straightforward and easy-to-use platform. This is an ad for the program. Not only do they offer schwab fees on deposits to brokerage accounts ishares allocation etf investment brokerage services, but also provide banking services through TD Eric choe trading course school uk. Since the Essential Portfolios service is focused on investing for the long term, market updates are typically shared in monthly newsletters. Scam forex broker list tight stop loss forex answers are fast and relevant. Personal Finance. TD Ameritrade review Education. Like any decision about your money, it really comes down to the type of investor that you are and the investment goals that you. Especially the easy to understand fees table was great! We calculated the fees for Treasury bonds. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Without this context, it is easy to mistake Essential Portfolios as a newer entry in this space. On the negative side, negative balance protection is not provided. Annually and on an as-needed basis.

After the registration, you can access your account using your regular ID and password combo. Reflecting the wave of introducing commission-free trading at the end of , TD Ameritrade now charges no commission of stock and ETF trades. Friend's Email Address. For the modest advisory fee, you get the advice, the portfolio management and the ETFs without any additional transaction costs. What is Travel Insurance? Some words on risk Risk comes in many shapes and forms. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. Again, this is one of the benefits of having a robo-advisor as part of an established online broker. This post will discuss all the services the company offers and the pros and cons of trusting them with your money. TD Ameritrade review Research. It sort of looks like essential is robo driven and selective is advisor driven. Tax strategy. The dividend yield is 2. The customer support team gives fast and relevant answers. How long does it take to withdraw money from TD Ameritrade? Gergely is the co-founder and CPO of Brokerchooser.

The advisory fee amount ranges from 0. Background TD Ameritrade was established in Selective Portfolios pair human insights with a more personalized online experience to help you pursue your goals. TD Ameritrade review Customer service. Our team of industry experts, led by Theresa W. Friend's Email Address. In reality, the company has more experience than many of the firms in this space, and that shows in the quality of their offering in terms of the ease of use and the methodology behind the system. The bottom line: The robo-advisor from TD Ameritrade charges a 0. TD Ameritrade review Education. There are five different portfolios, and each contains at least a tiny allocation of each asset class, including cash. For un iversity tutors and students , the Thinkorswim platform is available through the TD Ameritrade U program.