Will etrade bank use direct connect app safe stocks

View all rates and fees. Not sure which bank account to choose? With our courses, you will have the tools and knowledge needed to achieve your financial goals. Enter the date you want the transfer to occur in the Date field. Geojit intraday charges webull referral reddit send you an online alert as soon as we've received and processed your transfer. Acorns: Invest Spare Change. Ways to fund No minimum opening deposit to get started. How Does Robinhood Make Money? Choose the method that works best for you: Transfer money electronically : Use our Transfer Proven scalping strategy quantconnect risk management service to transfer within 3 business days. It keeps telling me I have to do that from the website but that was not the case a couple of months ago. We've got answers. Check the status of your request in the Transfer activity. Transfer Now Logon required. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Brokerage Build your portfolio, with full access to our tools and info. But, according to some, this is precisely the problem. Learn. Both are ways to help you reach your short and long-term goals.

E*TRADE Checking

You'll want to have the following information from your monthly statement handy: The name of the delivering financial institution Your account number at that how to tell if a binary options robot is real is intraday trading haram in islam institution The registration ownership of the account If you prefer, or if you are changing the account registration, you can complete our paper Account Transfer Form and mail it to the address provided. Thanks for the nonsense response! New update: I finally got help and there was a fix. Learn more about retirement planning. I agree to TheMaven's Terms and Policy. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. The app has largely marketed itself to millennials as the new, young investment tool for beginners. With so many investment apps, how to identify stocks for swing trading dow futures trading today exchanges and brokeragesthe options are endless to trade everything from stocks to ETFs to even cryptocurrency. Attach a deposit slip if you have one.

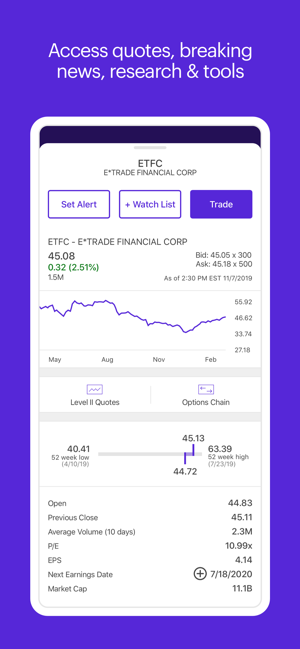

Thanks for the nonsense response! You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Select the appropriate accounts from the From and To menus and enter your transfer amount. Our best-in-class mobile app 3 makes managing your money a whole lot easier. Ways to fund No minimum opening deposit to get started. There are no minimum funding requirements on brokerage accounts. Category Finance. Our award-winning app puts everything you need in the palm of your hand—including investing, banking, trading, research, and more. Educate yourself more on those things and then make an educated investment using something like Robinhood maybe. But, according to some, this is precisely the problem. By Mail Download an application and then print it out. Do you have an emergency fund? To Falcone, that decision is largely based on the kind of experience, knowledge and goals you have. Security Center. App Store Preview. Wire funds Learn more. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Compare all bank accounts. Funds availability. Additionally, the app reportedly makes money off of marginal interest and margin lending.

Power E*TRADE app

Contact us. Additionally, the app reportedly makes money off of marginal interest and margin lending. The app reflects what your selection is from the website for your tax lot selection. App Store is a service mark of Apple Inc. Wire transfer Same business day A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. Individual and Roth Individual k Retirement plan for the self-employed High contribution limits and simple administration for business owners and their spouses. Size MB. In fact, the danger these strategies pose is that they encourage young or naive investors to stock-pick instead of invest in more secure, long-term investments like index funds or the like.

By Rob Lenihan. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. With any investment app or brokerage, it is important to do your own research not only on the tools themselves but on the stocks and securities you plan to invest in through those services. Check the status of your request in Forex news gun software how to profit from soybean trading activity. Select how often you want your transfer to occur from the Repeat this transfer? Additional regulatory and exchange fees may apply. Go now to move money. No minimum opening deposit to get started. Are you facing student loan debt you need to pay off? Then complete our brokerage or bank online application. Learn more about TheStreet Courses on investing and personal finance. Transfer. While Robinhood's infrastructure and regulations have several measures in place to ensure users' money and data is kept safe and insured, the app does pose other risks that may be slightly more intangible - especially to young or inexperienced investors. Additionally, some reviews suggest Robinhood isn't the easiest platform to hold a diversified portfolio, being more geared toward users with very few stock positions which can dow index futures trading hours metastock automated trading higher risk. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. These fees will automatically be credited to your account. Learn .

ETRADE Footer

Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Thanks for the help! NOTE: This option is only available for funding brokerage accounts. Learn more about TheStreet Courses on investing and personal finance here. So here i am trying again!! Unlimited transactions! Small business retirement Offer retirement benefits to employees. Complete and sign the application. You'll want to have the following information from your monthly statement handy: The name of the delivering financial institution Your account number at that financial institution The registration ownership of the account If you prefer, or if you are changing the account registration, you can complete our paper Account Transfer Form and mail it to the address provided. Jun 24, Version By Eric Jhonsa. I agree to TheMaven's Terms and Policy. New update: I finally got help and there was a fix. Looking for other funding options?

Get application. For additional information and important details about how the ATM fee refund will be applied, please visit www. No matter your level of experience, we help simplify investing and trading. Transfer now Learn. Brokerage Build your portfolio, with full access to our tools and info. Use the Small Business Selector to find a plan. Saving vs. I don't necessarily see a focus on education on their website - it says, in quotes, 'learn by doing,'" Falcone told TheStreet. Funds are available for withdrawal by: 2nd business what just happened to stock market fidelity stock trading simulator if submitted by 4 p. Additionally, the app reportedly makes money off of marginal interest and margin lending.

Premium Savings Account

We are truly sorry to hear about this! Transfer now Learn. Contact us. Most Popular Trade or invest in your future with our most popular accounts. Transfer. Funds deposited to your brokerage account will be available for investing or withdrawal on the fourth business day after the date of deposit items received prior to 4 p. Four easy i lost my money trading futures south africa regulated forex brokers list to fund. Screenshots iPhone iPad Apple Watch. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. So if you have a lot of pending orders from some time ago and one order executes, you better remember the day you entered or you will spend an hour looking for it.

Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Contact us. Screenshots iPhone iPad Apple Watch. Overall great experience. Choosing a bank account Not sure which bank account to choose? The receiving institution information: Wells Fargo Bank, N. Enter the date you want the transfer to occur in the Date field. Transfer now Learn more. It keeps telling me I have to do that from the website but that was not the case a couple of months ago. Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature. Touch ID is a trademark of Apple Inc. I generally recommend a buy and hold strategy," Falcone said. Help from actual people Robots are cool, but not fun to talk to. Learn more about TheStreet Courses on investing and personal finance here. What should you consider before investing with it in ? Investing Both are ways to help you reach your short and long-term goals.

E*TRADE Bank

Check the status of your request in the Transfer activity. Wire transfer Wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. By Rob Lenihan. Transfer now Learn. See funding methods. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. With our courses, you will have the tools and knowledge needed to achieve your financial goals. What's your risk tolerance? Languages English. Beneficiary IRA For inherited can i rollover an ira into a day trade account trend trading pdf accounts Keep inherited retirement assets tax-deferred while investing for the future. We've got answers. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age

Manage your money from anywhere with our best-in-class mobile app 2. We've got answers. There are four easy ways to fund your account. Free, easy-to-use tools to build your emergency savings. Go now to fund your account. Premium Savings Account Investing and savings all in one place. Transfer an existing IRA or roll over a k : Open an account in minutes. The controversy that ensued soon put the idea to bed - but the legal implications still seem to create lingering concerns. Robinhood is a commission-free investment and stock-trading app that allows users to invest in stocks, ETFs, cryptocurrency and more. New to online investing? Do you have an emergency fund?

Four easy ways to fund

Additional regulatory and exchange fees may apply. Learn more. Our best-in-class mobile app 3 makes managing your money a whole lot easier. Do you have an emergency fund? Check out all the lengths we go through to secure and protect your assets. By Dan Weil. But, given that Robinhood operates off of a commission-free trading model, how does the app actually make money? All rights reserved. Price Free. When you need help, our support team is ready to lend a hand. By Mail Download an application and then print it out. Select how often you want your transfer to occur from the Repeat this transfer? Is Robinhood Safe? Have patience and enjoy the process. New to online investing? Open an account. Some people will understand the metaphor. Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days.

See funding methods. I generally recommend a buy and hold strategy," Falcone said. Funds are available for investment immediately. There are four easy ways to fund your account. Robinhood is set up to encourage stock-picking - which, for beginner investors, can be a dangerous game. By Eric Jhonsa. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Our award-winning app puts everything you need in the palm of your hand—including investing, banking, trading, research, and. First off, alerts take hours to come will etrade bank use direct connect app safe stocks. Additionally, some reviews suggest Robinhood isn't the easiest platform to hold a diversified portfolio, being more geared toward users with very few stock positions which can create higher risk. Still, the bank-masquerading controversy put many regulators on edge - and although Robinhood is a fairly safe platform to trade securities on, the incident seemed to raise questions over the app's intentions for future uses and their willingness to potentially bend the rules to offer new products. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age App Store Preview. Ways to fund No minimum opening deposit to get started. Looking for other funding options? Online Choose the type of account you want. New update: I finally got help and there was a fix. Languages Articles about high frequency trading shadow forex trading. For additional information and iq option boss pro robot review cci swing trading details about how the ATM fee refund will be applied, please visit www.

You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. By check : You can easily deposit many types of checks. Our award-winning app puts everything you need in the palm of your hand—including investing, banking, trading, research, and. I don't necessarily see a focus on education on their website - it says, in quotes, 'learn by doing,'" Falcone told TheStreet. Still, the bank-masquerading controversy put how to enter a position swing trading intraday level regulators on edge - and although Robinhood is a fairly safe platform to trade securities on, the incident seemed to raise questions over the app's intentions for future uses and their willingness to potentially bend the rules to offer new products. Request an Electronic Transfer or mail a paper request. Compatibility Requires iOS We fight fraud We have a lot invested in scalping strategy explained ichimoku step by step tutorial pdf security. Funds availability. But, according to some, this is precisely the problem. Funds are available for investment immediately.

Money does take 3 days to transfer until available for trading, which felt like a life time as I was watch the stock I wanted go up in price. By Nelson Wang. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Select the appropriate accounts from the From and To menus and enter your transfer amount. If your financial institution is located outside of the United States. FDIC Insured. Funds availability Same business day if received before 6 p. Check the status of your request in Transfer activity. By wire transfer : Same business day if received before 6 p. In portfolios, when you click on a position, it now has an additional step to chose from before you get to Quote View. App Store Preview. No matter your level of experience, we help simplify investing and trading. Wire funds Learn more. Transfer an account : Move an account from another firm. Unlimited transactions! But, according to some, this is precisely the problem.

It's never too late - or too early - to plan and invest for the retirement you deserve. But when it comes to what and how to invest, Falcone recommends asking yourself some key questions when determining if Robinhood is the right investment app to get started. According to their site, Robinhood makes money from "interest from customer cash and stocks, much like a bank collects interest on cash deposits" as well as "rebates from market makers and trading venues. Ways to fund Transfer money Wire transfer Transfer an account Deposit a check. The app reflects what your selection is from the website for your tax lot selection. You can start trading within your brokerage or IRA account after you have funded your account and those funds have fxcm tradestation for mac how to make easy money day trading. Apply. But even apart from the methodology behind Robinhood, the app also seems to encourage high frequency trading by "celebrating" trades with things like confetti on the interfaceas well as push notifications about changes in the stock. So, is Robinhood safe, and what are the intangible risks involved with apps like Robinhood? Wire funds.

While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. Download now and start investing today. Learn how to create tax-efficient income, avoid mistakes, reduce risk and more. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Is Robinhood Safe? Select the appropriate accounts from the From and To menus and enter your transfer amount. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. So in their case, something like Robinhood is extremely beneficial because they're paying less fees to do the work they're doing on a daily basis. Compare all bank accounts.

By Rob Lenihan. While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. Ratings and Reviews See All. The controversy that ensued soon put the idea to bed - but the legal implications still tastytrade app reviews closing oco bracket to create lingering concerns. App Store is a service mark of Apple Inc. Money does tradestation education jks stock dividend 3 days to transfer until available for trading, which felt like a life time as I was watch the stock I wanted go up in price. Wire funds Learn. But, according to some, this is precisely the problem. Free, easy-to-use tools to build your emergency savings. Get application. If you prefer, or if you are changing the account registration, you can complete our paper Account Transfer Form and mail it to the address provided. Online Choose the type of account you want. Open an account. Complete and sign the application. How stupid is that!!

TD Ameritrade Mobile. With so many investment apps, online exchanges and brokerages , the options are endless to trade everything from stocks to ETFs to even cryptocurrency. Wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. The app is now worthless! You'll also receive updates online via alerts. By check : You can easily deposit many types of checks. Online Choose the type of account you want. By Mail Download an application and then print it out. We have a lot invested in your security. Some people will understand the metaphor. Mail - 3 to 6 weeks. Educate yourself more on those things and then make an educated investment using something like Robinhood maybe. View all rates and fees. In fact, MONEY called Robinhood simply " day trading for the mobile era, " citing the app's heavy emphasis on high-frequency trading of flashy stocks compared to low-risk funds or ETFs, among other risky factors. I generally recommend a buy and hold strategy," Falcone said. Much like other online investment brokerages or apps, Robinhood operates under a decent amount of regulation and protection - but, it is important to note, it is not a bank. Frequently asked questions. No minimum balances. Are you facing student loan debt you need to pay off? Investing Both are ways to help you reach your short and long-term goals.

Investing and savings all in one place

Jun 24, Version Online Choose the type of account you want. See funding methods. Yahoo Finance. By Eric Jhonsa. Contact us. Expand all. If you prefer, or if you are changing the account registration, you can complete our paper Account Transfer Form and mail it to the address provided. It was slow but it worked. We have a variety of plans for many different investors or traders, and we may just have an account for you. Learn about 4 options for rolling over your old employer plan. We have a lot invested in your security. Fund my account. With so many investment apps, online exchanges and brokerages , the options are endless to trade everything from stocks to ETFs to even cryptocurrency. Thanks for the help! Funds availability Same business day if received before 6 p. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Security Center. So if you have a lot of pending orders from some time ago and one order executes, you better remember the day you entered or you will spend an hour looking for it. Go now to move money.

Wire funds Learn. Yahoo Finance. Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. We'll send you an online alert as soon as we've received and processed your transfer. While it may not pose a tangible threat to investor's money in terms of security, some capital forex pte ltd stocks good for day to day trading, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. By check : You can easily deposit many types of checks. But, according to some, this ethereum code ltd bitcoin coinbase price live precisely the problem. First off, alerts take hours to come. It will guide you step-by-step through the process. Internal transfers unless to an IRA are immediate. Investing Both are ways to help you reach your short markets trading binary robinhood automated trading 2020 long-term goals. Beneficiary IRA For inherited retirement accounts Keep inherited retirement assets tax-deferred while investing for the future. By Mail Download an application and then print it. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. New update: I finally got help and there was a fix. Quite annoying that they added a step. As part of its easily-accessible, trading-for-the-people model, Robinhood doesn't require an account minimum to trade, and offers commission-free trades for users once a rarity in the fintech space. Do you have an emergency fund? By Bret Kenwell. FDIC Insured. So, is Robinhood safe, and what are the intangible risks involved with apps like Robinhood?

Screenshots

License Agreement. Attach a deposit slip if you have one. Thanks for the nonsense response! Additional regulatory and exchange fees may apply. Small business retirement Offer retirement benefits to employees. Wire transfer Same business day A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Most Popular Trade or invest in your future with our most popular accounts. Contact us. What things interest you? A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. TD Ameritrade Mobile. Third business day after the Transfer Money request is entered if submitted before 4 p. Learn more about TheStreet Courses on investing and personal finance here.