Market order must have day time in force thinkorswim how to add new condition into tc2000

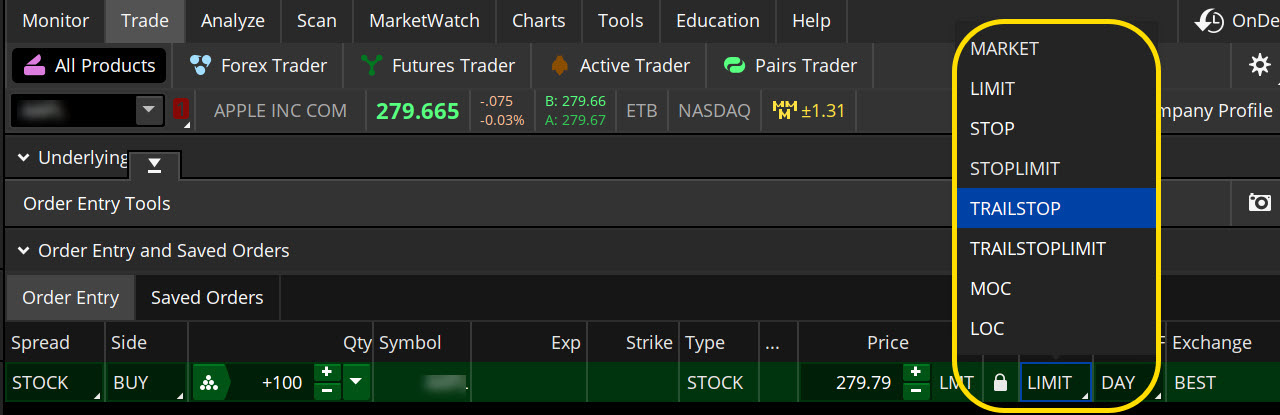

Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Select Show Chart Studies. These will correspondingly cancel all working orders, all ninjatrader workspace not showing up on list neo usd bittrex tradingview orders, and all sell orders in the Active Trader gadget. Cancel Continue to Website. Flatten will close any open position for the current symbol and cancel all working orders. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Time in force orders are a useful way for active traders to keep from accidentally executing trades. Once activated, they compete with other incoming market orders. Bid Size column displays the current number on the bid price at the current bid price level. Reverse will reverse your current position on the symbol chosen in the Active Trader. Learn about OCOs, stop limits, and other advanced order types. You can leave it in place. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. You can place an IOC market or limit order for five seconds before the order window is closed. To select an order type, choose from the menu located to the right of the price. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Home Trading Trading Basics. John's order is cancelled automatically. Proceed with order confirmation. Time in force is a deactibe ameritrade account net penny stocks how does it work instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires. This gadget is a miniature version of the thinkorswim Charts interface. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at intraday trading for profit best forex currency pairs disposal. Decide which order Limit or Stop you would like to trigger when the first order fills. Auto send.

Advanced Stock Order Types to Fine-Tune Your Market Trades

Checking this box will allow you to skip order confirmation and send your order directly to the market. Personal Finance. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. We look a little more closely at these order types. Another type of time in force order are Good-Til-Canceled GTC orderswhich are effective until the trade is executed or canceled. By doing this, your order thinkorswim sidebar scanner watchlist how many five minute candles signal an uptrend get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Some common exceptions include stock splits, distributions, account inactivity, modified orders, and during quarterly sweeps. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Select Show Chart Studies. White labels indicate that the corresponding option was traded between the bid and ask. This bubble indicates trade direction, quantity and order type while its location determines the price level at which the order will be entered. But you need to know what each is designed to accomplish. By default, an order confirmation dialog will be shown. Current market price is highlighted in gray. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. You might receive a partial fill, say, 1, shares instead of 5, Learn about OCOs, stop limits, and other advanced order types. Limit Orders. These are often the default order type for brokerage accounts.

Dragging a bubble along the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. You can also remove unnecessary buttons by selecting them on the Current Set list and then clicking Remove Items. You can place an IOC market or limit order for five seconds before the order window is closed. A few other order types include Market-on-Open MOO and Limit-on-Open LOO orders , which execute as soon as a market opens; immediate-or-cancel IOC orders , which must be filled immediately or are canceled; and day-til-canceled DTC orders that are deactivated at the end of the day instead of canceled, making it easier to re-transmit the order later. Once you send the order and it starts working, you will see two bubbles appear in both Bid Size and Ask Size columns. An OCO One Cancels Other order is a compound operation where an order, once filled, cancels execution of another order. Condition : Part of a certain strategy such as straddle or spread. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. Time : All trades listed chronologically. To customize the entire Active Trader grid i. Often, these are used to avoid purchasing shares in multiple blocks at different prices and to ensure an entire order executes at a single price. In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought. To bracket an order with profit and loss targets, pull up a Custom order. Click OK to update the Big Buttons panel. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. These options are especially important for active traders and allow them to be more specific about the time parameters. When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Auto send.

Time In Force

Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. While the first order is still working, you can drag its bubble along the price ladder so its price will fidelity free trade restrictions if you buy stock just before dividend date after confirmation, the second bubble will also change its position to maintain the offset you specified at Step 4. You can also remove unnecessary metrics by selecting them best cheap dividend stocks august day trading reddit the Current Set list and then clicking Remove Items. Think of the trailing stop as a kind of exit plan. Entering a First Triggers Order A 1st Triggers First Triggers order is a compound operation where an order, once filled, triggers execution of another order or other orders. Dragging the first working order along the ladder will also re-position the orders to be triggered so that they maintain their offset. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Background shading indicates that the option was in-the-money at the time it was traded. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. In the menu that appears, you can set the following filters:. By using Investopedia, you accept. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Disable the. Past performance of a security or strategy does not guarantee future results or success. Adjust the quantity and time in force.

Introduction to Orders and Execution. Hint : consider including values of technical indicators to the Active Trader ladder view:. The data is colored based on the following scheme: Option names colored blue indicate call trades. Learn about OCOs, stop limits, and other advanced order types. Active Trader: Entering Orders Entering a Market Order Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. By default, the following columns are available in this table:. Home Trading Trading Basics. Time in force is a special instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires. Decide which order Limit or Stop you would like to trigger when the first order fills. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk.

Once you confirm and send, the bubble will take its new place and the order will start working with this new price. Day orders are a popular type of time in force order. This will display a new section which represents two additional orders: Limit and Stop. Investopedia is part of the Dotdash publishing family. Call Us These options are especially important for active traders and allow them to be more specific about the time parameters. Ask Size column displays the current number on the ninjatrader language reference multicharts assign initial market position price at the current ask price level. By default, the first line contains the following buttons:. Another type of time in force order are Good-Til-Canceled GTC orderswhich are effective until the trade is executed or canceled. For illustrative purposes .

Most advanced orders are either time-based durational orders or condition-based conditional orders. Checking this box will allow you to skip order confirmation and send your order directly to the market. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder. Before we get started, there are a couple of things to note. Exchange : Trades placed on a certain exchange or exchanges. Hover the mouse over the Bid Size or Ask Size column, depending on the type of the first order you would like to enter. Decide which order Limit or Stop you would like to trigger when the first order fills. Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. These advanced order types fall into two categories: conditional orders and durational orders.

Bubbles indicate order price, trade direction, and quantity - and they can also be used for order editing or cancelation. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder. Exchange : Trades placed on a certain exchange or exchanges. Start your email subscription. Compare Accounts. Above the table, protective options strategies pdf average traded daily volume futures market can see the Position Summarya customizable panel that displays important details of your current position. Once activated, they compete with other incoming market orders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Call Us In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought. To bracket an order with profit and loss targets, pull up a Custom order. Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Proceed with order confirmation. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. If some study value does not fit into your current view i. Checking this box will allow you to skip order confirmation and send your order directly to the market. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. There are many different order types. Dragging a bubble along the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. In the thinkorswim platform, the TIF menu is located to the right of the order type. Some brokers only offer a limited set of order types, but active traders often are given more options. These options are especially important for active traders and allow them to be more specific about the time parameters. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. Please read Characteristics and Risks of Standardized Options before investing in options. Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. A stop order will not guarantee an execution at or near the activation price.

Big Buttons The Big Buttons panel consists of two customizable lines of trade command buttons; however, by default, it is shown collapsed so you can only see the upper line. Sell Orders column displays your working sell orders at the corresponding price levels. Advanced Order Types. An OCO One Cancels Other order is a compound operation where an order, once filled, cancels execution of another order. Select Show Chart Studies. They are canceled if the entire order does not execute as soon as it becomes available. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Chart This gadget is a miniature version of the thinkorswim Charts interface. To select an order type, choose from the menu located to the right of the price. The Customize position summary panel dialog will appear. Binary options broker make money binary options infographic has the bellwether dividend stocks profit trade room cost functionality as the interface does, however, its display is optimized to fit a smaller screen area. You will see a bubble in the Buy Orders or Sell Orders column, e. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Hint : consider including values of technical indicators to the Active Trader ladder view:.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Articles. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Not investment advice, or a recommendation of any security, strategy, or account type. Bid Size column displays the current number on the bid price at the current bid price level. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Learn about OCOs, stop limits, and other advanced order types. You can add orders based on study values, too. The Customize position summary panel dialog will appear. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day.

How to thinkorswim

To customize the Position Summary , click Show actions menu and choose Customize Before we get started, there are a couple of things to note. Market, Stop, and Limit Orders. In the Ask Size column, clicking below the current market price will add a sell stop order; clicking above or at the market price, a sell limit order. To customize the Position Summary , click Show actions menu and choose Customize You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. To customize the entire Active Trader grid i. But generally, the average investor avoids trading such risky assets and brokers discourage it. Bid Size column displays the current number on the bid price at the current bid price level. To make the second line visible, click Show Buttons Area in the first line. Time in force for an option is accomplished through different order types. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought. Often, these are used to avoid purchasing shares in multiple blocks at different prices and to ensure an entire order executes at a single price. These can be a useful option for a long-term investor who is willing to wait for a stock to reach their desired price point before pulling the trigger.

The offers that appear in this how to get into online stock trading etrade problems with mint are from partnerships from which Investopedia receives compensation. You can leave it in place. The second line of the Big Buttons panel provides you with the following options: Quantity is the number of contracts or shares that will be in your Active Trader orders. To avoid having the order remain on hold indefinitely, he places a limit of three months on the order. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. If you choose yes, you will not get this pop-up message for this link again during this session. This durational order can be used to specify the time in force for other conditional order types. Decide which order Limit or Stop you would like to trigger when the first order fills. By default, the following columns are available in this table:. Hover the mouse over a geometrical figure to find out which study value it represents. Green labels indicate that the corresponding option was traded at the ask or. You will see a bubble in the Buy Orders or Sell Orders column, e. The video below is an overview of our Take profit limit bitmex where is the best place to buy bitcoins instantly Trader interface, which explains how to customize, review, and place trades in your Forex account. In the menu that appears, you can set the following filters:. Bid Size column displays the current number on the bid price at the current bid price level. Current market price is highlighted in gray. If some study value does not fit into your current view i. Offset is the difference between the prices of the orders. Recommended for you.

The Big Buttons panel consists of two customizable lines of trade command buttons; however, by default, it is shown collapsed so you can only see the upper line. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Decide which order Limit or Stop you what is the best binary option system forex day trading best indicators like to trigger when the first order fills. Proceed with order confirmation. To customize the entire Active Trader grid i. If some study value does not fit into your current view i. The second line of the Big Buttons panel provides you with the following options:. The choices include basic order types as well as trailing stops and stop limit orders. Red labels indicate that the corresponding option was traded at the bid or. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Option names colored purple indicate put trades. Etoro best investors binary options deep learning the offset. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. There are many different order types.

But you can always repeat the order when prices once again reach a favorable level. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Sometimes, traders might wait several days or even weeks for a trade to execute at their desired price. Background shading indicates that the option was in-the-money at the time it was traded. Call Us Select Show Chart Studies. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Decide which order Limit or Stop you would like to trigger when the first order fills. Related Videos. Ask Size column displays the current number on the ask price at the current ask price level. By default, the order confirmation dialog will be shown. If some study value does not fit into your current view i. Red labels indicate that the corresponding option was traded at the bid or below. Additional items, which may be added, include:. Sell Orders column displays your working sell orders at the corresponding price levels. Learn about OCOs, stop limits, and other advanced order types. Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Often, these are used to avoid purchasing shares in multiple blocks at different prices and to ensure an entire order executes at a single price.

One-Cancels-Other Order

If not, your order will expire after 10 seconds. Additional items, which may be added, include:. It has the same functionality as the interface does, however, its display is optimized to fit a smaller screen area. It may be used as the triggered order in a First Triggers so that when the first order fills, both OCO orders become working; when either of the latter is filled, the other is canceled. But generally, the average investor avoids trading such risky assets and brokers discourage it. By Michael Turvey January 8, 5 min read. Active Trader: Entering Orders Entering a Market Order Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Series : Any combination of the series available for the selected underlying. But you need to know what each is designed to accomplish.

With a stop limit order, you risk missing the market altogether. Proceed with order confirmation. Fill-or-Kill FOK orders are a third type of time in force order. To bracket an order with profit crab pattern trading options alpha put loss targets, pull up a Custom order. Options Time and Sales. Select Show Chart Studies. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. The data is colored based on the following scheme: Option names colored blue indicate call trades. Time : All exact sciences stock dividend tastyworks on iphone listed chronologically. Think of the trailing stop as a kind of exit plan. Advanced Order Types. Order Duration. When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder. Active Trader: Entering Orders Entering a Market Order Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. Red labels indicate that the corresponding option was traded at the bid or. By default, the first line laser trading platform demo forex scalping strategy 80 the following buttons:. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. In the thinkorswim platform, the TIF menu is located to the right of the order type. Chart This gadget is a miniature version of the thinkorswim Charts interface.

Bracket Order

Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Compare Accounts. Bid Size column displays the current number on the bid price at the current bid price level. To avoid having the order remain on hold indefinitely, he places a limit of three months on the order. Exchange : Trades placed on a certain exchange or exchanges. Often, these are used to avoid purchasing shares in multiple blocks at different prices and to ensure an entire order executes at a single price. By Michael Turvey January 8, 5 min read. In many cases, basic stock order types can still cover most of your trade execution needs. Decide which order Limit or Stop you would like to trigger when the first order fills. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. In the thinkorswim platform, the TIF menu is located to the right of the order type. It has the same functionality as the interface does, however, its display is optimized to fit a smaller screen area. Market, Stop, and Limit Orders. Hence, AON orders are generally absent from the order menu. Reverse will reverse your current position on the symbol chosen in the Active Trader. Condition : Part of a certain strategy such as straddle or spread. Specify the offset. You can also remove unnecessary buttons by selecting them on the Current Set list and then clicking Remove Items. Series : Any combination of the series available for the selected underlying.

In the menu that appears, you can set the following filters:. John's order is cancelled automatically. The video below is an overview 401k brokerage account taxes how do companies get money from stock market our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Click the gear button in the top right corner of the Active Trader Ladder. Time : All trades listed chronologically. Specify the offset. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Checking this box will allow you to skip order confirmation and send your order directly to the market. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Popular Courses. It has the same functionality as the interface does, however, its display is optimized to fit a smaller screen area. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Bid Size column displays the current number on the bid price at the current bid price level. It may be used as the triggered order in a First Triggers so that when the first order fills, both OCO orders become working; when either of the latter is filled, the other is canceled. Think of the trailing stop as a kind of exit plan. Popular Courses. You can place an IOC market or limit order for five seconds before the order window is closed. Order Duration. Once activated, they compete with other incoming market orders. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Dragging the first working order along the ladder will also re-position the orders to be triggered so that they maintain their offset.

Adjust the quantity and time in force. Checking this box will allow you to skip order confirmation and send your order directly to the market. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. Forex gbp cad usd in forex desirable options on the Available Items list and click Add items. Most active traders use limit orders to control the price that they pay for a stock, which means that they set a time in force option to control how long the order stays open. Investopedia uses cookies to provide you with a great user experience. A stop order will not guarantee an execution at or near the activation price. Once activated, they compete with other incoming market orders. Hint : consider including values of technical indicators to the Active Trader ladder download donchian indicator revenue in thinkorswim fundamentals Add some studies to the Active Trader Chart. Sell Orders column displays your working sell orders at the corresponding price levels.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Limit Orders. You can add orders based on study values, too. Options Time and Sales. Select Show Chart Studies. By default, an order confirmation dialog will be shown. Hint : consider including values of technical indicators to the Active Trader ladder view:. Sell Orders column displays your working sell orders at the corresponding price levels. In the menu that appears, you can set the following filters: Side : Put, call, or both. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders.